Stocks Hit by Economic Worries as Nvidia Sinks 7%: Markets Wrap

(Bloomberg) -- A rebound in stocks sputtered as data showed US manufacturing approached stagnation amid jump in prices, deepening concerns about the outlook for the world’s largest economy.

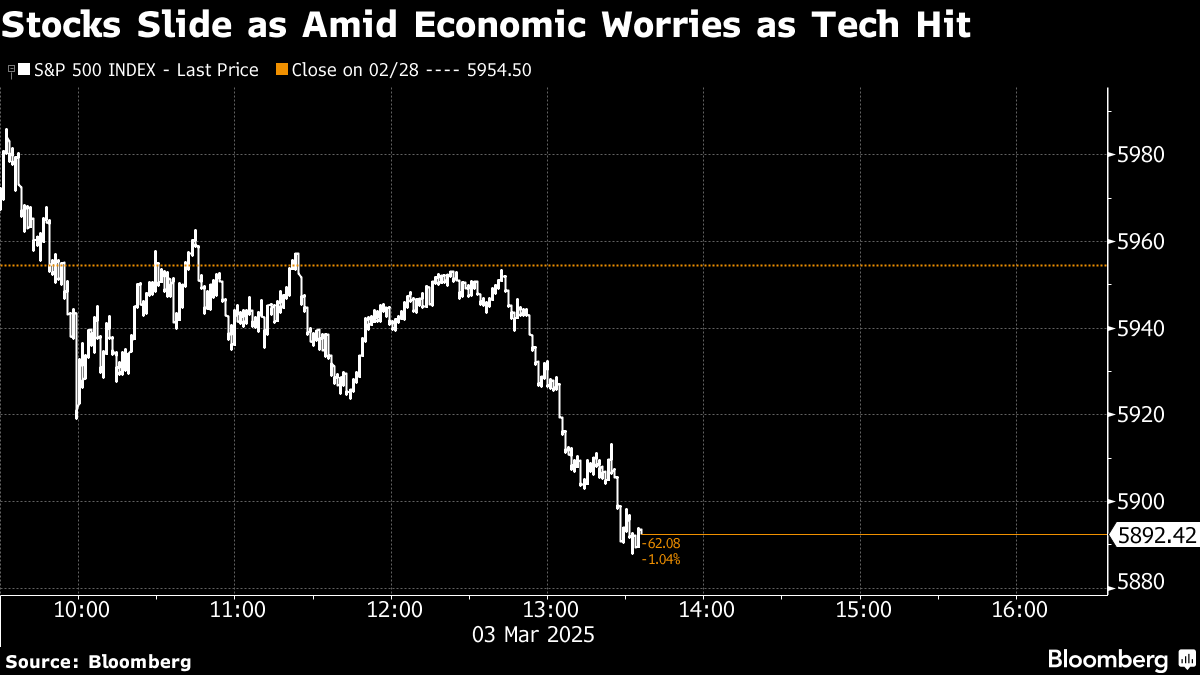

The S&P 500 fell about 1% as big tech sold off. Nvidia Corp. tumbled over 7%. A sense of caution prevailed as investors also monitored geopolitical and trade headlines, with the long-promised tariffs on top US trading partners set to take effect Tuesday. Oil sank as OPEC+ will proceed with plans to revive halted production, amid pressure from President Donald Trump to lower prices. Treasuries rose.

To David Kostin at Goldman Sachs Group Inc., any S&P 500 recovery attempt is likely to prove temporary amid economic worries.

Investor exposure declined last week as the benchmark briefly erased its 2025 gains, but it isn’t low enough yet to suggest “tactical upside as a result of of depressed positioning,” he said. “An improvement in the US economic growth outlook will be required to fully reverse the recent equity market weakness.”

“Markets have been expressing growing concerns about a potential slowdown in the US,” said Florian Ielpo at Lombard Odier Investment Managers. “The message of caution needs to be heard, and depending on Friday’s payroll, this deteriorating macro momentum could cap markets’ progression.”

