Companies Facing Carbon Offset Backlash Quietly Fund Their Own Projects

(Bloomberg) -- A world away from its steel-and-glass headquarters in London, GSK Plc is wading into unfamiliar waters: A mangrove nursery in coastal Indonesia that’s being nurtured to harbor crabs, fish — and carbon.It’s the precious carbon GSK is really after, as it seeks to apply the mangroves’ carbon-capture prowess to nullify climate-warming gases emitted by its global network of factories and vehicles, and the many asthma inhalers it sells. The drugmaker, wary about the poor quality and questionable climate benefits of carbon offsets for sale on the open market from brokers, is now devising its own credits.Carbon offsetting is “a fundamental mechanism to move capital where it is needed for nature, climate and health,” said Adele Cheli, sustainability partnerships and strategy director at GSK. “Just because it’s not perfect doesn’t mean we’re going to step out. We’re going to lean in and make it better.”

Other companies are pursuing similar ideas. Shell Plc was the first large company to branch out into offsets development and has created a “nature-based solutions” team that's working on projects from Australia to Senegal. TotalEnergies SE plans to invest $100 million a year in nature-based projects to develop a “natural carbon sink capacity” of more than five million tons of CO2 per year from 2030. BP Plc owns a majority stake in a carbon offset developer and has “scaled up” its carbon credit development efforts.

Danish clean energy giant Orsted A/S says it intends to generate carbon removal credits from a Gambian mangrove project. And Bayer AG

being challenged,” said laus Kunz, head of ESG strategy at the German drug and agriculture company. “Quality of the projects is key. If done properly, this is a positive tool.”

It’s also an untested and risky gamble for corporations that are under intense scrutiny from climate-conscious investors. Offsets are a known source of

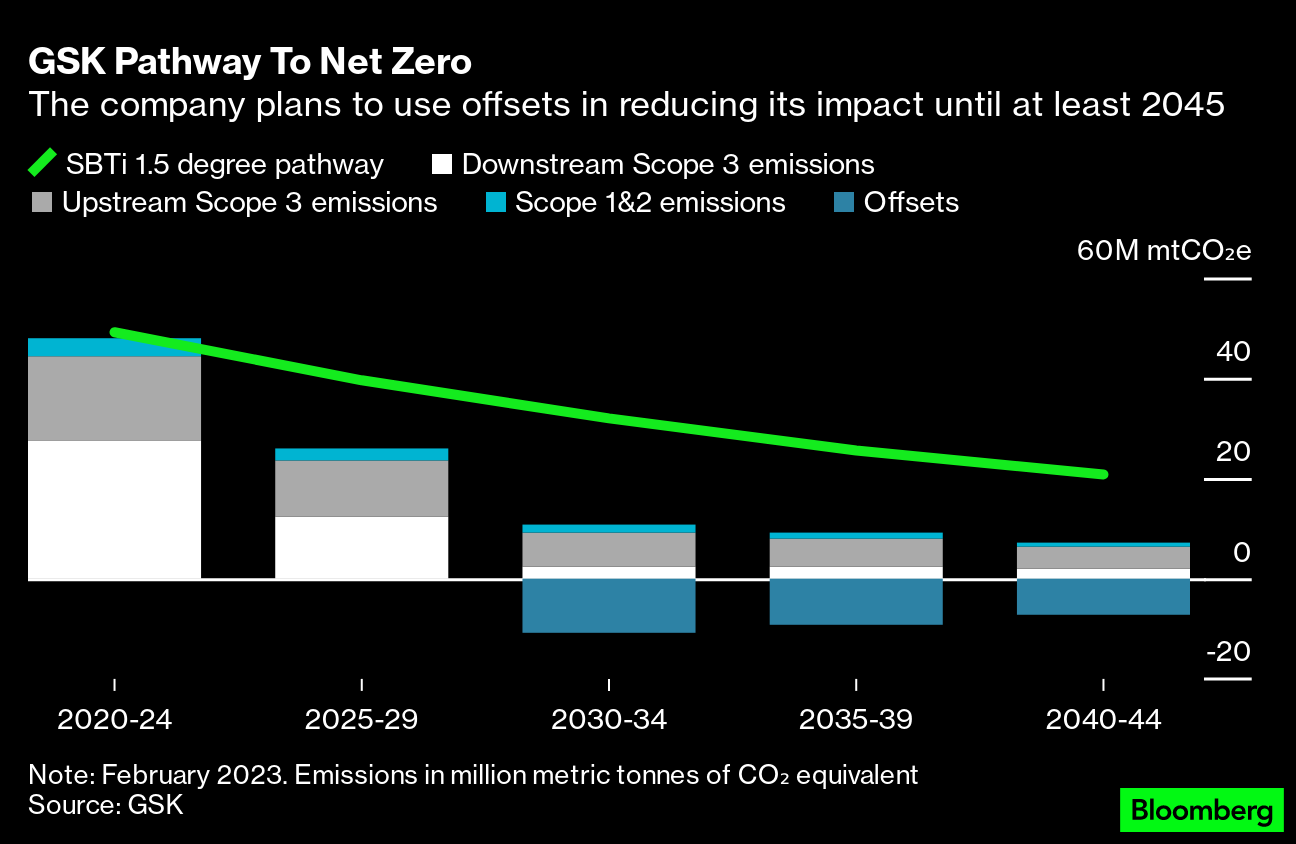

GSK and VW said they were aware of the greenwashing risk and the need to prioritize emission avoidance and reduction ahead of offsetting. The pharma company said it consulted with technical experts on issues such as “additionality” and “leakage,” and how to share benefits with local communities. GSK said it would prioritize carbon removal credits for its 2030 target. For its 2045 target, only removal offsets will be allowed.

If it works,

That may explain why Volkswagen AG — whose direct and indirect emissions are about 30 times larger than GSK’s — wants to generate 40 million credits a year by 2030, according to a person familiar with the matter who declined to be identified. A VW spokesperson declined to comment on the target.The German automaker aims to achieve net zero by 2050, and has teamed up with a local carbon developer to create a venture called Volkswagen ClimatePartner GmbH to generate offsets. It aims to use those credits to offset Ralf Pfitzner, VW’s head of sustainability.

The venture has about eight projects on the go, including the protection of forests and savannas, and plans to release the first credits by 2025, according to Michael Rumberg, managing director of the venture.

One approach is to invest in mangroves, an attractive tool for sucking carbon dioxide from the air. Easily identified by their distinctive latticed roots, the plants thrive in shallow, brackish water, creating a defense against floods and a vibrant habitat for aquatic life. sequester up to 50 times more carbon in their soils by area than tropical forests, according to the World Bank. But mangroves are under threat globally, and Indonesia is one of the hardest-hit areas. GSK’s project in Java, carbon developer First Climate, aims to restore over 2,500 hectares of mangroves. In return, the pharma company Cheli said. A carbon credit represents a ton of carbon dioxide emissions removed from, or not added to, the atmosphere. And this is just the beginning. GSK plans to eventually generate around two million credits a year for its own use. As more projects come on line, the company in the next five years expects to secure all the credits it needs for the 2030 to 2034 period. “It’s good to invest in it now. If you start today, you may have a good credit in five years,” said Anais Bach, former head of operations for TotalEnergies’s nature-based solutions business who now runs a carbon-focused startup. “Those who do nothing now will be in trouble as projects at the right price and quality will only become scarcer.”©2023 Bloomberg L.P.