Oil Holds Decline as Risk-Off Mood Sends Markets Into Tailspin

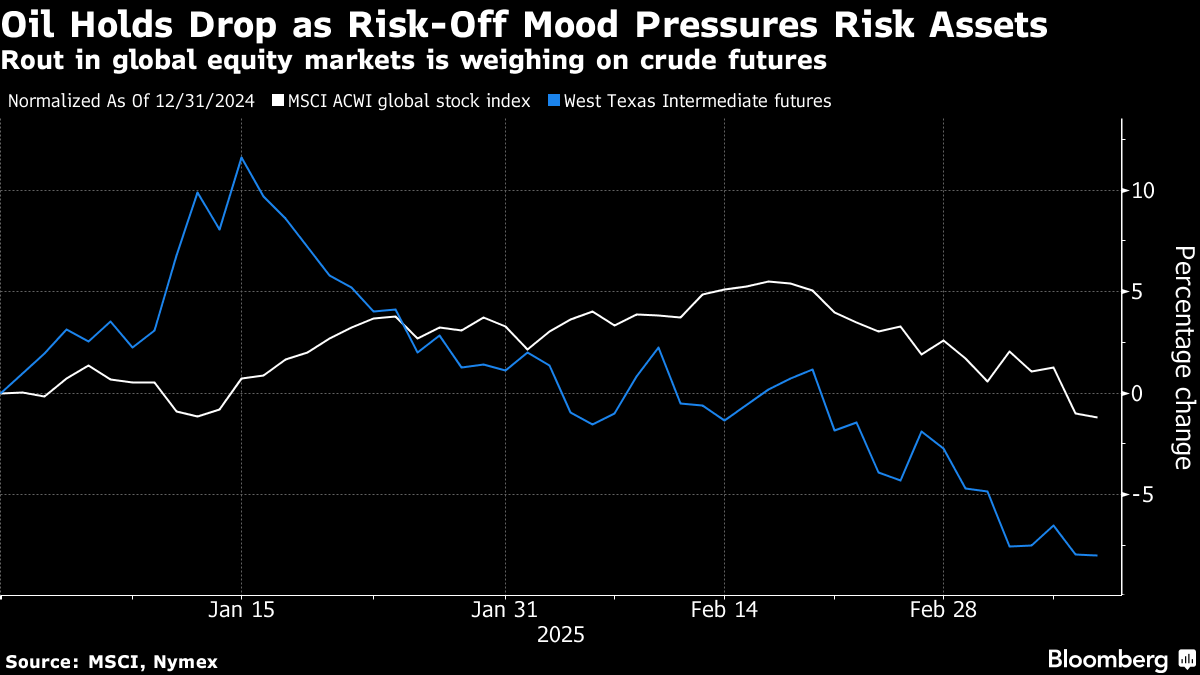

(Bloomberg) -- Oil steadied after a decline, tracking equity markets and risk assets on concerns tariffs and other measures will stunt growth in the world’s largest economy.

West Texas Intermediate traded around $66 a barrel after losing 1.5% on Monday, while Brent crude was near $69. Investors retreated from every type of risk on Monday with economic fear racing across markets as US President Donald Trump presses on with tariff measures and geopolitical shakeups, although the selloff moderated on Tuesday.

Oil has fallen almost a fifth from a high in mid-January as Trump’s chaotic rollout of tariff hikes and push to slash federal spending darken the economic outlook in the biggest producer and consumer of crude. Other bearish factors include OPEC+ plans to add supply and weakening demand in China, where Beijing told refiners to pivot away from making mainstay fuels like diesel and gasoline.

“External factors continue to push oil prices lower with lingering growth concerns driving a broader risk-off move,” said Warren Patterson, head of commodities strategy for ING Groep NV. “A clearly worsening sentiment across broader markets make it difficult to call a bottom.”

US Energy Secretary Chris Wright provided some bullishness, saying the Trump administration was prepared to enforce US sanctions on Iranian oil production. He spoke at the CERAWeek by S&P Global conference in Houston on Monday.

Executives from some of the world’s top oil and gas producers — including Chevron Corp., Shell Plc and Saudi Aramco — offered full-throated support for President Trump’s energy-dominance agenda at the gathering. Vitol Group Chief Executive Officer Russell Hardy said oil between $60 to $80 a barrel is a “reasonable” range for the next few years.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Cathay Full-Year Net Rises as Carrier Posts Bumper Second Half

Petro Says Colombia Should Buy Qatar Gas to Fight Rip-Off Prices

Oil Falls as China Data Deepens Gloom and Risk-Off Takes Hold

US Ends Waiver Allowing Iraq to Buy Electricity From Iran

Stocks Bounce Back as Powell Says Economy Is Fine: Markets Wrap

Amador to Become Mexico Finance Chief as Ramirez de la O Resigns

Oil Posts Seventh Weekly Loss on Easing War Risk, Tariff Chaos

Oil Trims Losses as Traders Weigh Demand Impact from Tariffs

China’s Congress Pledges to Fix Overproduction of Steel and Fuel