S&P 500 Stages Rebound After $5 Trillion Plunge: Markets Wrap

(Bloomberg) -- A bounce in stocks calmed nerves among equity investors, but the fallout from Donald Trump’s political maneuvering continued to shake global markets and rattle US consumers. Yields on German bonds surged as government leaders agreed on a massive defense spending package, while the ultimate haven asset — gold — topped $3,000 for the first time.

The almost 2% advance in the S&P 500 was set to be the biggest since the aftermath of the presidential election. Not even data showing a slide in consumer confidence prevented the market rebound. That follows a selloff that culminated in a 10% plunge of the US equity benchmark from its peak. Treasuries trimmed a recent rally fueled by a flight to safety. Bullion climbed as much as 0.5% to $3,004.94 an ounce before erasing gains.

The moves capped a week of drama that included Trump’s on-and-off-again tariffs, recession calls, geopolitical talks and concerns over a US government shutdown. Combined with all the questioning around lofty tech valuations, global equity funds saw their biggest redemption this year.

“The markets are grappling with the notion of where fair value rests for a stock market that faces headwinds from tariffs, fiscal spending cuts, and potentially softening economic data, said Yung-Yu Ma at BMO Wealth Management. “Negative investor sentiment is building, so a multi-day relief rally could be coming soon.”

Despite Friday’s advance, the S&P 500 still headed toward a fourth straight week of losses — the longest such streak since August. Trading volume was 10% below the average of the past month. Tech megacaps led gains on Friday, with Nvidia Corp. and Tesla Inc. up at least 3.3%. The Nasdaq 100 climbed 2.1%. The Dow Jones Industrial Average added 1.4%.

The yield on 10-year Treasuries advanced three basis points to 4.30%. A dollar gauge fell 0.2%.

“We are seeing some oversold rally efforts once again,” said Dan Wantrobski at Janney Montgomery Scott. “But we caution folks looking to dive back in at the first sign of stability here: nearly everyone is looking for a bottom and to ‘buy the dip’ at some point, but the current condition of the markets has not implied any real improvement on a technical basis - the tape is simply very oversold at this stage.”

Andrew Brenner at NatAlliance Securities says he gets asked multiple times a day: “Is the worst over?”

“We don’t know. We would like to see a capitulation trade, but the seasonals are starting to turn,” Brenner said. “The end of February to the middle of March is an awful time for equity seasonals.”

It took just 16 trading sessions for US stocks to tumble into a correction, leaving a frazzled Wall Street asking just how long the “adjustment period” White House officials have warned about will last.

In the prior 24 instances when stocks have fallen at least 10% from a record but avoided a bear market, it has taken an average of eight months to reclaim an all-time high, according to data from CFRA Research. That would leave the Feb. 19 high intact until mid-October. The average drawdown reached 14% in those cases.

“Corrections are unnerving in the moment, though they are not unusual, and often act as a pressure release valve for overheated markets,” said Mark Hackett at Nationwide. “This will not be the last correction, pullback, or market scare that the bulls will have to face, and yes, an element of caution is warranted.”

“We say this is a correction, not a bear market in US stocks,” Bank of America Corp.’s Michael Hartnett said. “Since equity bear threatens recession, fresh declines in stock prices will provoke flip in trade and monetary policy.”

