Tesla Smashes Quarterly Delivery Record With 308,600 Cars

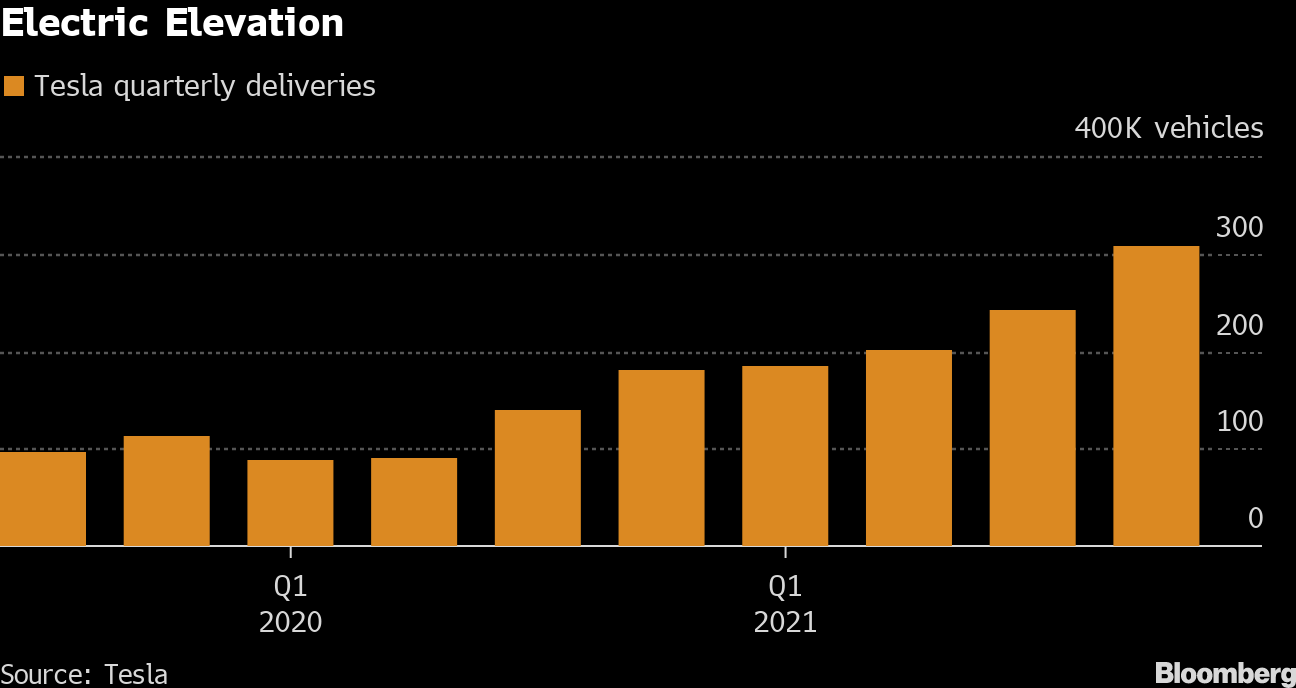

(Bloomberg) -- Tesla Inc. delivered 308,600 vehicles worldwide in the fourth quarter, smashing the previous record for the electric-car maker and setting a capstone on a year in which the company joined the exclusive $1 trillion market valuation club.

The better-than-expected results posted Sunday pushed Tesla’s total sales for the year to more than 936,000, up about 87% over 2020’s deliveries of just under a half-million vehicles. Thirteen analysts surveyed by Bloomberg on average had expected about 263,000 vehicles for the quarter, though some had revised their numbers upward in the final days of December.

The record quarter underscores the “green tidal wave taking hold” for Tesla and Chief Executive Officer Elon Musk heading into 2022, Daniel Ives, an analyst at Wedbush Securities, said in a note to clients. The strong results also point to robust demand in China and Tesla’s skill at navigating the global semiconductor shortage, he said. The company’s previous delivery record was 241,300, set in the third quarter.

“This is a trophy-case quarter for Tesla as the company blew away even bull-case expectations,” Ives, who rates the shares as outperform and has a $1,400 price target, said in an email. He called it a “jaw-dropper performance for Musk & Co. in the December quarter with massive tailwinds into 2022.”

Crypto trading suggests that Austin, Texas-based Tesla’s shares will rise when Wall Street wakes up Monday. Tesla tokens climbed 2% to $1,093 as of 2:38 p.m. in New York on the FTX crypto exchange after the deliveries were announced Sunday.

The EV market leader’s shares have soared on the back of expectations for continued growth, with the stock up almost 50% in 2021 and a market valuation exceeding $1 trillion -- one of only five publicly listed U.S.-based companies to achieve that status. The shares fell 1.3% on Dec. 31 to close at $1,056.78.

Musk praised his crew for coming through, saying in a tweet that the numbers were the result of “great work by Tesla team worldwide.”

Quarterly deliveries are one of the most closely watched indicators for Tesla. They underpin its financial results and are widely seen as a barometer of consumer demand for electric vehicles as a whole because the company has led the charge for battery-powered cars.

Read more: Tesla cedes a bit of trillion-dollar value to end year

Tesla has said repeatedly it expects 50% annual increases in deliveries over a multi-year period. The seventh consecutive quarterly gain comes amid a global semiconductor slump that has crimped production at most other automakers and kept sales in check despite rising demand.

Musk, who became the world’s richest person last year, has described 2021 as a “supply chain nightmare” even as his company continued to grow deliveries each quarter. It has fared better than other automakers due in part to efforts by its engineers to rewrite software to adapt to whatever chips they could find for other purposes.

Tesla has said its delivery counts should be viewed as slightly conservative, and final numbers could vary by 0.5% or more.

Deliveries and actual production don’t necessarily match up one-for-one during any given quarter. Production was 305,840 for the fourth quarter and 930,422 for the year.

The company doesn’t break out sales by geography, but the U.S. and China are its largest markets and the bulk of sales were of the Model 3 and Y. Tesla currently makes the Model S, X, 3 and Y at its factory in Fremont, California, and the Model 3 and Y at its plant in Shanghai. In 2022, Tesla will be adding production capacity with two new factories coming online in Austin and Berlin.

Musk has promised to provide an update on Tesla’s new product plans on the company’s next earnings call.

(Updates with analyst comment in third paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GB Energy Faces Doubts as UK Declines to Affirm Future Funds

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands

Germany Set to Scale Down Climate Ambitions