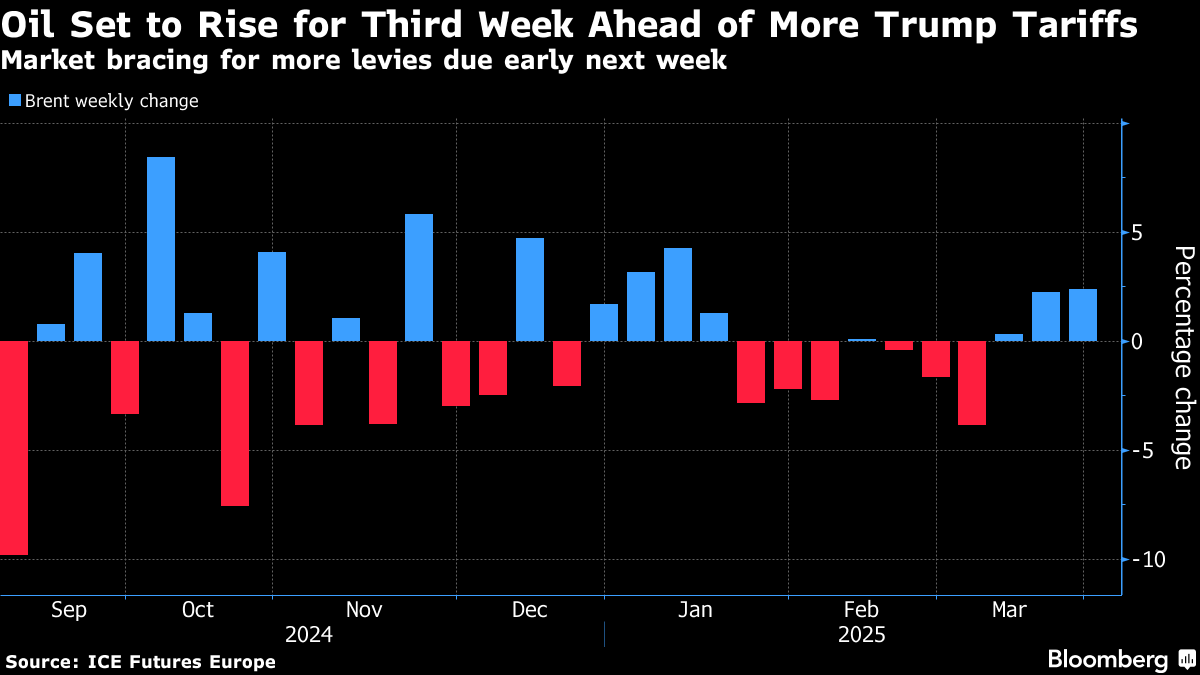

Oil Poised for Third Weekly Gain Ahead of More Trump Tariffs

(Bloomberg) -- Oil headed for a third weekly advance as the market braced for more tariffs from the Trump administration due early next week.

Brent traded near $74 a barrel after closing 0.3% higher on Thursday, while West Texas Intermediate was below $70. So-called reciprocal levies and a duty on buyers of crude from Venezuela are scheduled to take effect on April 2, the latest round in a series of US tariffs that’s rattled global markets.

Oil has trended higher since early March as investors weigh the disruption to supply caused by President Donald Trump’s sanctions and levies, with traders snapping up bullish options to hedge against price spikes. Venezuela has also ramped up crude exports to China to the highest in almost two years.

The potential hit to crude flows has been at times tempered by concerns over softer demand and rising supply, with top trading houses bearish on crude prices over the rest of the year. Next month, OPEC+ is scheduled to start reviving idled production, the first in a series of planned hikes.

“Fundamentals are weak,” said Kim Kwangrae, a commodities analyst at Samsung Futures Inc. US sanctions and tariffs have underpinned recent gains, while geopolitical tensions added to uncertainty, he added.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China Vanke Due as Chinese Developers See Signs of Recovery

Trump Revokes Permits to US, Foreign Oil Firms in Venezuela

S&P 500 Sinks 2% as Economic Fears Spur Bond Rally: Markets Wrap

Oil Holds Gain as US Posts Biggest Drop in Stockpiles This Year

Oil Holds Steady as Report Points to Big Drop in US Stockpiles

China Refiners Face Yet Another Blow as Trump Presses Venezuela

Billion-Dollar US Levies on Chinese Ships Risk ‘Trade Apocalypse’

Oil Steadies at Start of Week as Market Weighs Trump’s Tariffs

CATL’s Lithium Partner Lopal Sees Swings in Near-Term Prices