Why Toyota’s New Prius Won’t Be Its Last

(Bloomberg) -- Toyota aired a Super Bowl commercial almost 18 years ago that opened with cars in traffic, their wheels spinning but going nowhere. “It’s been a long time since transportation has truly advanced,” a narrator intoned. “We’ve been moving; we just haven’t been moving forward.”

The ad for the second-generation Prius echoes the criticism being lobbed at the manufacturer that just debuted a fifth-generation version of its flagship hybrid. Toyota has ranked last when Greenpeace scored the 10 biggest automakers’ decarbonization efforts. InfluenceMap, a think tank that evaluates corporate climate policy engagement, said last month that Toyota remains the most obstructive company in the transport sector.

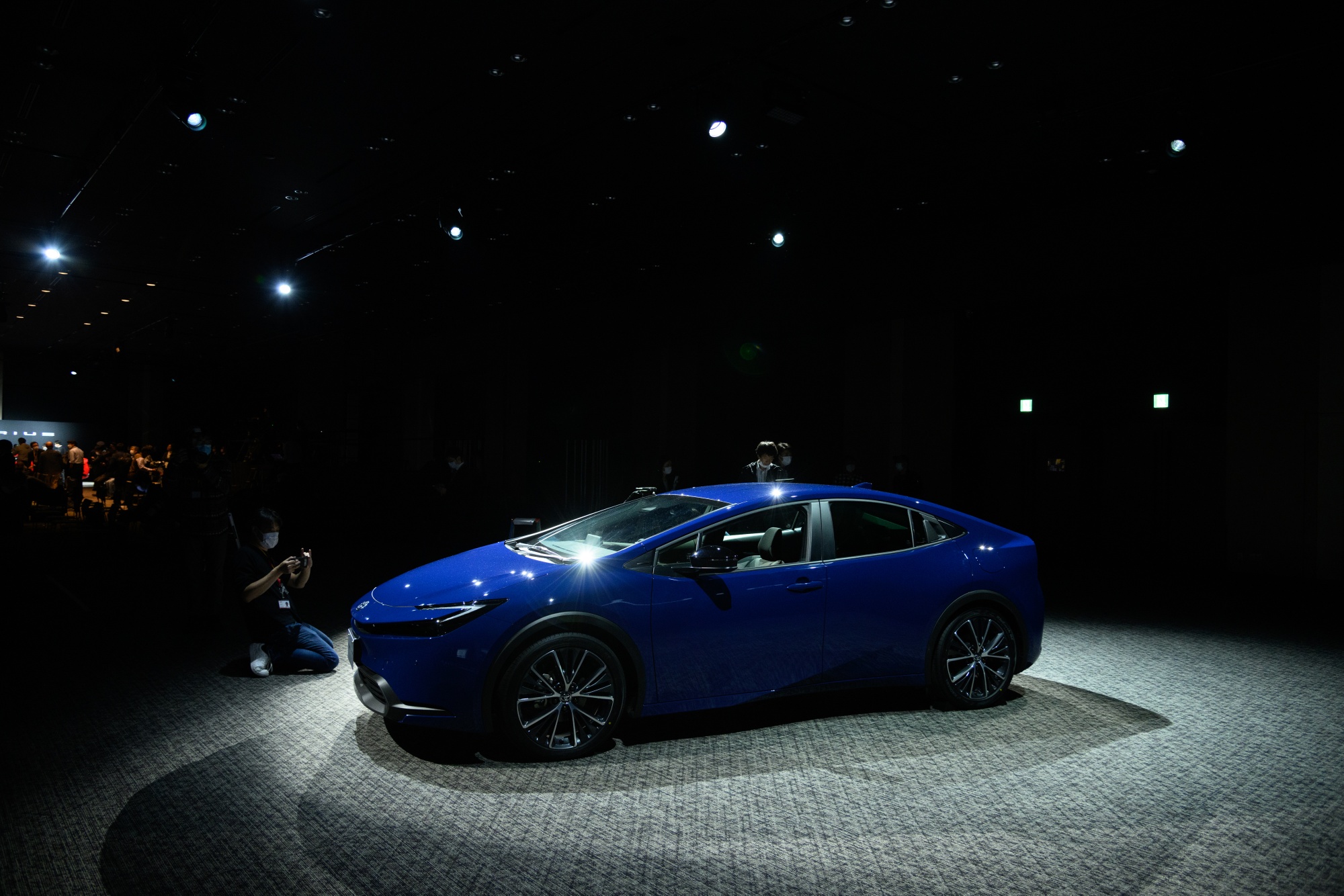

Toyota would fare better in these rankings if it were to make a no-holds-barred pivot to fully electric vehicles and embrace policies pushing in that direction. But while the company vowed a year ago to plow ¥4 trillion ($30 billion) into an effort to sell 3.5 million EVs annually by the end of the decade, the new-look Prius the company just unveiled won’t be the last iteration.

