Why Volkswagen Wants to Be Relevant in America Again

(Bloomberg) --

For years, Volkswagen’s poor performance in the U.S. fueled debate among the company’s managers about whether Europe’s biggest carmaker should simply pack up and leave.

According to Chief Executive Officer Herbert Diess, that’s no longer remotely an option.

“We are going nowhere,” Diess said in a recent interview with CBS’s . “No, we have to come back in the U.S. We have to become relevant in the U.S. And we are in the right way.”

The right way, according to Diess, is to focus on the larger vehicles that appeal to U.S. drivers, instead of shipping over sedans designed for European consumers. This includes electric SUVs like the ID.4 and the ID. Buzz, a battery-powered iteration of the hippie-era minibus that still maintains a cult following.

“We didn't take the U.S. customer seriously enough,” Diess said.

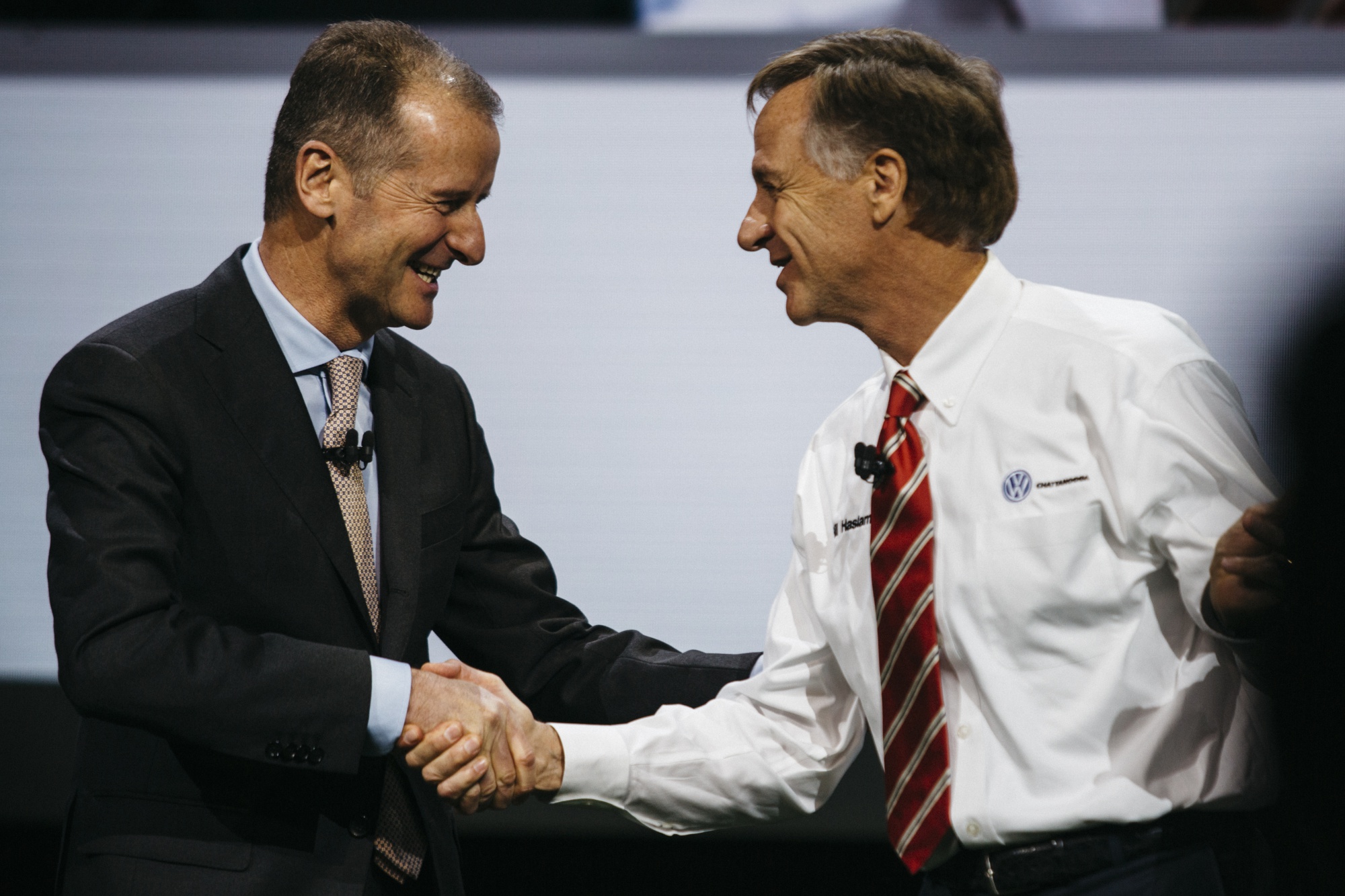

The right way also means showing your face and shaking hands, especially after the company’s cataclysmic diesel-emissions scandal. Last month, Diess attended the South by Southwest festival in Austin, Texas, where he showed off the ID. Buzz, rubbed shoulders with startup CEOs and met with Texas Governor Greg Abbott. A few days later, he was in Chicago to chat with Jeff Bezos and attend the Amazon founder’s invite-only MARS technology conference.

Volkswagen and its brands including Audi, Porsche and Bentley have long focused on Europe and growing in China, which now accounts for roughly 40% of the group’s total sales. While this approach yielded healthy profits, it’s not ideal positioning at the moment.

The war in Ukraine has disrupted supply chains in Europe, and the lengthening list of sanctions targeting Russia is a grim reminder of what could happen if China were to assert itself in Taiwan. VW has for years fielded uncomfortable questions about operating in Xinjiang, where human rights groups and a panel of United Nations experts have raised concerns about coercive labor practices. Diess told he’s “absolutely sure” there’s no forced labor at VW’s plant, and said locals “are much better off” if the company stays in the region.

China’s geopolitical tensions and interest in cultivating homegrown automotive champions make the U.S. a relatively attractive place for VW to prioritize investment. Buyers there spend big on luxury cars and regularly fork over more than $50,000 on large SUVs and pickups. The latter segment is also going electric. When pointed out that VW doesn’t have plans to make an electric truck, Diess quickly replied “not .”

Succeeding in the U.S. won’t be easy. Japanese automakers’ efforts to ding Detroit’s dominance of pickups have largely failed, with Toyota’s Tundra and Nissan’s Titan never coming close to the volumes mustered by Ford’s F-Series or GM’s Chevrolet Silverado. When it comes to battery-powered sedans and SUVs, Tesla is far ahead.

During my recent road trip through the American Southwest, I was surprised how many Model 3s we saw, and Tesla’s new factory in Austin, Texas, will churn out more Model Ys. During a Wednesday evening earnings call, Elon Musk said Tesla is on track to expand production to more than 1.5 million vehicles this year, implying more than 60% growth at a time when VW and others are struggling to source enough wire harnesses and semiconductors.

None of this is discouraging the German giant. Sales for VW’s main brand climbed 15% to 375,030 units in the U.S. last year. That’s still a far cry from the more than half a million vehicles the company delivered during the late 1960s and early ’70s, when the Beetle and original minibus were all the rage. But VW is setting itself up to claw back some of that share, retooling its factory in Chattanooga, Tennessee, to make EVs including the ID.4. It’s building up U.S. EV charging infrastructure and is looking to build more battery plants in the country.

“This is such an important market,” Diess said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GB Energy Faces Doubts as UK Declines to Affirm Future Funds

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands

Germany Set to Scale Down Climate Ambitions