Musk Puts $14 Trillion Price Tag on Sticking by Fossil Fuels

(Bloomberg) -- Converting the world to entirely clean energy will require $10 trillion worth of investment, but continuing to rely on fossil fuels would cost about $14 trillion, according to Elon Musk.

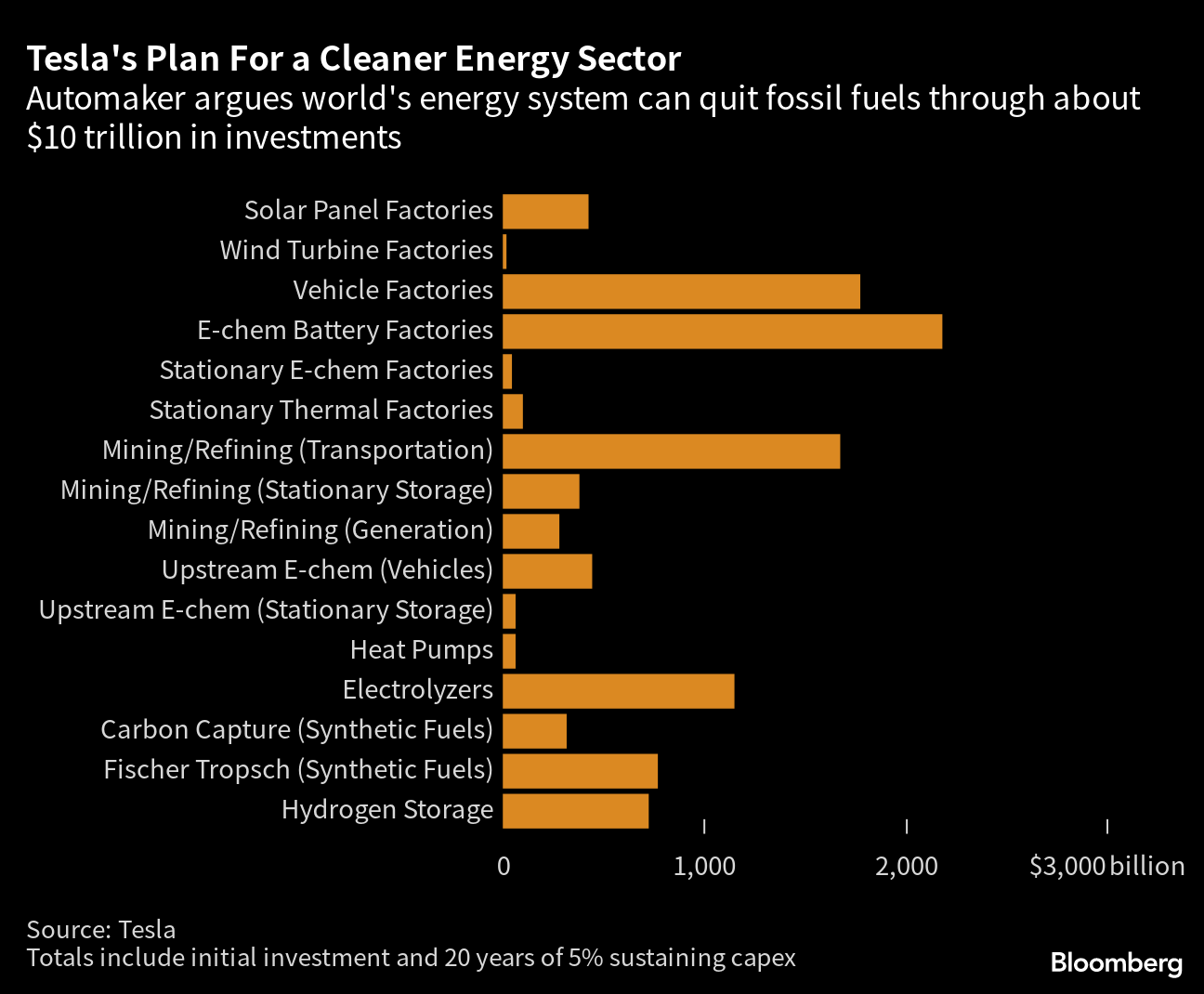

A massive build-out of solar-panel factories and metal refineries are required over the next 20 years to deliver renewable-power generation and electricity-storage capacity needed to power the global economy entirely with carbon-free energy, Tesla Inc. said in its Master Plan Part 3 published Thursday.

The white paper fleshes out the details of Musk’s vision for a world without fossil fuels first outlined during last month’s investor day. “Earth will move to a sustainable energy economy,” Musk said during the event in Austin, Texas. “And it will happen in your lifetime.”

Tesla sees upgraded grids powered with wind and solar, global arrays of battery farms and underground hydrogen caverns to store energy, a retooling of heavy industries like steel and cement-making, and homes to businesses warmed or cooled with heat pumps.

The cost of the alternative — continuing to produce oil, coal and natural gas — is higher, Tesla argues, and at 2022 rates would total about $14 trillion over the next two decades.

