Shale Drillers Are Holding Firm on Output as Oilfield Costs Rise

(Bloomberg) -- US shale oil drillers continue to show little sign of responding to high global prices with more production, only now it's not just their focus on rewarding shareholders that's holding them back, but also a preoccupation with soaring costs.

The combined oil and gas production forecasts from a dozen companies that have reported second-quarter results in recent days is barely changed from three months earlier, down just 0.6%, despite US crude prices surging to $120 a barrel this year after Russia invaded Ukraine. At the same time, higher diesel, steel, chemical and labor costs have prompted the companies to raise capital budgets by 7%.

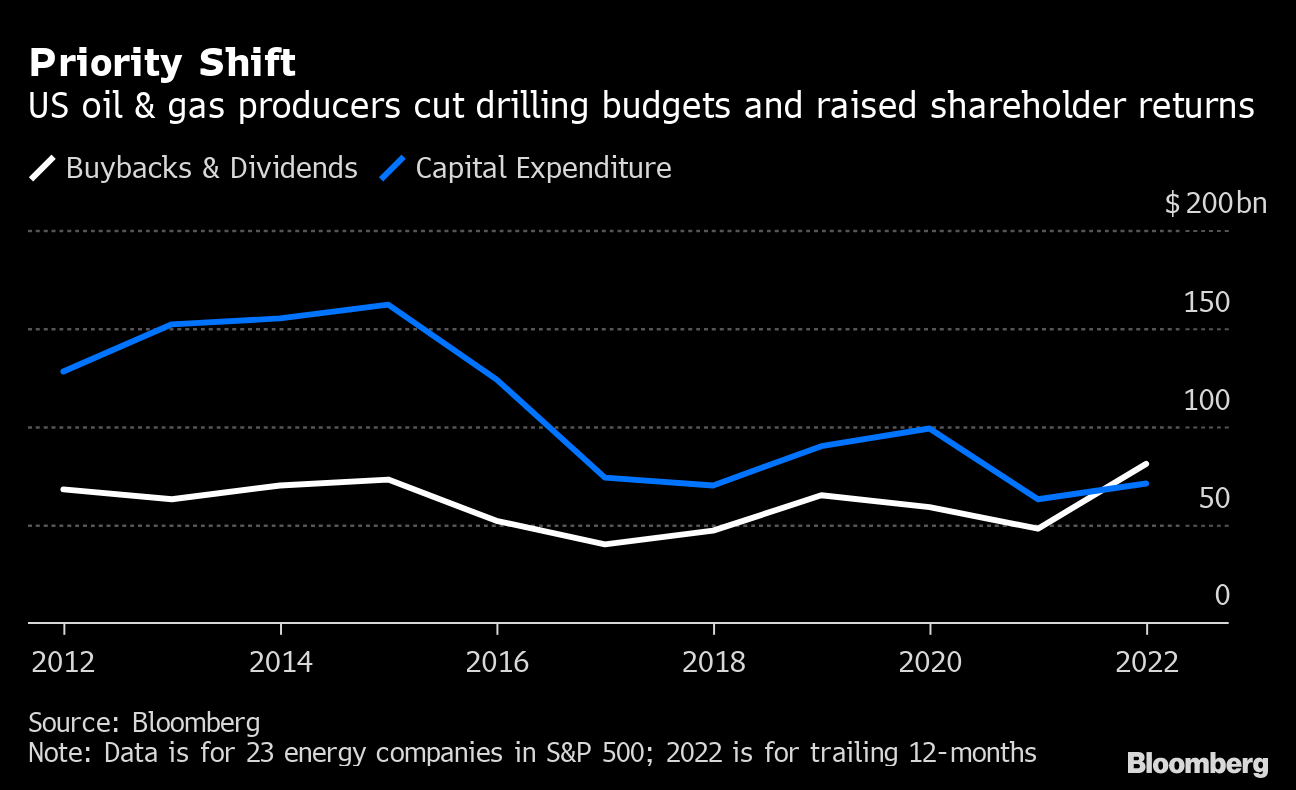

Shale executives’ unwillingness to boost production means the world oil market has effectively lost its two biggest growth engines. The Organization of Petroleum Exporting Countries admitted to “severely limited availability of excess capacity” this week, and said what little is left can only be tapped with “great caution.” Meanwhile, US drillers have concluded that record profits and cash flows are better spent on share buybacks and dividends rather than deploying more rigs.

“There’s no oil out there,” Kaes Van’t Hof, chief financial officer of Diamondback Energy Inc., said during a conference call with analysts. “We’re not changing our plan for every $10, $20, $30 move in oil price.”

US oilfields currently pump about 12 million barrels a day, 8% higher than a year ago but still 1 million barrels a day below the pre-pandemic all-time high. Just about the only American companies planning to significantly expand output are supermajors like Exxon Mobil Corp. and Chevron Corp. or family-owned operators such as Mewbourne Oil Co.

Even the jump in oil prices after Russia’s invasion of Ukraine, and pleas from President Joe Biden for supply hikes, haven’t lured US shale drillers back to the growth mode that was long their modus operandi. They’re finally learning “discipline” after back-to-back crude-market crashes, said Bill Smead, who manages $4.8 billion at Smead Capital Management Inc.

“They got castrated in 2016, they got slaughtered in 2020, and then they got demonized for ruining the environment after that,” said Smead, who is Continental Resources Inc.’s largest independent investor and a top-20 shareholder in Occidental Petroleum Corp. “Why would you do anything to help the people that hate you?”

Shale explorers also are unwilling to invest beyond current drilling plans because of "deteriorating efficiencies" amid cost inflation, said Noah Barrett, lead energy analyst at Janus Henderson, which manages about $350 billion.

"They're thinking more like investors and less like engineers,” Barrett said. “They're hesitant to ramp spending in this environment."

Shale drillers are reaping huge profits at the moment. With over half of the 35 independent drillers tracked in BloombergNEF having posted quarterly earnings, the group is on track to report a record $26.4 billion in free cash flow. Most of that will be funneled back to investors through buybacks and dividends.

Returning to growth mode “just seems like a real long punt for us right now,” said Rick Muncrief, Devon Energy Corp.’s CEO. “We’re certainly not getting that feedback from our investors.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Germany’s Merz Takes Aim at Greens in Final Election Stretch

GB Energy Faces Doubts as UK Declines to Affirm Future Funds

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands