Oil Holds Hefty Gain After US Inflation Slowdown Aids Sentiment

(Bloomberg) -- Oil steadied after the biggest gain in two weeks that was driven by easing US inflation and bullish demand data.

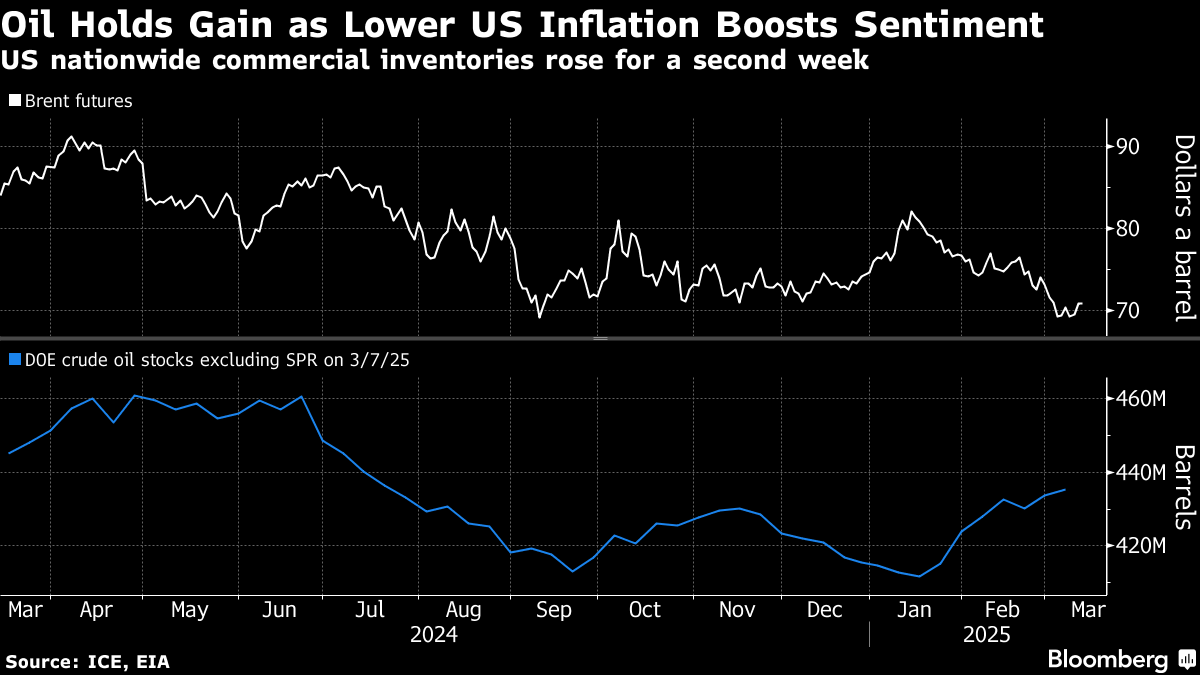

Brent crude traded near $71 a barrel after jumping 2% on Wednesday, with West Texas Intermediate below $68. US consumer prices rose at the slowest pace in four months in February, official data showed, although economists anticipate that an escalating trade war will drive up prices on goods like food and clothing in the coming months.

“Crude oil prices have been a beneficiary of the risk-on sentiment across markets,” said Charu Chanana, chief investment strategist for Saxo Markets Pte in Singapore. “However, risks persist, with concerns around global growth and potential tariffs clouding the outlook.”

Crude has tumbled from a high in mid-January, with some of the biggest oil traders getting more bearish on the outlook for prices as supply starts to outstrip demand. They may get further insight into the balance later Thursday when the International Energy Agency releases its monthly report, two days after the US slashed its forecasts for a glut.

Meanwhile, production from OPEC and its allies surged last month as Kazakhstan further breached its cap, a report from the group’s secretariat showed on Wednesday. The central Asian nation said it has agreed with international oil companies to cut its output.

In the US, nationwide commercial inventories rose for a second week, though the 1.4 million barrel gain was a fraction of the increase predicted by an industry group. Levels at Cushing, Oklahoma — the delivery point for WTI — fell by 1.2 million barrels, their first drop in five weeks.

Timespreads, meanwhile, also show a strengthening market. The premium for front-month Brent over four months ahead has widened to $ a barrel in the bullish, backwardated structure, from a low of $1.04 a barrel last month.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Vopak doubles investment in gas and industrial infrastructure to €2 billion by 2030

Oil Buoyed as Bullish US Figures Ease Concern About Weak Demand

Top Oil Traders Turn Bearish on Prices, Seeing Oversupply

Oil Holds Decline as Risk-Off Mood Sends Markets Into Tailspin

Petro Says Colombia Should Buy Qatar Gas to Fight Rip-Off Prices

Oil Falls as China Data Deepens Gloom and Risk-Off Takes Hold

US Ends Waiver Allowing Iraq to Buy Electricity From Iran

Stocks Bounce Back as Powell Says Economy Is Fine: Markets Wrap

Amador to Become Mexico Finance Chief as Ramirez de la O Resigns