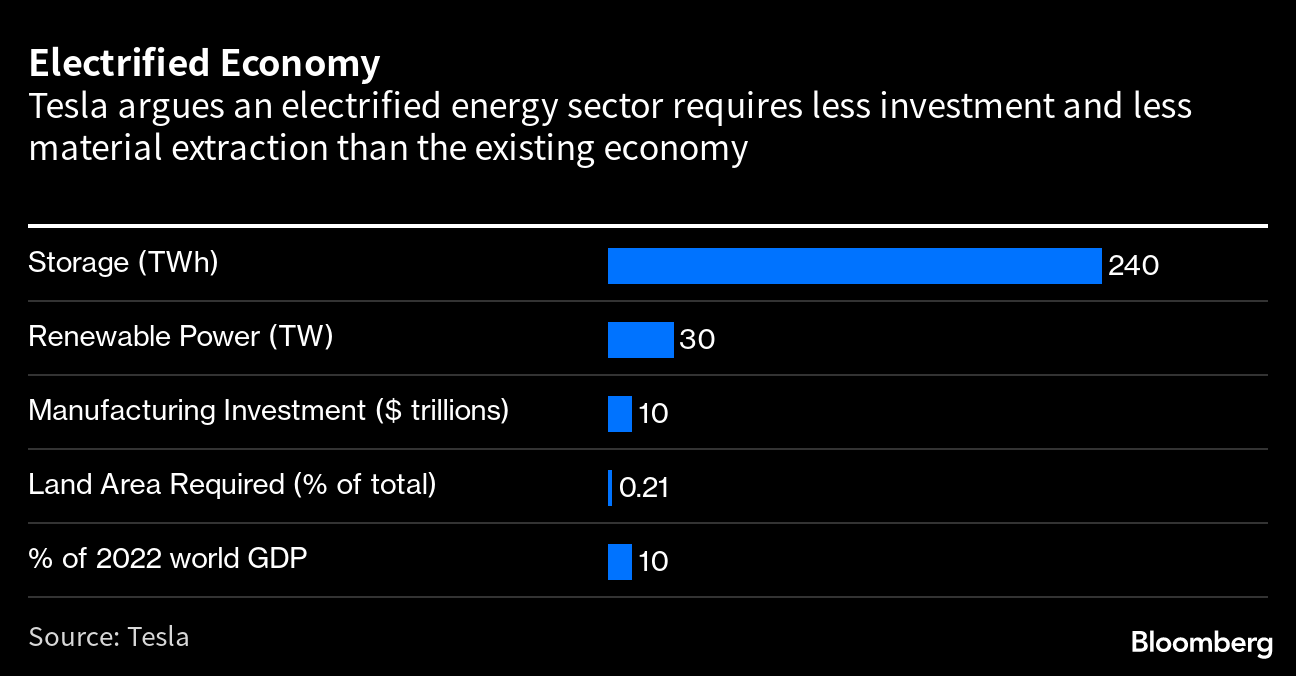

Musk’s envisaged global energy system requires about 30,000 gigawatts of renewable-power capacity and 240,000 gigawatt-hours of storage batteries. Those figures compare to renewables capacity of 3,214 gigawatts in 2021 and a stationary energy storage sector that’s forecast to have 1,432 gigawatt hours of capacity by the end of the 2030, according to BloombergNEF. That would represent a huge boon to clean tech firms like Tesla.

While the $10 trillion investment cost of a cleaner world is high, Musk argues that’s just a fraction of the $100 trillion global economy and entirely feasible when spread out over two decades.

“Over 20 years, it would be 0.5% of the global economy,” he told investors last month. “So this is not a big number.”

The world’s metals sector would be poised for a major demand boom under Musk’s scenario. A total of $502 billion of mining capital expenditure and $662 billion of spending on refining would be needed to produce the nickel, lithium, copper and other materials to be used in batteries and clean-energy equipment, Tesla forecasts.

At peak levels, the world would need to dig up 3.3 gigatons — or 3.3 billion metric tons — of earth every year to obtain the necessary metals for the transition to cleaner power sources. Tesla said that total mass could be reduced if aluminum is substituted for copper, because the former is found with much higher ore grades than the latter. In any case, it added, it’s still much less than the 15.5 gigatons currently extracted annually for fossil fuels.

There’s also little prospect of the world exhausting supplies of required metals, as only a fraction of current resources are needed and higher demand will encourage explorers to look for new deposits.

Recycling will begin to meaningfully replace new metals supply from 2040, as expired batteries, solar panels and wind turbines are harvested for reuse. Other materials will be phased out or minimized: using copper instead of silver in solar panels, using artificial graphite in batteries, and eliminating rare earths from wind turbines.

“The electrified and sustainable future is technically feasible and requires less investment and less material extraction than continuing today’s unsustainable energy economy,” Tesla said in the document.

(Updates with with ore grades in 10th paragraph. An earlier version of this story was corrected after erroneously stating in the headline that the cost of sticking with fossil fuels is $4 trillion.)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GB Energy Faces Doubts as UK Declines to Affirm Future Funds

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands

Germany Set to Scale Down Climate Ambitions