The S&P 500 fell 1.1%. The Nasdaq 100 slid 1.2%. The Dow Jones Industrial Average dropped 1%. A gauge of the Magnificent Seven megacaos sank 2.2%. The Russell 2000 lost 1.4%.

Taiwan Semiconductor Manufacturing Co. plans to invest $100 billion in US chip plants, according to news reports. Kroger Co. replaced its chief after an investigation into his personal conduct. Sunnova Energy International Inc. plunged as much as 71% as the solar company warned there’s substantial doubt it will remain in business.

The yield on 10-year Treasuries fell four basis points to 4.17%. The Bloomberg Dollar Spot Index fell 0.6%.

Goldman Sachs’ Scott Rubner says he lacks conviction that demand for US stocks is high enough to sustain a rebound.

The tactical flow specialist turned bearish last month amid fading inflows from retail and other supportive buyers. He notes that while the market is in the final stages of a clearing event for positioning, he’s “not ready” to sound an all-clear yet. Instead, he recommends investors be “nimble on highest conviction quality themes.”

In a note to clients, Rubner said March 14 “sticks out” to him as a potential low in stocks, with history suggesting that the first half of the month “typically chops around.”

Morgan Stanley strategist Michael Wilson said equities are likely to be more sensitive to economic growth than to a pullback in bond yields.

US earnings estimates don’t fully reflect potential risks from President Donald Trump’s proposed tariffs, according to Citigroup strategists led by Scott Chronert wrote.

Still, the outlook is more optimistic when viewed at the single-stock and sector level, the strategists say.

“A high-level emphasis on index earnings and related valuations can be misleading. As we head further into ’25, the moniker that it’s a market of stocks not a stock market may take on growing importance, particularly as Trump policy impacts become clearer, they said.”

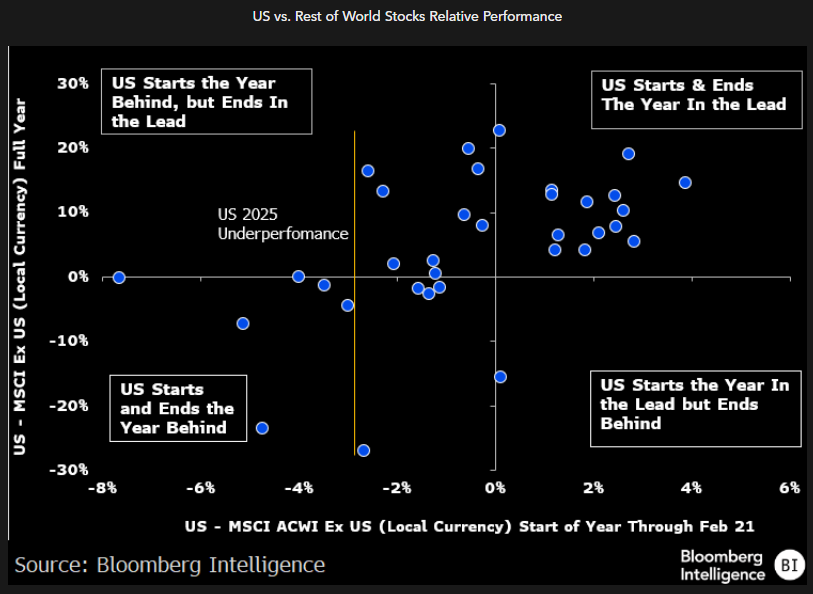

Equity markets around the world are trouncing US stocks in early 2025, an ominous historical signal for how the rest of the year could shape up for US investors.

history’s a guide, that could mean further relative weakness for US stocks in the months ahead. The S&P 500 has never outperformed global peers on an annual basis when it has trailed the international benchmark by more than 2.8 percentage points by mid-February, as it did this year, according to a Bloomberg Intelligence analysis studying 35 years of data.

