Chinese Solar Maker Says US May Be Too Pricey for Expansion

(Bloomberg) -- A top solar material producer is planning its first factory outside China, but may pass on the US because of high costs, according to the company’s chief executive officer.

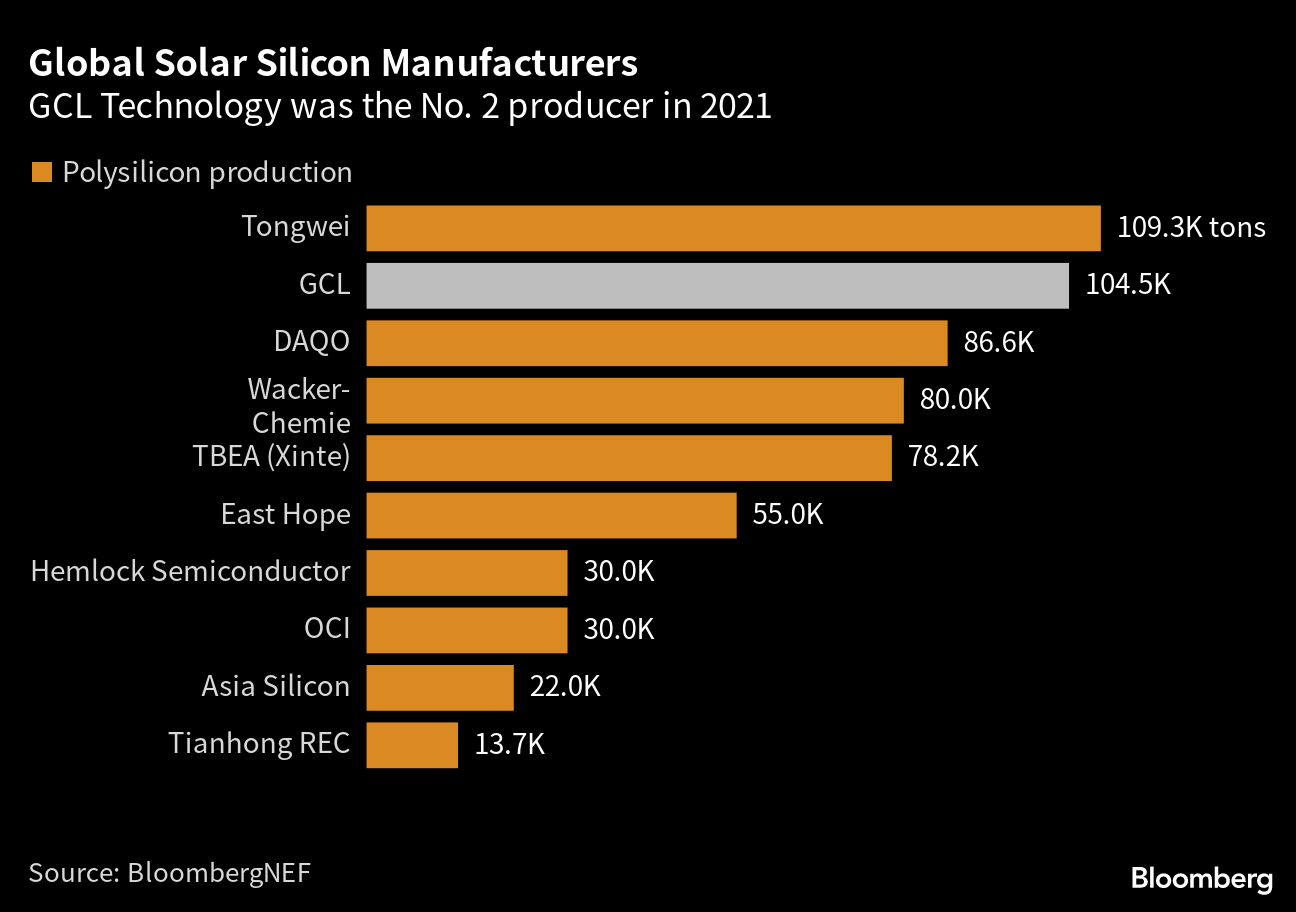

GCL Technology Holdings Ltd., the world’s second-largest manufacturer of polysilicon, wants to tap into higher prices overseas and serve foreign customers, according to Lan Tianshi, the company’s joint-CEO. Countries around the world are trying to develop their own supply chains for solar panels to compete with China’s dominance in the sector.

