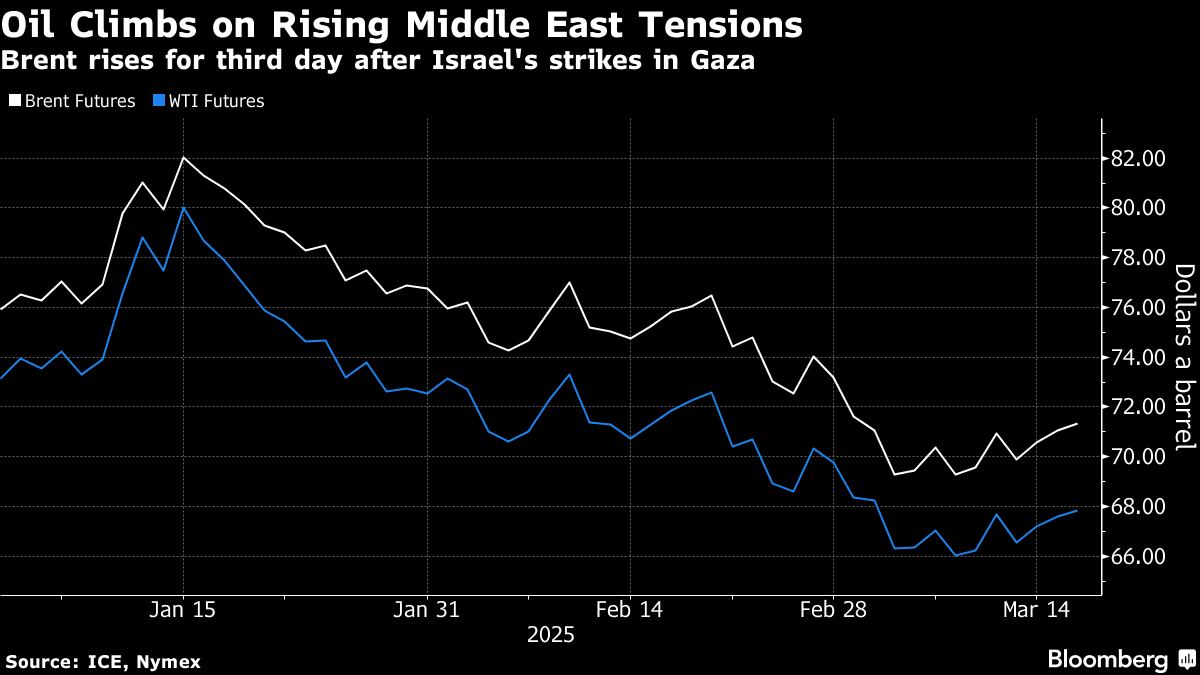

Oil Gains for Third Day as Israeli Strikes Stoke Mideast Tension

(Bloomberg) -- Oil rose for a third day as escalating tensions in the Middle East overshadowed concerns about a potential global glut.

Global crude benchmark Brent traded above $71 a barrel, after rising by 1.7% over the past two sessions, while West Texas Intermediate neared $68. Israel launched a series of military strikes across Gaza, with the nearly two-month-old ceasefire with Hamas appearing to be quickly falling apart.

Elsewhere, US President Donald Trump said he would view attacks by Yemen’s Houthis on shipping as equivalent to direct affronts by Iran. Ahead of the latest spike in tensions, which have seen US forces targeting the rebels, his administration had already been tightening sanctions against Tehran.

Crude remains on track for a quarterly loss on a confluence of bearish factors. An escalating global trade war threatens demand, while OPEC and its allies are set to raise production from April. That’s as the global market was already set for a glut, according to the International Energy Agency.

The potential hit to global crude supply as the US clamps down on Iran “could range in the order of 1 million barrels a day, offsetting gains from OPEC as it phases out voluntary production cuts,” ANZ Group Holdings Ltd. analysts Brian Martin and Daniel Hynes said in a note.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions

Shale Drillers Idle US Rigs at Fastest Pace in Almost Two Years

Oil Heads for Weekly Decline as Trade War Roils Global Markets

US Crude Flows to China Trickle to Near Zero After Tariff Blitz

Aramco announces discovery of 14 new oil and gas fields in Eastern Region

Oil Extends Steep Selloff as Fresh Tariff Wave Imperils Demand