Exxon’s Emissions-Reduction Pledge Lags Supermajor Rivals’

(Bloomberg) -- Exxon Mobil Corp. pledged to cut greenhouse-gas emissions 20% by 2030, marking its most ambitious emissions target to date but falling far short of the sweeping climate commitments from some of its biggest rivals.

While it’s Exxon’s first explicit promise to reduce overall pollution, the goals stand in stark contrast to plans by BP Plc and Royal Dutch Shell Plc to totally eliminate emissions by the middle of the century. In addition, Exxon’s target only applies to company assets like oil wells and refineries -- known as Scope 1 and 2 sources -- and excludes partnerships as well as the much larger volume of Scope 3 emissions that arise from the use of its products by customers.

“What Exxon is doing would have been leading edge five years ago but it looks as though they’re well behind their peers,” said Andrew Logan of Ceres, a nonprofit coalition of companies and investors who manage more than $47 trillion.

Exxon’s announcement Wednesday came amid a revamp of its environmental commitments and long-term strategic outlook after hedge fund Engine No. 1 pulled off a sweeping board shakeup earlier this year that saw a quarter of directors replaced. The victory was widely seen as a warning to the fossil-fuels industry to better manage environmental threats and finances.

“We believe the company plan laid out today strikes the right balance between helping society move closer to a net-zero future while providing the products people need for modern living,” Chief Executive Officer Darren Woods said in a statement on the company’s website.

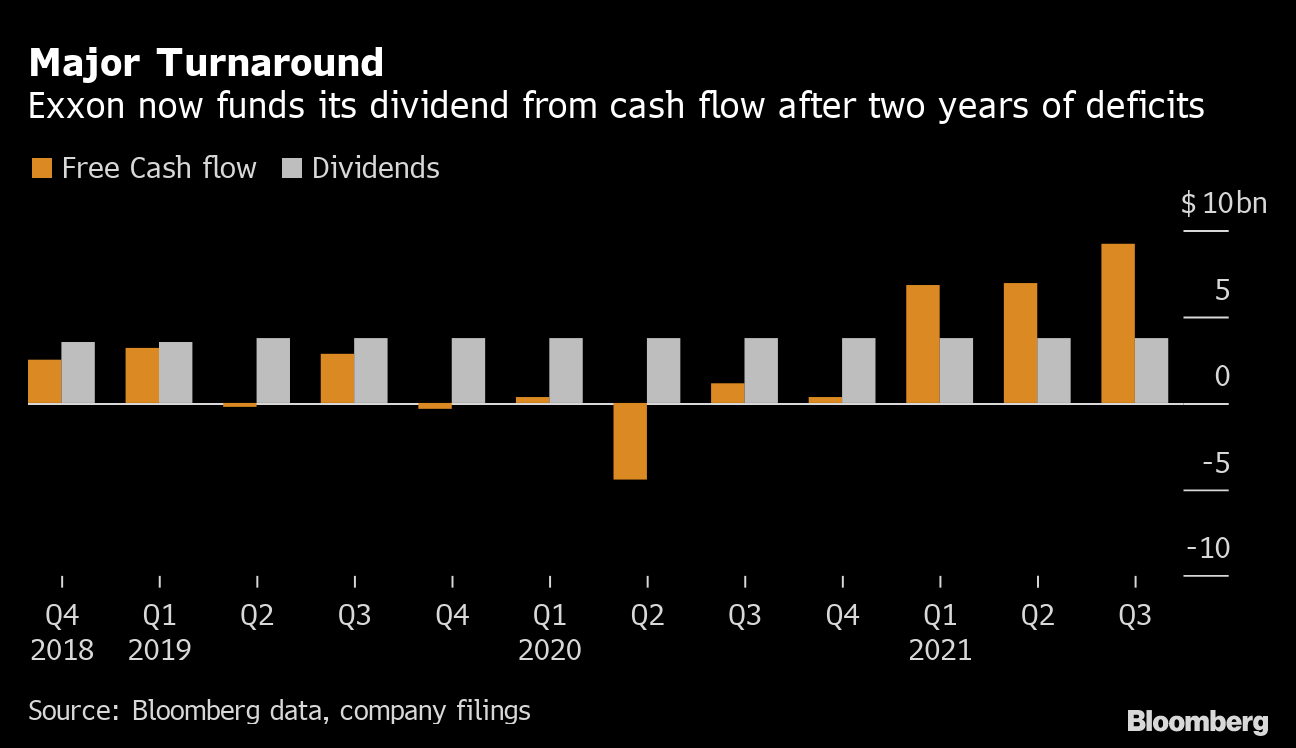

Exxon’s new goals appear to seek thread the needle between climate concerns and the huge petroleum investments that Woods sees as crucial to funding cash flow and dividends.

