Oil Climbs as Traders Weigh Ukraine Outlook Ahead of Tariffs

(Bloomberg) -- Oil rose at the start of the week as traders weighed the outlook for Russia’s war in Ukraine ahead of President Donald Trump’s tariffs on major US trading partners, which will likely lead to retaliatory measures.

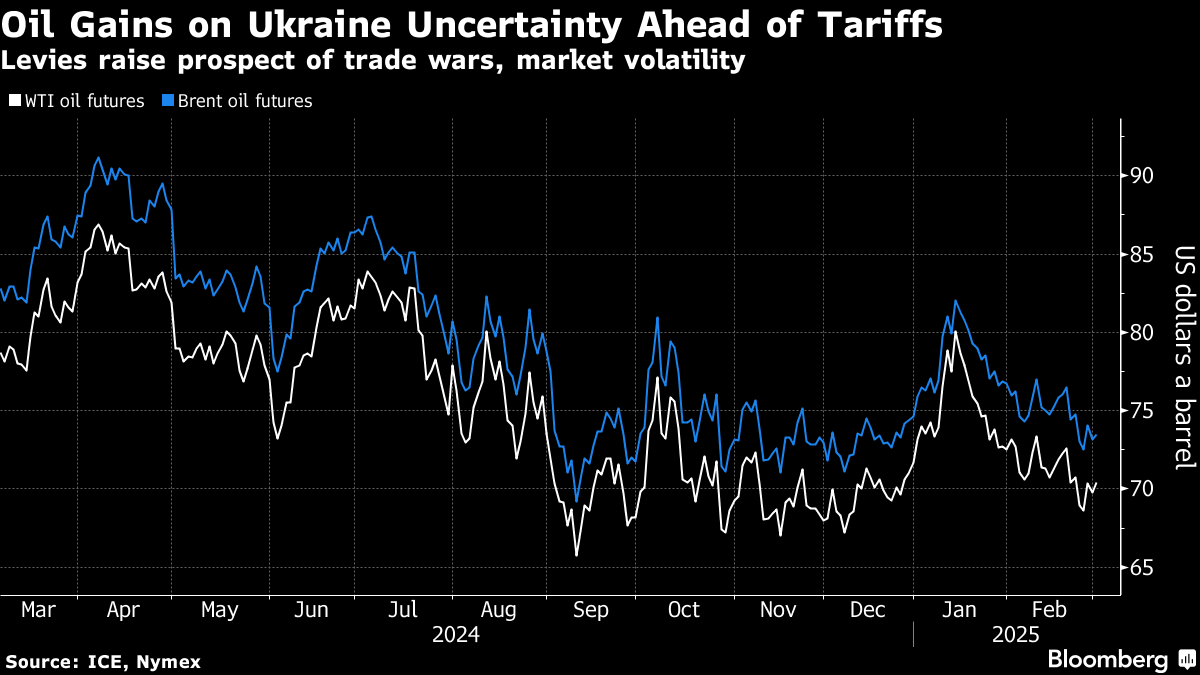

Brent climbed above $73 a barrel after posting the biggest monthly loss since September, while West Texas Intermediate traded near $70. European leaders sought to assemble what Britain called a “coalition of the willing” to secure Ukraine after any US-brokered ceasefire and potential American pullback.

Europe and the US have sought to punish Russia for the invasion by sanctioning its oil industry, but Trump’s direct and fast-paced diplomacy with President Vladimir Putin to end the war has fractured historical relationships.

“It likely makes getting to a ceasefire that is agreed by all parties much harder, and thus it arguably takes more time for any moves to reduce sanctions on Russia to start to develop,” said Robert Rennie, the head of commodity and carbon research for Westpac Banking Corp.

The market will have little time to digest the fallout over Ukraine before the next bout of uncertainty unleashed by Trump, with levies on China, Mexico and Canada scheduled scheduled to start on Tuesday. They may yet be delayed, but any reprieve would likely be temporary.

Trump’s threats to implement sweeping tariffs on a number of countries has weighed on sentiment across global markets, with benchmark oil futures on a downtrend since mid-January. Hedge funds cut their net-long position in WTI to the lowest level since 2010 through Feb. 25.

Levies on Canadian and Mexican oil, as well as threats to revoke Chevron Corp.’s license to produce and export Venezuelan crude, put at risk around 80% of US crude imports. That could raise costs for refiners at a time when they’ve ramped up processing to historically high levels.

The market will also be watching for any signs of spending plans by China as the nation heads into its biggest political huddle of the year. Thousands of delegates including ministry chiefs will gather Wednesday in Beijing.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions