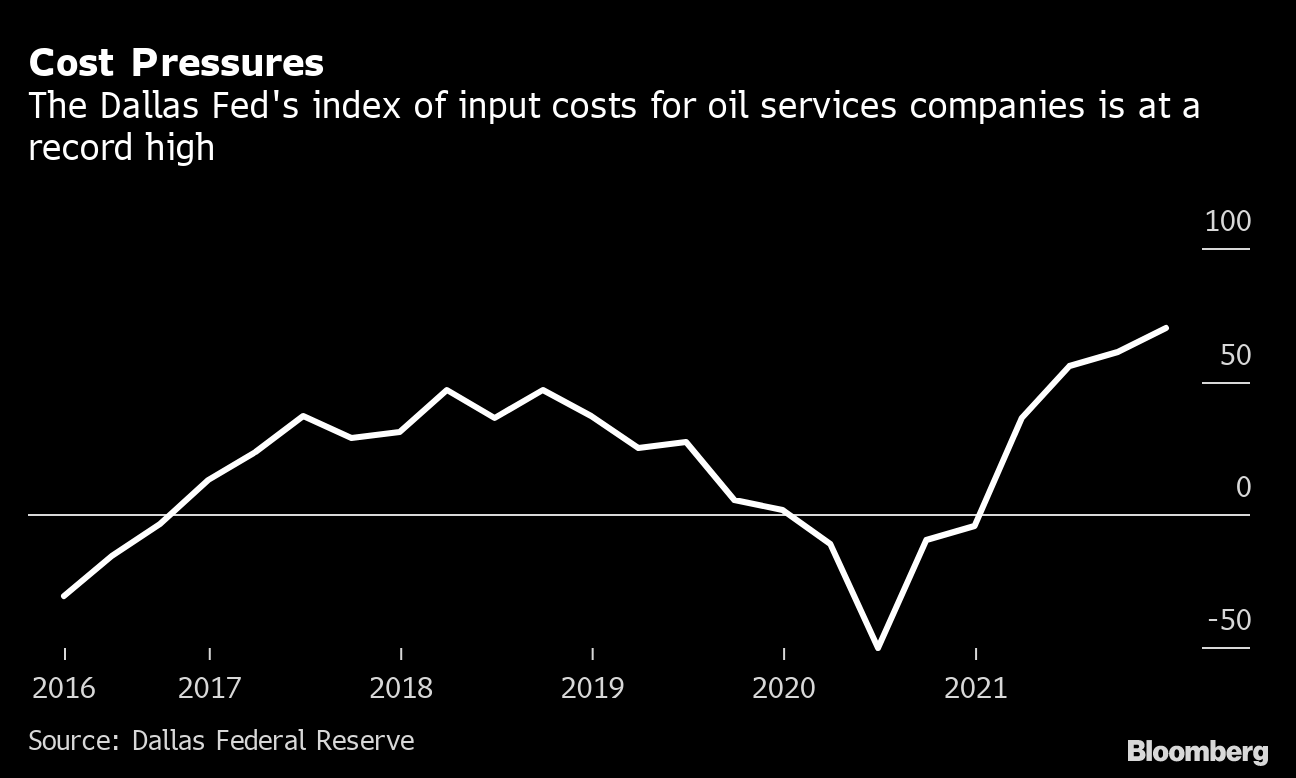

Shale Drillers Face Record Cost Pressures as Banks Shun Sector

(Bloomberg) -- Oil drillers in the biggest U.S. fields are shouldering record costs at the same time that some banks are increasingly reluctant to loan money to the sector, according to the Federal Reserve Bank of Dallas.

Equipment, leasing and other input costs for oil explorers and the contractors they hire surged to an all-time high during the current quarter, the Dallas Fed said in a report released on Wednesday. Drillers also are seeing the universe of willing lenders shrink in the Eleventh Federal Reserve District that includes Texas and parts of Louisiana and New Mexico.

“The political pressure forcing available capital away from the energy industry is a problem for everyone,” an unidentified survey respondent said. “Banks view lending to the energy industry as having a ‘political risk.’ The capital availability has moved down-market to family offices, etc., and it is drastically reducing the size and availability of commitments regardless of commodity prices.”

Meanwhile, supply-chain snarls are hindering efforts to replace diesel-burning pumps with cleaner, electric-powered gear in the Permian Basin, where components such as transformers are in “extremely short supply,” another respondent said.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GB Energy Faces New Doubts as UK Declines to Affirm Future Funds

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands

Germany Set to Scale Down Climate Ambitions