U.S. Oil Boom Towns Risk Ghost Town Future

(Bloomberg) -- The world has spent a decade gorging on fuel from America’s shale basins, and oil prices are topping $100 a barrel. So it might seem an odd time to be contemplating the energy transition. But that's precisely the task facing the small towns across places like Texas, Wyoming and New Mexico: deciding when to move on from their bedrock industry, even when it’s in an upswing.

Recent volatile swings in the oil market are a stark reminder that even as prices rally, the next bust could be just around the corner. The current geopolitical situation makes the contradiction even more acute. If Russia’s invasion of Ukraine means prolonged disruptions for energy supplies in the coming months, the world will become even more dependent on U.S. oil. But in the bigger picture, governments across the globe have pledged to wean themselves off of fossil fuels, and some analysts say peak oil demand could become a reality within a decade.

For America’s small oil communities, getting the timing right can mean the difference between losing out on the last great boom and turning into a ghost town. At stake is not only hundreds of thousands of U.S. jobs, but also more than $138 billion generated annually through tax revenues for localities, states, tribes, and the federal government.

Morse Haynes, 63, runs economic development for Andrews, Texas. Having spent all his life in or around the Permian Basin, Haynes knows what the industry means for his town of almost 15,000, and he’s not ready to move on.

“So much of our community, that’s just who we are. All these businesses, they’re here because of the oil field,” Haynes said. “We still think fossil fuels will be around a while.”

But Morse’s son, Heath Haynes, sees things differently. He followed in his father’s footsteps and is also in charge of economic development for a small West Texas town. But unlike dad, Heath has his eyes farther down the field.

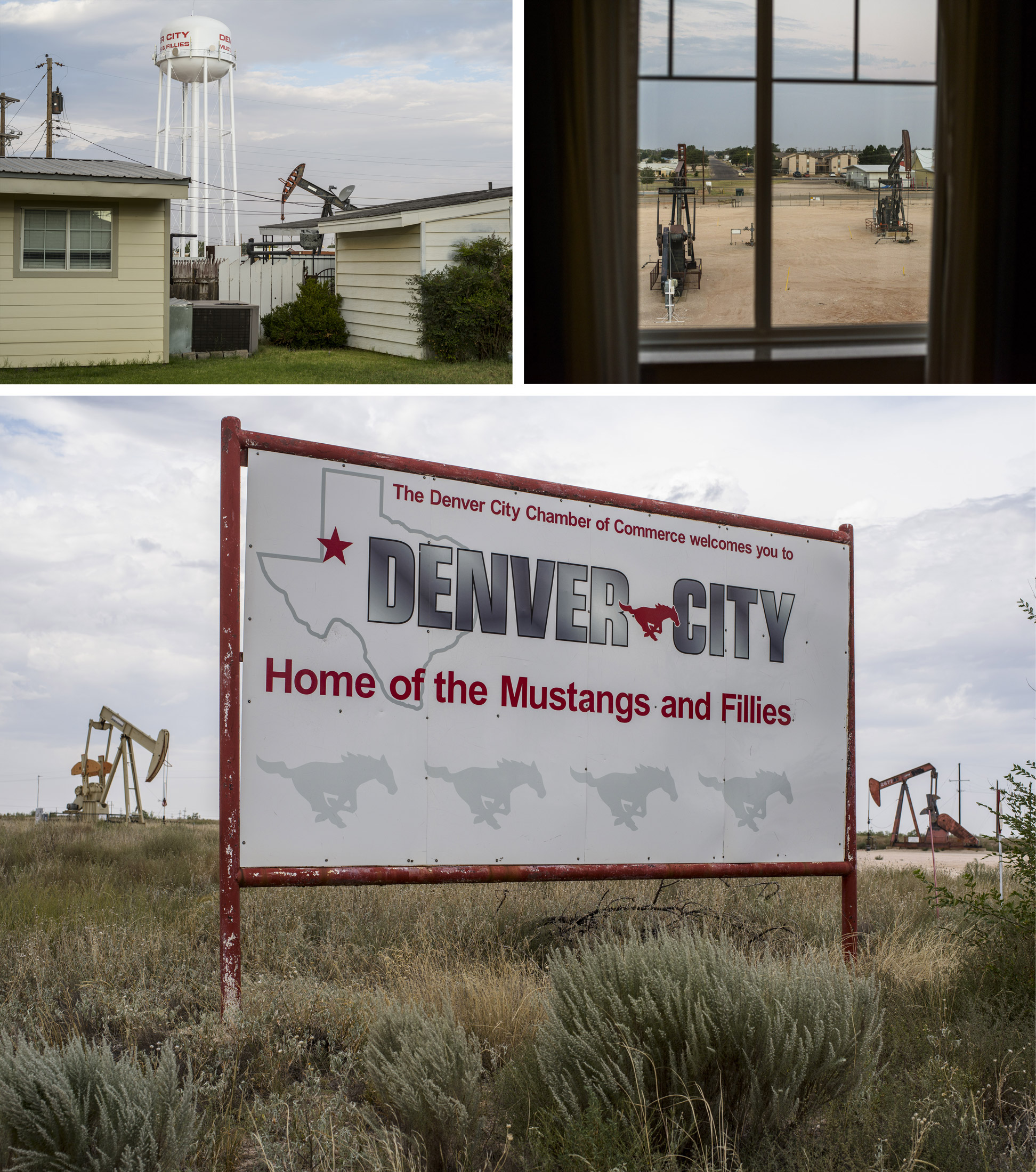

“We have conversations like that all the time, going back and forth,” Heath, 29, said. Sporting an Apple watch and grey dress slacks, Heath doesn’t dress much like a cowboy. His eyes light up with anticipation when he talks about wanting to “future-proof” his community of Denver City, named for a petroleum company, not the capital of Colorado. It’s impossible to miss the scores of rusty crude wells scattered around town, even bumping up against City Hall — at sunset, the bobbing heads of the pumpjacks are silhouetted against the horizon, like a herd of grazing donkeys on the open plains.

For Heath, thinking about transitioning into solar or wind, and planning for the day when oil no longer supports these corners of the U.S. can feel a bit like an adventure. For his father, Morse, it’s more like staring into the abyss.

“It’s him kind of talking about, ‘Well, that’ll never happen, we’re never gonna do that,’” Heath said of his father. “I’m like: ‘There’s opportunity out there.’”

For a century, oil has basically done right by these regions (the occasional bust not withstanding). And in the immediate future, things still look prosperous. Houston oil giant Halliburton Co. is forecasting a multi-year boom, and many companies have said hiring enough workers has been a challenge. Disruptions for wind and solar power mean the energy transition has run into its first big setback. And even the administration of President Joe Biden, who campaigned on promises to combat climate change, has signaled it won’t get in the way of companies that want to increase crude production right now.

In the midst of a boom, it’s hard to see why any city should start turning its back on oil. But that short-sightedness could leave these communities destined to encounter the fate that befell coal towns years earlier, with the global energy transition threatening to blindside this swath of the U.S. with a huge and dramatic bust.

In absolute dollar terms, California is the state with the second-most government revenue coming from fossil fuels at $7.82 billion, according to research from Resources for the Future, a Washington think-tank. On a per-capita basis, Wyoming tops the list, with more than $7,000 in annual revenues per resident.

But it’s Texas that stands out as having the most to lose. Even after rapid diversification in its economy over the last several decades, the state still generates almost $15 billion annually from fossil fuels, the most in the nation. That’s about 7% of all state and local own-source revenue, the Resources for the Future data show.

Put another way, if oil goes away, it would leave Texas with gaping holes for funding that would normally go to schools, hospitals and public services. By 2050, a worst-case scenario could mean an annual budget shortfall of $5.8 billion for K-12 education alone, according to research from Rice University’s Baker Institute.

As the Haynes father-son dynamic captures, planning for the end of oil all comes down to time horizons. So far, the Morses of the world are setting the pace.

“I would say 90% of the towns here in West Texas aren’t ready for the oil to go away and don’t have a plan.”

Interviews with dozens of economic directors, or people in similar roles, across the 40 U.S. communities with the biggest ties to oil jobs, found very few even taking the question of what happens after the energy transition into serious consideration. Only three had a concrete strategy in the works to replace fossil-fuel workers over time (even Heath of Denver City doesn’t have an exact plan). The interviews showed that these towns mostly remain confident that fossil fuels aren’t going away any time soon, or at least, that they don’t see many better alternatives.

In Pecos, Texas, Ken Winkles runs the town’s Economic Development Corp., but says it’s a one-person office that doesn’t have the capacity to look more than five years down the road. And in Douglas, Wyoming, Jonathan Teichert, the town administrator, says that people are starting to question whether “we’ve experienced our last boom,” but that’s met by equal anxiety over transitioning away too quickly from oil and gas.

There are also signs of shifting outlooks. In an interview early last year, Arthur Jackson, the senior vice president of economic development in Tulsa, Oklahoma, said that his community was more interested in continuing to support the oil and gas companies that call the region home. Now, Jackson has joined the ranks of those with a plan down on paper for tackling the energy transition. He's not racing away from oil jobs, but he is looking toward other industries for more diversification, he said in a follow-up interview this month.

Exxon Mobil Corp. and BP Plc and other oil majors are coming under increasing investor pressure to become more environmentally friendly. Some are talking about how their businesses will transition to a world that no longer uses crude. There are already signs of an entrenched decline. Despite the recent price rally, headcount in the U.S. oil industry still remains about 40% below 2014’s peak levels at 315,700 workers today. It is a particularly thorny challenge for the Biden administration, which has assured Americans that no jobs will be lost as a result of the energy transition. But how that promise will be upheld remains to be seen.

“If we want to continue to grow our economy and prosper, we’re going to have to find other ways to do it,” said Bobby Tudor, chairman of the Houston Energy Transition Initiative.

Texas is certainly no stranger to finding itself at an energy crossroads.

A crash in the market drove the region’s oil output steadily lower between 1980 and the early 2000s. Still, during that period the state economy outperformed the nation, the Federal Reserve Bank of Dallas said in a recent report.

But much of the strength during that era was concentrated in larger cities like Dallas, Houston and San Antonio. Many of the small oil towns were left to fend for themselves.

It’s a painful memory for Morse Haynes, who remembers what the crash meant for Monahans, Texas, in the 1980s, when oil dropped to $8 a barrel.

“All of a sudden there’s 2,000 less people,” he said. “That town got run down.”

That’s why Morse is open to welcoming renewable energy to diversify the city of Andrews, even if he doesn’t agree with his son that the oil transition is coming soon. The town has brought in four solar and wind projects over the past four years, and Morse is working on a fifth.

“We’re going to move more towards renewable, but I’m going to say it’s going to be slower than probably Heath would think that it would be — or any millennial,” Morse said of his son.

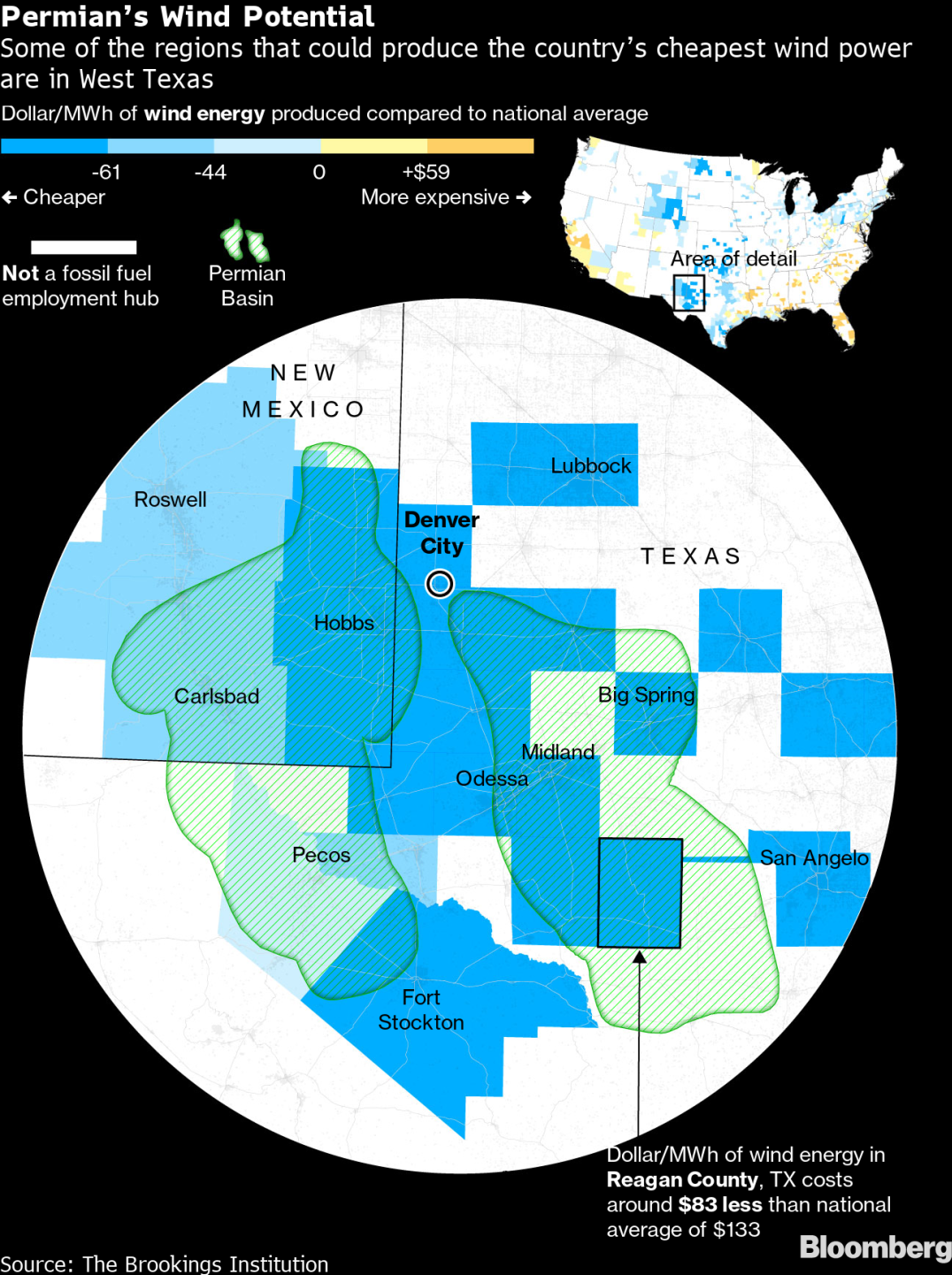

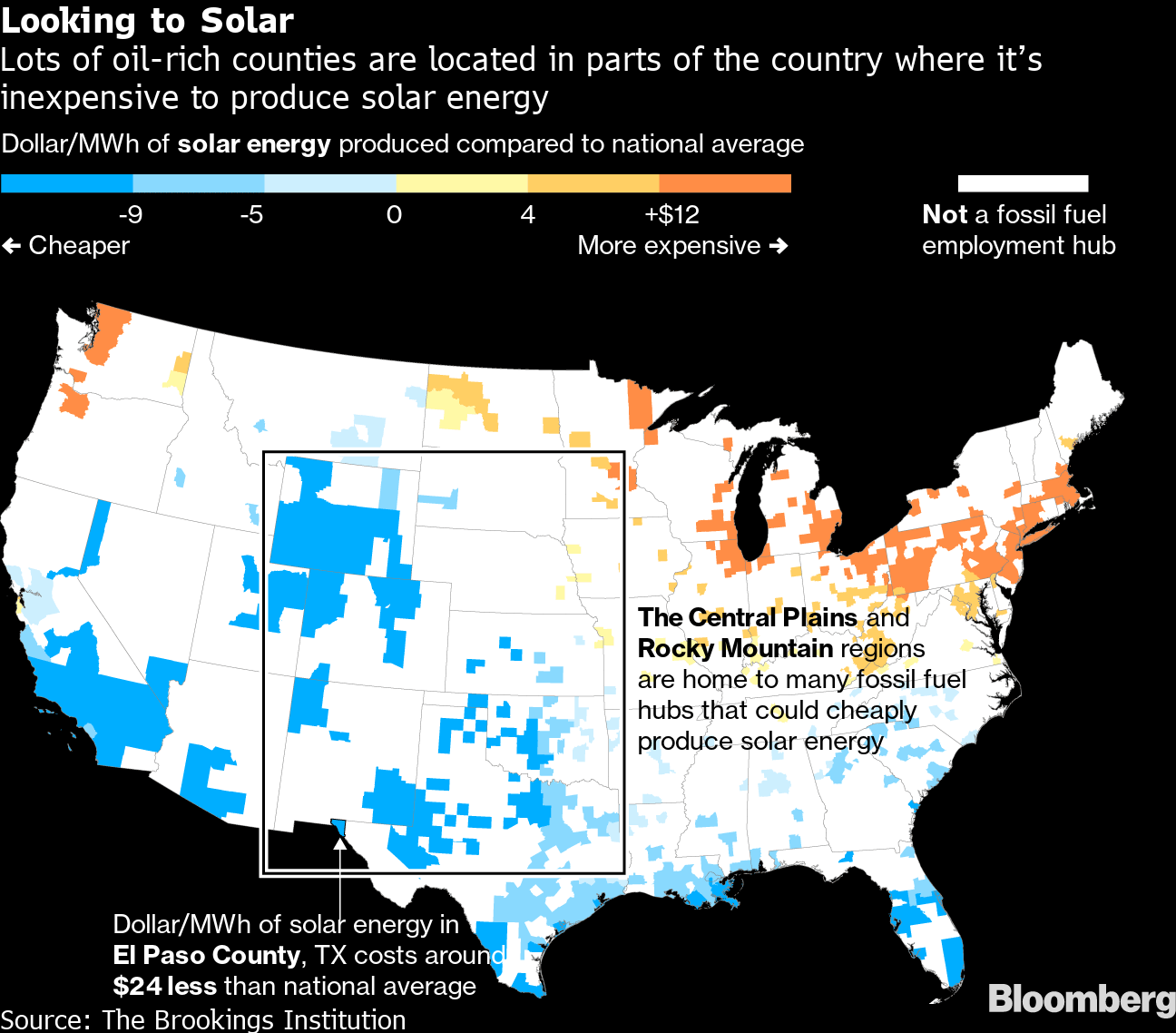

Geographic analysis conducted by the Brookings Institution found that a quarter of the counties in the U.S. with the greatest potential for both wind and solar electricity generation are also fossil-fuel hubs. Some of the regions that could produce the country’s cheapest wind power, for example, are in West Texas.

The problem, as Morse will quickly tell you, is that the industry just doesn’t bring in the same number of jobs that oil does.

During construction of solar and wind projects in Andrews, “you had all these workers in town,” he said. “Course, end of the day, when it’s built, you only have two employees.” That’s not enough to keep his community going, which is why Morse still needs to “cater” to what lays the foundation for his town.

“You are oilfields,” he said. “I would say 90% of the towns here in West Texas aren’t ready for the oil to go away and don’t have a plan.”

In neighboring New Mexico, on the edge of the Permian basin, Jennifer Grassham helped Lea County reshape its economic master plan last year. Grassham, the chief executive officer for the county’s Economic Development Corp., was one of only three economic heads interviewed by Bloomberg that was working on a formal strategy for the oil transition. Her plan includes recruiting producers for renewable energy like wind and solar, as well as hydrogren and nuclear energy for the region.

“Nobody wants to paint too rosy a picture or too bleak a picture,” Grassham said. “We want to paint the correct picture.”

Back in Texas, Heath Haynes weaves around in a white Chevrolet SUV, passing the dozens of wells scattered throughout town, dutifully pumping oil like they have for decades. But what Heath wants to point out on this afternoon in December is the active construction on a small drive-through, Scooters Coffee Shop, which he estimates will add more than a dozen jobs to the area.

“Baby steps. I’m not trying to do a giant culture shock,” Heath said. He’s also impressed by the strides Lea County has taken when it comes to wind projects, and he talks enviously of the nearby West Texas town, Lamesa.

“Have you seen that solar field? It just goes on and on and on. It’s huge. It’s crazy.”

Heath took the Denver City job in 2018 after two years working in IT. It helped that he grew up watching his dad in a similar role, and he knew that “any time I need a help line, I’ve got somebody to call.”

His predecessor used to come into the office wearing cargo shorts and a Hawaiian shirt, and many look at economic development in the area as a “retirement job,” Heath said. It’s a far cry from his own focus on the future. Right now, he’s got his eye on about 50 acres of land the city has available to recruit businesses. It’ll be a tough sell, half of that landscape is dotted by an army of wells.

“I know what oil and gas means to this community, but I also know what a diversified workforce would mean,” Heath said.

“Fifty years down the road, 100 years down the road, when I’m not here anymore, I would like for Denver City to still be here.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

EU Steps Back on 2040 Climate Goal in Order to Win Over Doubters

UK, EU to Work Toward Linking Carbon Markets at May 19 Summit

Europe’s Solar Season Is Getting More Intense and Disruptive

China’s Efforts to Curb Solar Glut Show Limited Impact, CEA Says

Austria Plans Funding Help to Encourage More Geothermal Drilling

China’s Megacity Shanghai Invests in Nation’s Fusion Energy Push

Germany’s Power Market Bailed Out by Gas Plants as Wind Plunges

IEA Chief Calls for Japan to Restart Dormant Nuclear Plants

China’s Envoy Sees Climate Fight Advancing Even Without US