Toyota insists that building more of the hybrids it’s been selling for 25 years doesn’t mean it’s spinning its wheels or failing to move forward. Executives briefed reporters in Brussels last week on plans to reach carbon neutrality in Europe by 2040 — a decade before the company plans to reach net zero globally — and argued the tack they’re taking is the quickest way to cut back on car pollution, given the lasting shortages of what’s needed for automakers and their customers to go fully electric.

“When battery materials and renewable energy charging infrastructure are scarce — which is what they’re going to be for the next 10 to 15 years — we need to employ systems thinking,” said Gill Pratt, Toyota’s chief scientist. “Battery cells should be put where they will do the most good.”

To illustrate his point, Pratt gave an estimate of the typical lifetime emissions of 100 non-electrified vehicles. He then gave a breakdown of how much the emissions rate of the fleet could be reduced assuming you only have 100 kilowatt hours of battery capacity to go around.

That happens to be the size of a Tesla Model S battery. Using the entire battery supply to fully electrify one car reduces the emissions rate of the fleet by less than 1%. Using this scarce amount of cells to replace six non-electrified cars with plug-in hybrids each using 18 kWh batteries would reduce the fleet’s emissions rate a bit more — by about 2.4%. But the winner in Pratt’s thought exercise would be to replace 90 non-electrified vehicles with hybrids using 1.1 kWh batteries, which would lower the emissions rate of the fleet by 18%.

“We can debate the lifetime average carbon emissions that I’ve assumed here for each vehicle type,” Pratt said. “The result is not going to change significantly, because the dominant factor is the different numbers of non-electrified vehicles that are displaced by the same amount of battery, not the exact lifetime emissions of each powertrain type. This is the fundamental rationale for Toyota’s diverse approach.”

Toyota is intimately familiar with battery raw material shortages — its trading arm Toyota Tsusho has invested in mining for more than a decade. Pratt pointed to the price of lithium soaring to record highs of more than $50,000 per ton, 10 times higher than just two years ago.

The automaker estimates that more than 1 billion people don’t have access to adequate electricity supply. And whereas the average battery-electric vehicle, or BEV, sells for more than $65,000 in the US, the current-generation Prius starts at just over $25,000.

“BEVs are a satisfactory answer in Europe and increasingly in the US, where infrastructure is being built out and there is enough electricity — for now,” Toyota President Akio Toyoda said in remarks shared with reporters. “They are not yet the answer everywhere, nor are they yet affordable for all.”

At a similar forum in Brussels this time last year, Toyota vowed to be ready to sell only zero-emission cars in Europe by 2035, aligning itself with the European Union’s planned phase-out of combustion engine cars. It staged the European premiere of bZ4X, the first in a series of six Toyota brand EVs it will sell in the region by 2026.

The launch of the RAV4-like SUV didn’t go according to plan — a single bZ4X was delivered to a customer in Europe before Toyota stopped sales worldwide over a hub bolt issue that could lead to wheels detaching from the vehicle. Sales will start months late in major European markets in the first quarter.

Despite the rocky start, the company’s sales units are projecting demand next year that the company won’t be able to meet with enough supply, Matt Harrison, the president of Toyota Motor Europe, said in an interview.

“We’re having to sort of manage around the world to put more capacity in place for bZ4X for beyond 2023, because we see that probably the demand is going to be higher than was expected,” he said. “We’re going to have a supply problem for bZ4X, not a demand problem.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Namibia Says EU Initiative’s Delay Affects Green-Bond Plans

China’s EV Boom Threatens to Push Gasoline Demand Off a Cliff

TotalEnergies accelerates decarbonisation of its platform at La Mède

SolarEdge Is Cutting 12% of Its Staff After $1 Billion Writedown

Bhutan Studying Green Financing for $23 Billion Hydropower Plan

Australia Says It Is On Track to Meet 2030 Emissions Cut Targets

TotalEnergies, bp, Equinor and Shell join forces to help increase access to energy

Cyclone-Prone Malawi Eyes First Energy Storage to Bolster Grid

EV Battery Maker Calls for Cheaper EU Energy to Counter China

COP29 Ends With Deal on Climate Finance After Bitter Fight

Watch/Listen

Enhancing efficiency and accelerating decarbonisation through AI and digital innovation

China’s natural gas market: transitioning amid renewable goals and carbon neutrality

Nabors: transforming drilling and rig operations with digitalisation