Oil Steadies at Start of Week as Market Weighs Trump’s Tariffs

(Bloomberg) -- Oil was steady at the start of the week as traders weighed the fallout from more US tariffs and an upcoming boost in OPEC+ supply.

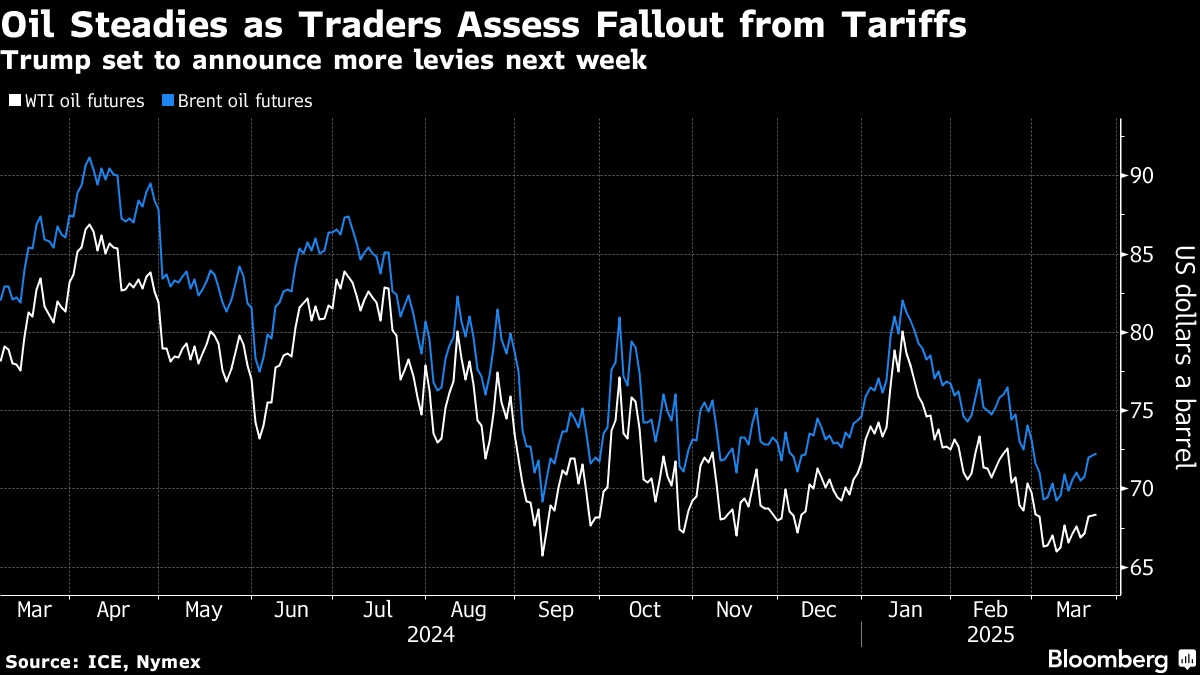

Brent traded below $72 a barrel after rising 2.2% last week, while West Texas Intermediate was near $68. Donald Trump’s wave of so-called reciprocal levies on April 2 are set to be more targeted, according to aides, rather than the barrage the US president has occasionally threatened.

Global markets have been gripped with uncertainty and volatility as Trump opens up trade wars on multiple fronts, with sweeping US duties met with retaliation from other countries including China and Canada. Oil futures are down more than 10% from this year’s peak in mid-January.

Trump’s new tariffs will coincide with more supply from the Organization of the Petroleum Exporting Countries and its allies, which plans to start reviving idled production next month. The group plans to increase output by 138,000 barrels a day, the first in a series of monthly hikes.

Meanwhile, Ukraine’s defense minister said talks with US officials in Riyadh on Sunday about ending Russia’s war “addressed key points including energy” as Trump pushes for a ceasefire. Delegates from the US and Russia are expected to hold separate talks on Monday.

©2025 Bloomberg L.P.