While the US took a major step forward in that regard with last year’s passage of the Inflation Reduction Act, building a factory there is still at least five times more expensive than in China and construction times are bogged down by regulatory requirements, according to Lan. While nothing has been decided, GCL has been focusing its search efforts on Europe, the Middle East and BRICS countries, he said in an interview.

“US policies are attractive, but not attractive enough,” Lan said.

GCL’s reticence on the US stands in contrast to three top Chinese solar equipment makers that have announced plans of US factories since passage of the IRA, which includes $374 billion in new climate-related spending and is designed to boost domestic renewable manufacturing capacities.

READ: Biden’s Landmark Climate Bill Lures China’s Clean Energy Giants

Suzhou, Jiangsu-based GCL plans to build a foreign factory through a joint venture with a local industry leader, and is likely to make announcements by the end of the year, Lan said. Given the higher prices of polysilicon outside of China, its overseas factory could reap double or triple the profit of Chinese facilities, he said.

Xinjiang Scrutiny

GCL’s operations in China include a polysilicon plant in Xinjiang, where the US and others have accused the government of human rights abuses against the ethnic Uyghur Muslim population, and forcing them to work in factories against their will. China has repeatedly denied the claims, saying they’re part of a conspiracy to undermine domestic industries.

The US last year passed a law forbidding the import of goods from the region unless companies can prove they weren’t made with forced labor, slowing the flow of solar panels to the country. Lan said GCL stands with the Chinese government on human rights issues, but will adapt to its buyers needs when it comes to manufacturing locations.

“We greatly respect others’ views on us and their choices of supply chain,” Lan said. “Wherever we build our factories and wherever our products go, in a broader scale, they are all efforts to fight climate change.”

Polysilicon Prices

Polysilicon is a highly refined form of silicon found in common sand, and is melted and sliced into thin squares that are eventually formed into solar panels. Prices of the material surged to the highest in a decade last year as demand surged beyond the capacity of existing factories. GCL cashed in on the rush, with its net income more than tripling in 2022.

Prices have fallen this year as new factories come online, and could drop to as low as $10 to $13 a kilogram in the second half compared to about $39 at last year’s peak, according to BloombergNEF. Lan acknowledged the drop in prices but said he expects them to be more resilient than expectations — between $17 and $20 this year — because of strong demand for high-quality material.

“Polysilicon makers will return to a relatively normal profit margin this year as the unbalance between supply and demand begins to ease,” Lan said.

New Technology

The company is also betting on a somewhat unique production method. Most polysilicon is produced using what’s known as the Siemens Process, requiring massive amounts of heat and caustic chemicals to remove impurities, creating material where less than one atom in every million is something other than silicon.

GCL’s fluidized bed reactor technology uses far less energy, making it cheaper and more environmentally friendly. Competitors have accused the end product of being lower in quality, but Lan said it’s now pure enough for the most advanced solar panels and even some lower-end semiconductors. The company could enjoy three to five years of relatively high return rates with the self-developed technology because of protections from intellectual property laws, Lan said.

The Week’s Diary

(All times Beijing unless noted otherwise.)

Monday, April 10

- China to release March aggregate financing & money supply by April 15

- Cosco Shipping Holdings earnings briefing in Shanghai, 14:00

- HOLIDAY: Hong Kong

Tuesday, April 11

- China inflation data for March, 09:30

- China farm ministry’s monthly crop supply-demand report (CASDE)

Wednesday, April 12

- Brazil’s President Lula visits China

- National Energy Administration briefing in Beijing, 15:00

- CCTD’s weekly online briefing on China’s coal market, 15:00

Thursday, April 13

- Brazil’s President Lula visits China

- China’s 1st batch of March trade data, including steel, aluminum & rare earth exports; steel, iron ore & copper imports; soybean, edible oil, rubber and meat & offal imports; oil, gas & coal imports; oil products imports & exports, ~11:00

Friday, April 14

- Brazil’s President Lula visits China

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- EARNINGS: Tongling Metals

Saturday, April 15

- China new home prices for March, 09:30

On the Wire

Tesla Inc. will build a new battery factory in Shanghai, increasing investment in China at a time of brewing tensions between Beijing and Washington.

(Updates with diary items)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GB Energy Faces Doubts as UK Declines to Affirm Future Funds

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands

Germany Set to Scale Down Climate Ambitions