A Xinjiang Solar Giant Breaks Ranks to Try and Woo the West

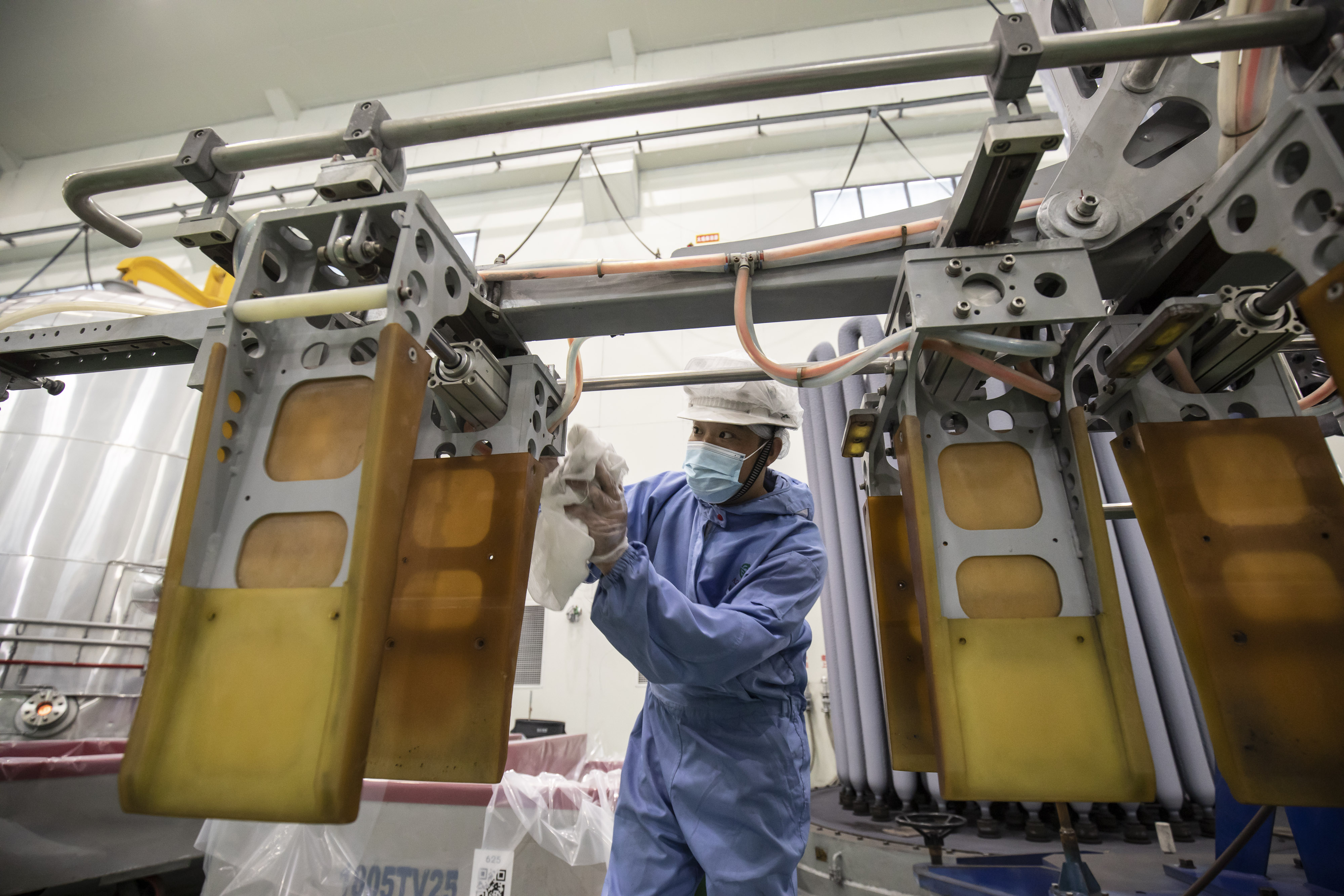

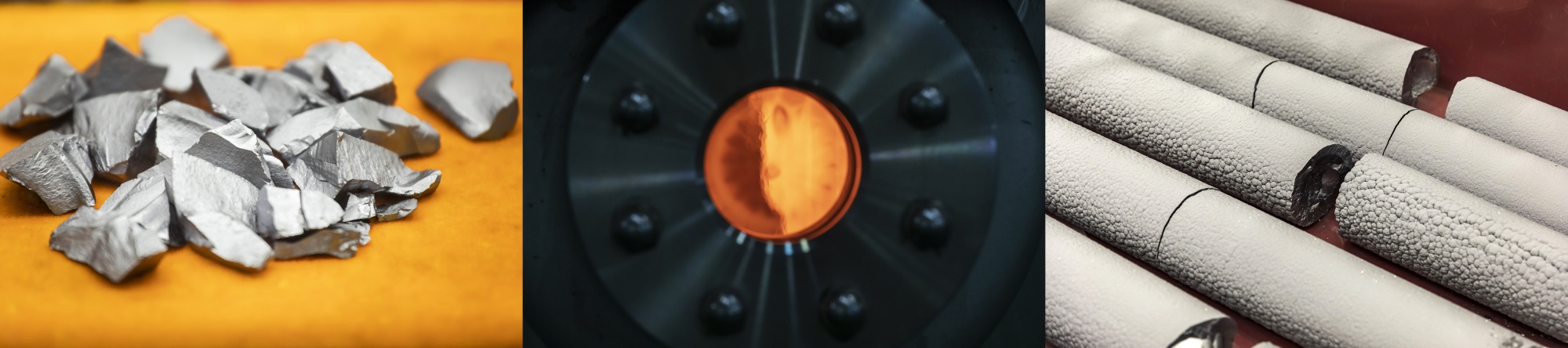

(Bloomberg) -- At the Daqo New Energy Corp. factory in China’s Xinjiang region, workers carefully processed tall columns of refined silicon last week as a group of reporters and analysts looked on. It’s the first time outsiders were allowed to witness the mundane factory scene since China’s dominant solar industry has come under scrutiny for its labor practices.

Unlike three other companies in Xinjiang that produce polysilicon—a key ingredient in solar panels—Daqo hasn’t been linked to alleged human-rights abuses. Yet Daqo has upheld the same secrecy as its peers with ties to the government-run labor program that's under international scrutiny. As recently as March, the company declined interview requests for its executives and turned away foreign observers.

Now the company’s leadership is breaking ranks in an attempt to shield itself from potential U.S. sanctions over China's treatment of the Uyghur minority group in Xinjiang.

READ MORE: Secrecy and Abuse Claims Haunt China’s Solar Factories in Xinjiang

Daqo’s chief financial officer, Ming Yang, acknowledges there's a “good probability” that Xinjiang-made polysilicon will be banned by President Joe Biden. As the only U.S.-listed polysilicon company based in Xinjiang, Daqo can’t just ignore concerns from overseas investors and regulators, he said in an interview. “We understand there are these perception risks, especially from the public and media, and some investors,” Yang said.

On Wednesday, U.S. climate envoy John Kerry said officials “believe in some cases” that Chinese solar products are being produced by forced labor and confirmed the administration is mulling restrictions. Daqo’s best bet is to try and win an exemption. Chinese smartphone maker Xiaomi Corp. this month managed to get itself removed from a U.S. blacklist of military-linked companies, suggesting there’s a way for individual companies to avoid penalties even as tensions rise between the world’s two biggest economies.

Concerns about forced labor in Xinjiang stem from a state-run labor program that some Western governments and academics have argued is used to compel mainly Muslim Uyghurs and other minorities to work against their will. Researchers have highlighted public documents showing three other polysilicon factories—not Daqo’s—accepted workers from the program. China says the initiative helps poor ethnic minorities find better employment and that accusations of forced labor in Xinjiang are lies invented by foreign adversaries.

Daqo’s campaign is being spearheaded by Yang, a Taiwan-born, Cornell-educated former McKinsey & Co. consultant who joined the firm in 2015. The night before the tour, the 46-year-old held court for two hours over dinner at a local hotel, sipping Moutai liquor

When asked later what he thought of the government’s treatment of Uyghurs, including internment camps that officials describe as vocational training facilities, Yang equivocated. “Do they exist or not? Actually, I don’t know,” he said. “But certainly if they do exist, then I think there are moral standards that this will be judged” against.

Yang and his team plan to appoint an agency to conduct a human-rights audit of their operations—and most probably those of key suppliers—to back up the company’s assertion that it has “zero tolerance” for forced labor. Daqo has shortlisted three possibilities: a global auditing firm and two fair-labor institutions referred to them by the U.S. government.

It’s a gamble. Conducting independent, third-party inspections at random times would require cooperation from a local government that has for years prevented foreign journalists and diplomats from freely visiting the region. Yang said the authorities have given Daqo “preliminary assurances” that the auditors will be granted access.

