Oil Posts Seventh Weekly Loss on Easing War Risk, Tariff Chaos

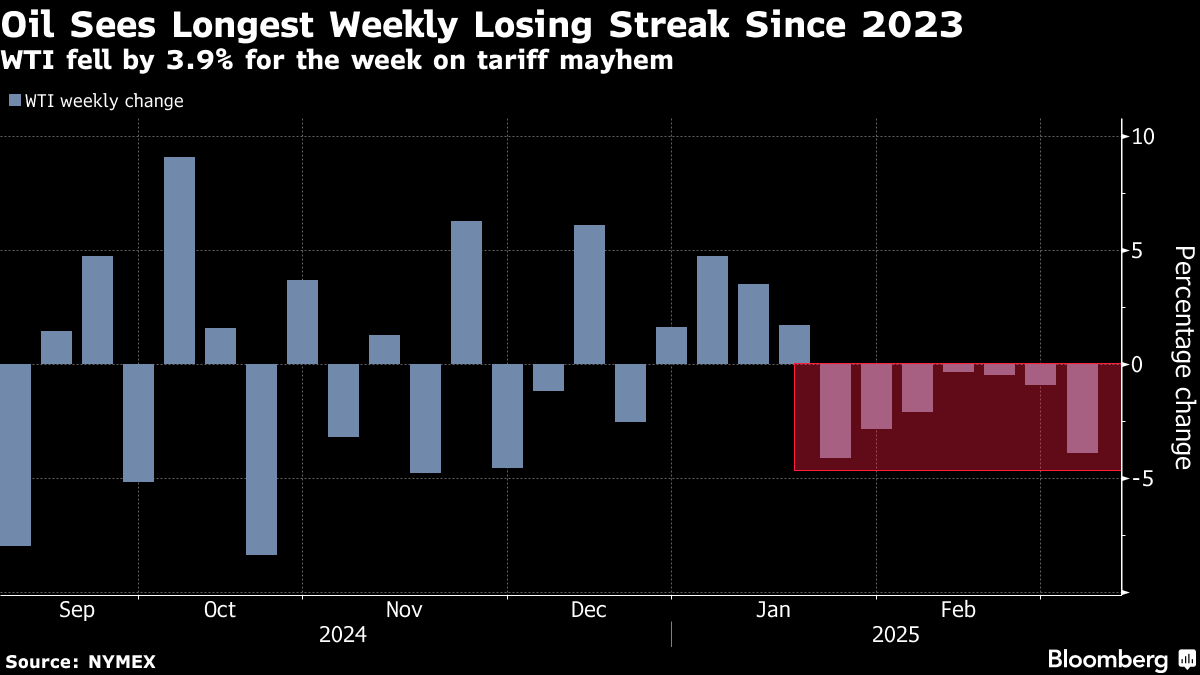

(Bloomberg) -- Oil’s one-day advance wasn’t enough to rescue prices from a seventh straight weekly decline as the prospect of a temporary truce in Ukraine capped on-again, off-again tariff news that upended global markets.

West Texas Intermediate futures climbed by 0.7% Friday to settle above $67 a barrel after Bloomberg reported that Russia is open to a pause to fighting in Ukraine, raising the prospect of a resumption in Moscow’s crude exports. US President Donald Trump earlier pressured the two warring nations to hasten peace talks and the White House signaled that it may relax sanctions on Russian oil if there’s progress.

Crude also found support from a weakening dollar and US plans to refill its strategic oil reserve, but still was down 3.9% on the week.

Aramco Cuts Oil Prices to Asia as OPEC+ Eases Output Curbs

The Biden administration’s farewell sanctions on Russia have snarled the nation’s crude trade in recent months, with total oil and natural gas revenue last month falling almost 19% from a year earlier, Bloomberg calculations showed. Russia’s oil-related taxes are a key source of financing its war against Ukraine.

A potential reintroduction of Russian barrels to the market comes amid a gloomy period for the supply outlook, as OPEC+ forges ahead with a plan to start reviving idled output in April. Meanwhile, Trump’s trade policies have fanned concerns about reduced global energy demand.

“You’re seeing some volatility as people try to interpret what they think is going to happen and what it’s going to mean, but the bottom line is Russia has been able to sell its oil,” said Amy Jaffe, director of New York University’s Energy, Climate Justice and Sustainability Lab.

Trump signed orders on Thursday paring back tariffs on Mexico and Canada until April 2. That timing coincides with a date when the president is expected to start detailing plans for so-called reciprocal duties on nations around the world. Canada says it won’t scrap retaliatory measures if the US administration keeps any levies in place.

Tankers carrying fuel from Canada destined for the US started to divert to Europe prior to the news of the delay, which led to Canadian heavy crude rallying. The US is a major consumer of oil from its northern neighbor.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Extends Drop as Trump’s Trade War Hurts Outlook for Demand

Oil Slumps as Traders Await Next Moves in China, Economic Data

Oil Edges Up as Traders Eye Next Moves in US-China Trade Tumult

Ambani’s Reliance Posts Profit Beat as Energy Unit Recovers

As Elliott Moves In, BP Investment Case Splits ESG Fund Market

Oil Holds Decline With Focus on OPEC+ Supply and Tariff Outlook

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field