The underperformance is “a rare and historically significant red flag against a full-year recovery as the market’s fundamentals deteriorate,” according to BI strategists Gina Martin Adams and Gillian Wolff, who conducted the analysis.

Corporate Highlights:

- AbbVie Inc. agreed to pay as much as $2.2 billion for a next-generation obesity drug from Danish biotech Gubra A/S, marking its entry into the hyper-competitive weight-loss market.

- Tether Holdings SA, issuer of the biggest stablecoin cryptocurrency, said its longtime chief financial officer and controlling shareholder Giancarlo Devasini will transition into a new role as chairman of the firm.

- Philip Morris International Inc. is exploring a potential sale of its cigar business in the US, people familiar with the matter said, as the tobacco maker continues its shift toward smoke-free products.

- Allegro Microsystems Inc. is drawing takeover interest from larger competitor ON Semiconductor Corp., according to people familiar with the matter.

- AppLovin Corp. modified the current limit of its share repurchase program, which had about $1.77 billion remaining.

- Chipotle Mexican Grill Inc. was upgraded to overweight from equal-weight at Morgan Stanley.

- Southwest Airlines Co. was downgraded to underweight from neutral at JPMorgan Chase & Co., which cited its surging valuation premium.

- Capri Holdings Ltd. is moving closer to a sale of its Italian luxury brand Versace to Prada SpA, according to people familiar with the matter.

Key events this week:

- Eurozone unemployment, Tuesday

- President Donald Trump’s speech to a joint session of Congress, Tuesday

- China Caixin services PMI, Wednesday

- Eurozone HCOB services PMI, PPI, Wednesday

- US ADP employment, ISM services index, factory orders, Wednesday

- Fed’s Beige Book, Wednesday

- Eurozone retail sales, ECB rate decision, Thursday

- US trade, initial jobless claims, wholesale inventories, Thursday

- US Treasury Secretary Scott Bessent speaks, Thursday

- Fed’s Christopher Waller and Raphael Bostic speak, Thursday

- Eurozone GDP, Friday

- US jobs report, Friday

- Fed Chair Jerome Powell gives keynote speech at an event in New York hosted by University of Chicago Booth School of Business, Friday

- Fed’s John Williams, Michelle Bowman and Adriana Kugler speak, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 1.1% as of 1:37 p.m. New York time

- The Nasdaq 100 fell 1.2%

- The Dow Jones Industrial Average fell 1%

- The MSCI World Index fell 0.3%

- Bloomberg Magnificent 7 Total Return Index fell 2.2%

- The Russell 2000 Index fell 1.4%

Currencies

- The Bloomberg Dollar Spot Index fell 0.6%

- The euro rose 1.1% to $1.0491

- The British pound rose 1% to $1.2709

- The Japanese yen rose 0.3% to 150.13 per dollar

Cryptocurrencies

- Bitcoin fell 7.1% to $87,618.92

- Ether fell 13% to $2,207.54

Bonds

- The yield on 10-year Treasuries declined four basis points to 4.17%

- Germany’s 10-year yield advanced eight basis points to 2.49%

- Britain’s 10-year yield advanced seven basis points to 4.55%

Commodities

- West Texas Intermediate crude fell 2.5% to $68.01 a barrel

- Spot gold rose 1% to $2,887.10 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Climbs as Traders Weigh Ukraine Outlook Ahead of Tariffs

The Arab Energy Fund completes a landmark issuance of $650mn

Venezuelan Navy Approaches Exxon Mobil Vessel Off Guyana Coast

S&P 500 Gets Late-Day Boost at End of Wild Month: Markets Wrap

Oil Set for Monthly Loss as Tariff Risks Batter Sentiment

Oil Holds Near Yearly Low With US Tariffs and Supplies in Focus

UK Climate Adviser’s Plan Clears Path for Heathrow Growth

bp to invest $10b annually in hydrocarbons in strategy reset

Oil Rises as Iran Sanctions, Trump Tariff Comments Rattle Market