Europe Energy Crisis Worsens as War Risk Adds to Gas Woes

(Bloomberg) --

Europe’s energy crisis intensified as the risk of war pushed up gas prices, power-plant halts were extended and the French government asked its biggest utility to take a $8.8 billion hit to protect consumers.

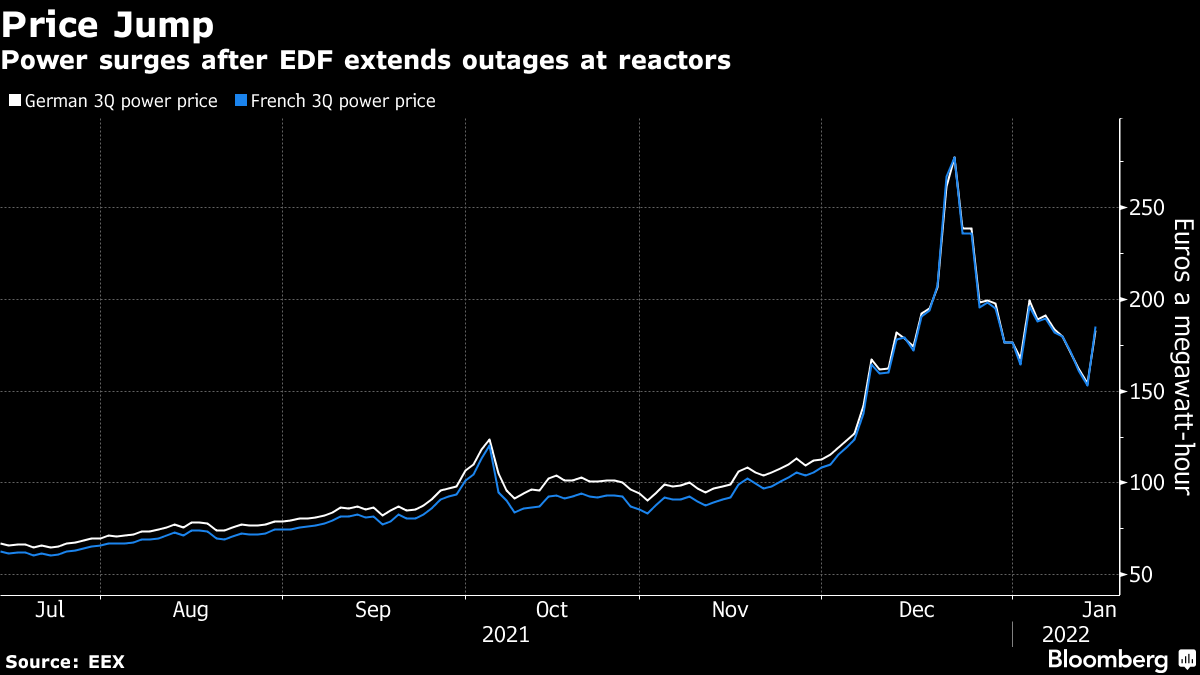

Power and gas prices surged on Friday with the prospect of military action in Ukraine increasing as geopolitical tensions escalated. Meanwhile nuclear giant Electricite de France SA sank the most on record after the government said it must sell power at a steep discount, and several reactors faced long outages.

“The risk of a potential new war in Ukraine and the effects this could have on the gas market continue to cause a lot of uncertainty,” analysts at Energi Danmark said. “German power climbs due to the news about reduced nuclear power production in France.”

German electricity for the third quarter soared as much as 23%, while benchmark European gas prices added as much as 13%.