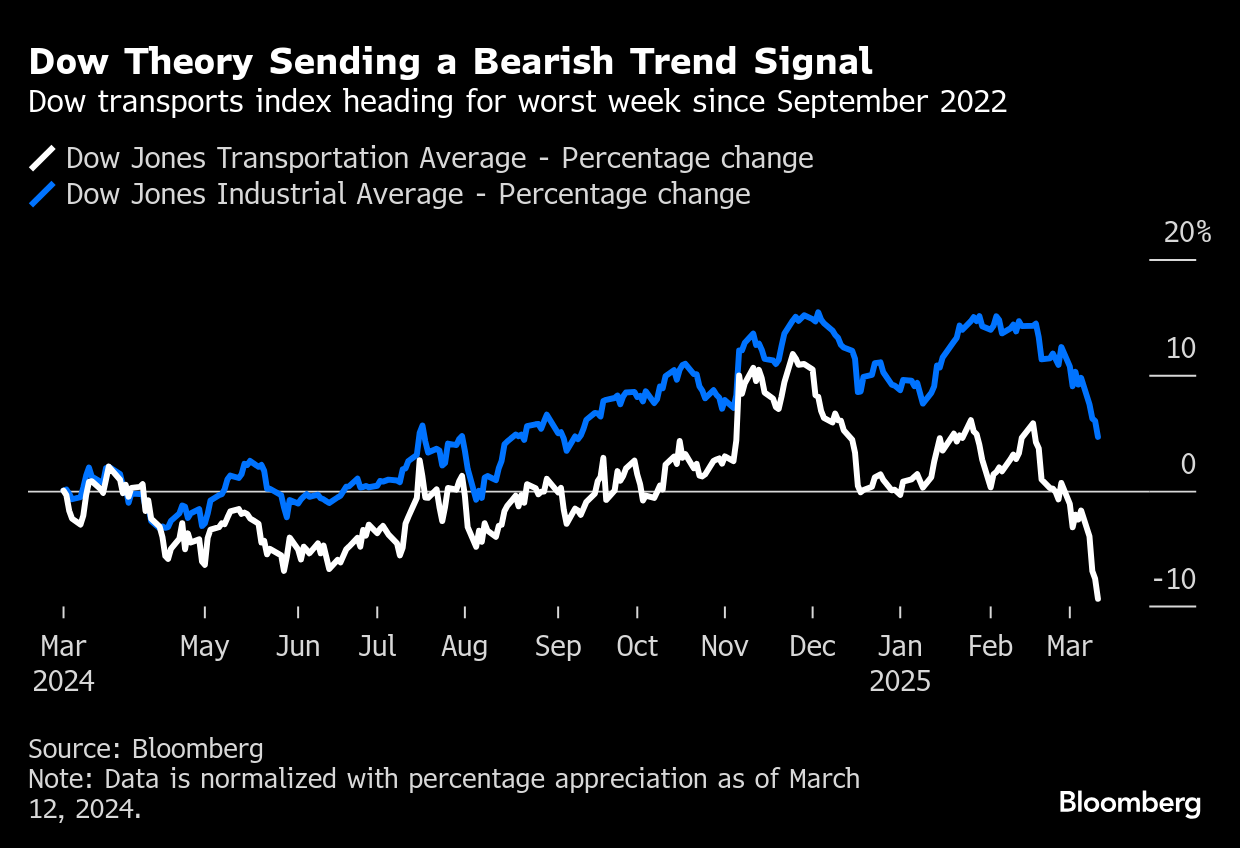

Yet a century-old indicator that has helped predict the direction of the US stock market is signaling more pain ahead for battered investors.

Known as the Dow Theory, it holds that moves in the Dow Jones Industrial Average must be confirmed by transport stocks, and vice versa, to be sustained. As of Thursday’s close, the 20-member Dow Jones Transportation Average — a barometer of consumer and industrial demand — has slumped 19% from its November peak, teetering near so-called bear-market territory.

“What usually differentiates quicker (often healthy) selloffs from drawn-out bear markets is whether a recession follows,” said Ross Mayfield at Baird Private Wealth Management.

The 23 non-recession corrections since 1965 averaged a 16% drawdown, he said. Meantime, the 8 recession selloffs over that period averaged a 36% drawdown.

“The good news is that despite headwinds, a near-term recession still looks unlikely,” he noted.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 1.7% as of 2:17 p.m. New York time

- The Nasdaq 100 rose 2.1%

- The Dow Jones Industrial Average rose 1.4%

- The MSCI World Index rose 1.5%

- Bloomberg Magnificent 7 Total Return Index rose 2.2%

- The Russell 2000 Index rose 2.1%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.2% to $1.0879

- The British pound fell 0.2% to $1.2932

- The Japanese yen fell 0.4% to 148.47 per dollar

Cryptocurrencies

- Bitcoin rose 5.1% to $84,400.06

- Ether rose 4.8% to $1,930.18

Bonds

- The yield on 10-year Treasuries advanced three basis points to 4.30%

- Germany’s 10-year yield advanced two basis points to 2.88%

- Britain’s 10-year yield declined one basis point to 4.67%

Commodities

- West Texas Intermediate crude rose 0.9% to $67.15 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises as US Sanctions on Iran, Russia Offset Bleak Outlook

Shell completes sale of Nigerian onshore subsidiary SPDC

Oil Holds Hefty Gain After US Inflation Slowdown Aids Sentiment

Vopak doubles investment in gas and industrial infrastructure to €2 billion by 2030

Oil Buoyed as Bullish US Figures Ease Concern About Weak Demand

Top Oil Traders Turn Bearish on Prices, Seeing Oversupply

Oil Holds Decline as Risk-Off Mood Sends Markets Into Tailspin

Petro Says Colombia Should Buy Qatar Gas to Fight Rip-Off Prices

Oil Falls as China Data Deepens Gloom and Risk-Off Takes Hold