Recasting the company as a friend of the ecosystem may be a tough sell: Exxon ranked last among the oil supermajors on environmental, social and governance scores prior to Wednesday’s announcement, according to S&P Global Inc.

Pivoting Away

While Exxon has evolved its stance on climate change since the combative tenure of former CEO Lee Raymond around the turn of the century, current management has been reluctant to follow rivals like BP and Shell in pledging to eliminate all emissions and pivoting away from fossil fuels.

Exxon plans to spend $20 billion to $25 billion a year through 2027. Although that’s about one-third lower than pre-Covid levels, the company said it’ll be enough to double cash flow and earnings compared with 2019 levels.

As part of that budget, Exxon will spent around $3 billion a year on low-carbon investments such as carbon capture, hydrogen and biofuels, and forecast returns in excess of 10% under current government policies.

Although Exxon’s new targets fall short of net zero, they do mean the oil giant will be meaningfully reducing its emissions on an absolute basis. U.S. rival Chevron Corp. outlined a net-zero “aspiration” earlier this year but only pledged to reduce so-called emissions intensity, a controversial measure of pollution per unit of energy that allows oil and natural gas production to increase.

Exxon’s new plan calls for limited increases in oil and natural gas production, with new projects mostly offsetting natural declines from older fields. Production will climb to the equivalent of just over 4 million barrels a day in coming years.

The new plans will generate enough cash to cover Exxon’s $15 billion-a-year dividend, the third largest in the S&P 500 Index, as well as capital spending even if crude were to drop as low as $35 a barrel, Chief Financial Officer Kathy Mikells said during the presentation.

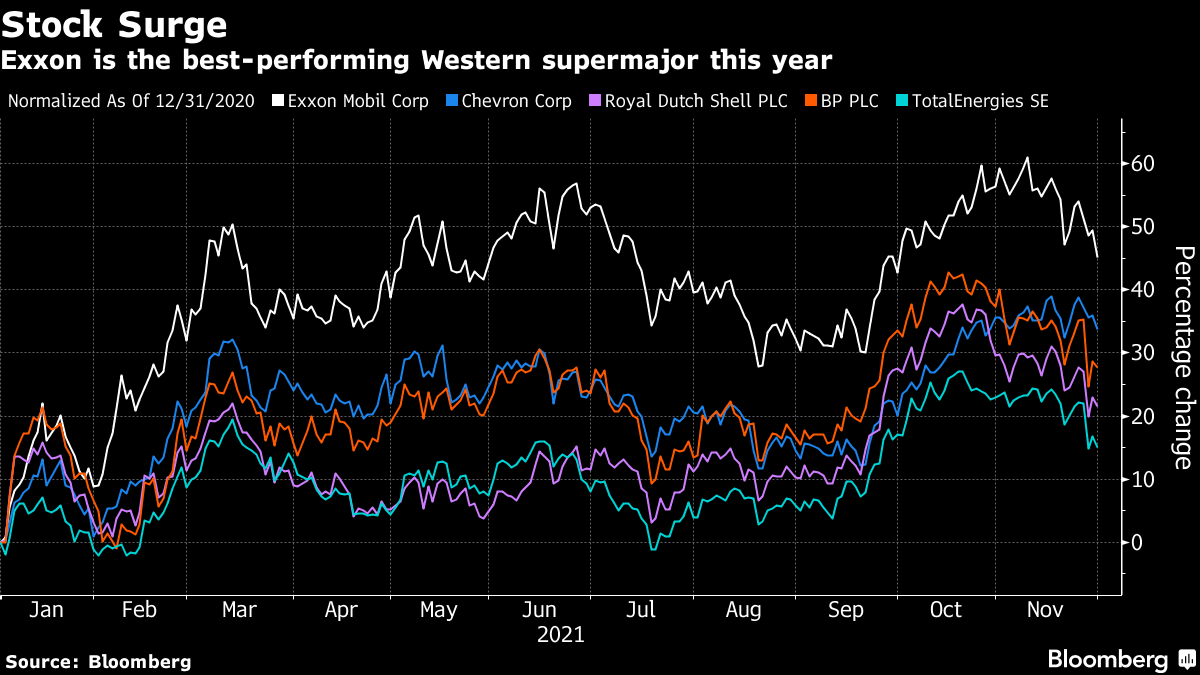

Exxon shares rose 2.5% to $61.36 at 12:08 p.m. in New York in tandem with international crude prices. The stock has advanced 49% this year for the best return among the supermajor oil companies.

(Updates with analyst’s comment in third paragraph.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GB Energy Faces New Doubts as UK Declines to Affirm Future Funds

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands

Germany Set to Scale Down Climate Ambitions