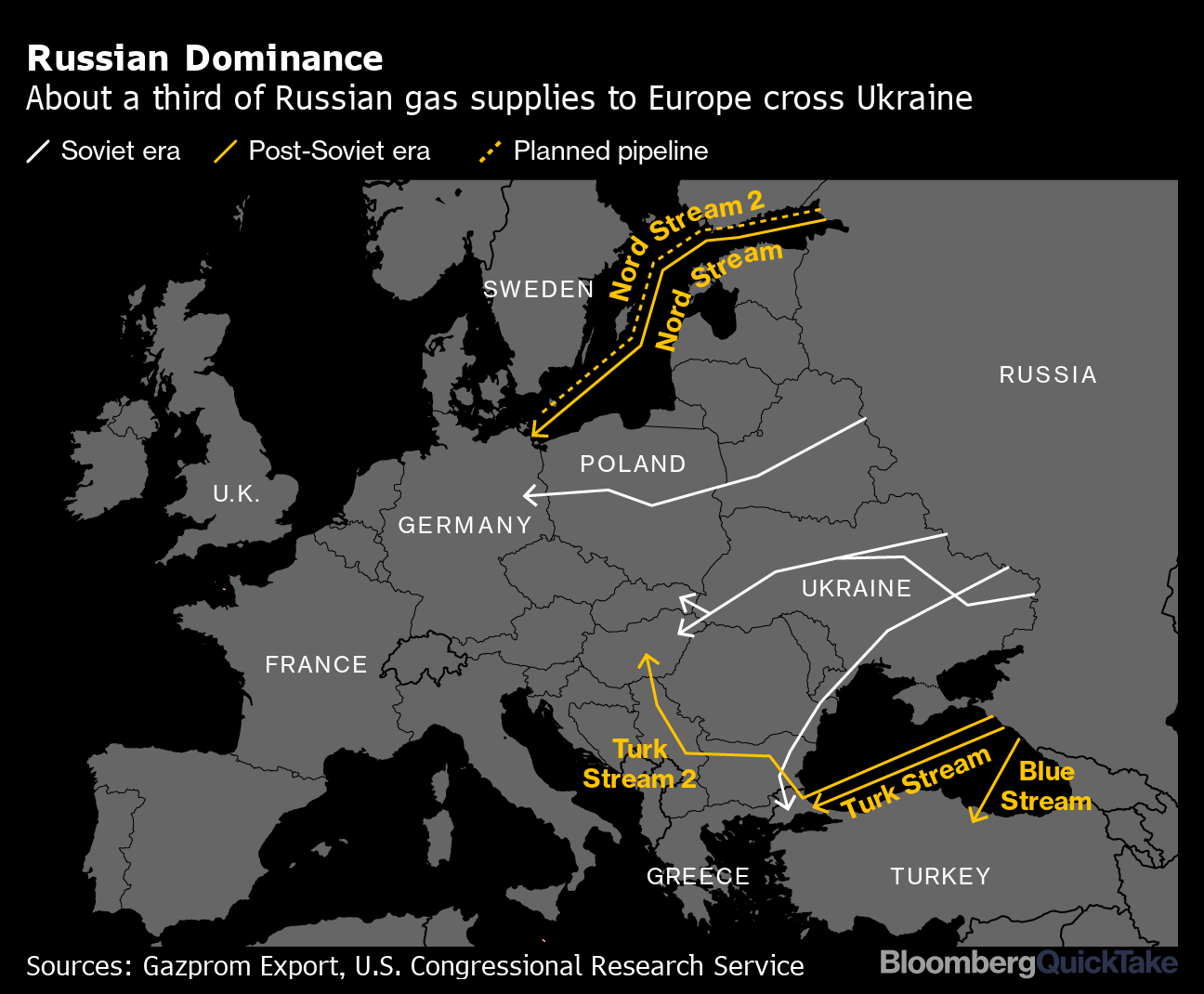

Europe’s energy prices are extremely volatile. The region’s gas storage is draining faster than expected, increasing the focus on imports from Russia and raising concern that supplies will fall short in the event of a severe cold snap.

QuickTake explainer: How Europe Has Become So Dependent on Putin for Gas

Pressure on the market extends beyond this winter. French and German power prices from April onward jumped Friday, with fewer nuclear reactors available to supply electricity.

Crippling Costs

The impact on household energy bills across the continent has left governments scrambling to find ways to help shield consumers from higher costs.

In France, the government is asking EDF to sell more power at a discount to market prices. Finance Minister Bruno Le Maire said the increase in electricity bills for households and very small businesses will be capped at 4% this year, including 8 billion euros ($9.2 billion) of tax cuts on electricity consumption. Without the moves, prices would rise by 35% from Feb. 1.

And EDF’s troubles go further. During once-a-decade maintenance at its Civaux and Penly reactors, the company found faults near welds on piping. Checking and repairing these is taking longer than expected, leaving the market short on supply and EDF without revenue from those units. The hit to earnings is likely to be about 6 billion euros, according to Jefferies International Ltd.

EDF shares tumbled as much as 25% on Friday, the biggest drop since they started trading in Paris in 2005.

“The longer nuclear outages will deepen and extend the ongoing energy crisis in Europe,” said Arne Bergvik, chief analyst at Swedish utility Jamtkraft AB. “The news is having such a big impact due to the strained situation for other fuels like gas or coal that will have to compensate for the lost nuclear output.”

Read more: EDF Slumps by Most on Record on Hit From Price Cap

In the European gas market, all eyes are on Russian flows, with fears mounting over possible conflict in Ukraine -- a key transit country. The U.S. is putting pressure on European allies to agree on potential sanctions against Russia, worried that the country might soon invade its neighbor. Russia has repeatedly said that is not its plan. Talks between the U.S. and Moscow this week failed to ease tensions.

At the center of supply concerns lies the newly built Nord Stream 2 pipeline, which won’t ship Russian gas to Germany before regulatory approvals are completed. On Thursday, the U.S. Senate blocked a measure to impose fresh sanctions on the link after the Biden administration warned it could disrupt allied unity in the confrontation over Ukraine.

“With further price volatility likely, especially during the first quarter, we see the sector as a minefield that will require careful navigation,” Bank of America Corp. said in a note.

(Adds Bank of America comment in final paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GB Energy Faces New Doubts as UK Declines to Affirm Future Funds

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands

Germany Set to Scale Down Climate Ambitions