Supply-chain audits are recognized by the U.S. government, "but the bar is high and they have mixed results of success," said Nicholas Turner, a lawyer at Steptoe & Johnson LLP in Hong Kong who specializes in economic sanctions. "A lot will depend on who the auditor is and the level of transparency the company can provide."

Daqo’s push for transparency could also end up raising more questions about the other key players in the industry—Xinte Energy Co., GCL-Poly Energy Holdings Ltd. and East Hope Group Co.—and China’s labor practices in the region. Together, the four factories provide almost half the global supply of polysilicon, helping to power a surge in solar energy around the world.

Operating in the region has become problematic for companies after China began a “strike-hard” campaign in Xinjiang in the 2010s in response to a series of deadly terror attacks by Uyghurs seeking greater political and cultural autonomy. The policies, which have seen Muslims placed under tight surveillance and separated from their families, have been characterized by the U.S. government as genocide.

For Daqo, distancing itself from the labor program could be almost as risky as facing U.S. sanctions. The company must be careful that in defending its own practices it doesn’t appear to be agreeing with Western criticisms of Chinese policies, or failing to show solidarity with Beijing and its industry peers. That’s why Daqo has tailored its message for two different audiences.

During the factory tour, which was also attended by analysts from HSBC Holdings Plc, JPMorgan Chase & Co. and Credit Suisse Group AG, Yang insisted that Daqo wouldn’t take part in the labor program. “If the government did ask us, we would not participate,” he said. As a foreign-invested company, Yang said Daqo wouldn’t be obligated to comply with such an order. Daqo has “very high integrity standards,” he said.

5 billion yuan ($778 million) in a listing this year on Shanghai’s Star board.

Kevin He, Daqo’s head of investor relations, struck a different tone from Yang at a press conference arranged by the foreign ministry in Beijing in early May. Sitting next to Xinjiang government officials, he lashed out at a U.S. solar industry lobby’s efforts to form an anti-forced labor alliance. The aim, he said, was to sabotage China’s participation in the global market. “We express our strong indignation and condemnation,” He said.

Foreign ministry spokesman Zhao Lijian reiterated on Monday that there is only voluntary employment in Xinjiang. "China welcomes those with just and objective view from all countries and institutions to visit Xinjiang, but is against investigations based on the presumption of guilt,” he said.

Concerns about Daqo’s perceived ties to Xinjiang Production and Construction Corps, or XPCC—a state-affiliated organization that's been sanctioned by the U.S. government for alleged human-rights abuses including mass arbitrary detention—are another “potential risk,” Yang said. The organization oversaw the development of Shihezi, the city where Daqo’s factory is based.

“We have no association with the XPCC,” Yang said. “We're not owned by them. We’re a fully foreign-owned enterprise and we have no collaboration.” Yang said Daqo will stop expanding its Shihezi operations after this year, citing diminishing energy price advantages and a desire to be closer to customers. The company is looking at Yunnan and Inner Mongolia as possibilities for future growth.

But Daqo faces an uphill battle as it tries to escape the shadow of Xinjiang. Last week, for example, researchers Laura Murphy and Nyrola Elima released a report detailing what they called “a long-term, mutually beneficial relationship” between Daqo and XPCC. They also cited public documents that indicate some of Daqo’s major suppliers may have hired workers from the labor program. Daqo said it didn’t find any evidence of forced labor at the plants.

Companies “must allow unannounced, unfettered, unmonitored audits that center Uyghur workers' voices and that guarantee zero repercussions for whistleblowers,” said Murphy, a professor at Sheffield Hallam University. “No company can guarantee any of those conditions in Xinjiang so long as internment camps remain in operation. And certainly none of this is accomplished by guided tours of factory floors.”

That means the pressure on Daqo will be difficult to evade, no matter how open the company makes itself. “We’re trying to be as transparent as possible," Yang said.

(Updates with analyst comment in 11th paragraph.)

For more articles like this, please visit us at bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Chinese EVs Make Inroads in Nigeria as Gasoline Prices Rise

India Mulls $1 Billion Subsidy Plan to China-Proof Solar Sector

After Wall Street Exodus, Climate Group Explores Axing 1.5C Goal

GB Energy Faces Doubts as UK Declines to Affirm Future Funds

Ex-Goldman Banker Targets CRE Deals Left Behind in Trump Era

UK Moves to Ease Offshore Wind Rules to Boost Renewables Rollout

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering