Green Bond Sales Surge in UAE Before It Hosts Climate Summit

(Bloomberg) -- A record amount of green debt has been raised this year by issuers in the United Arab Emirates and Saudi Arabia ahead of a major global climate conference starting next week in Dubai.

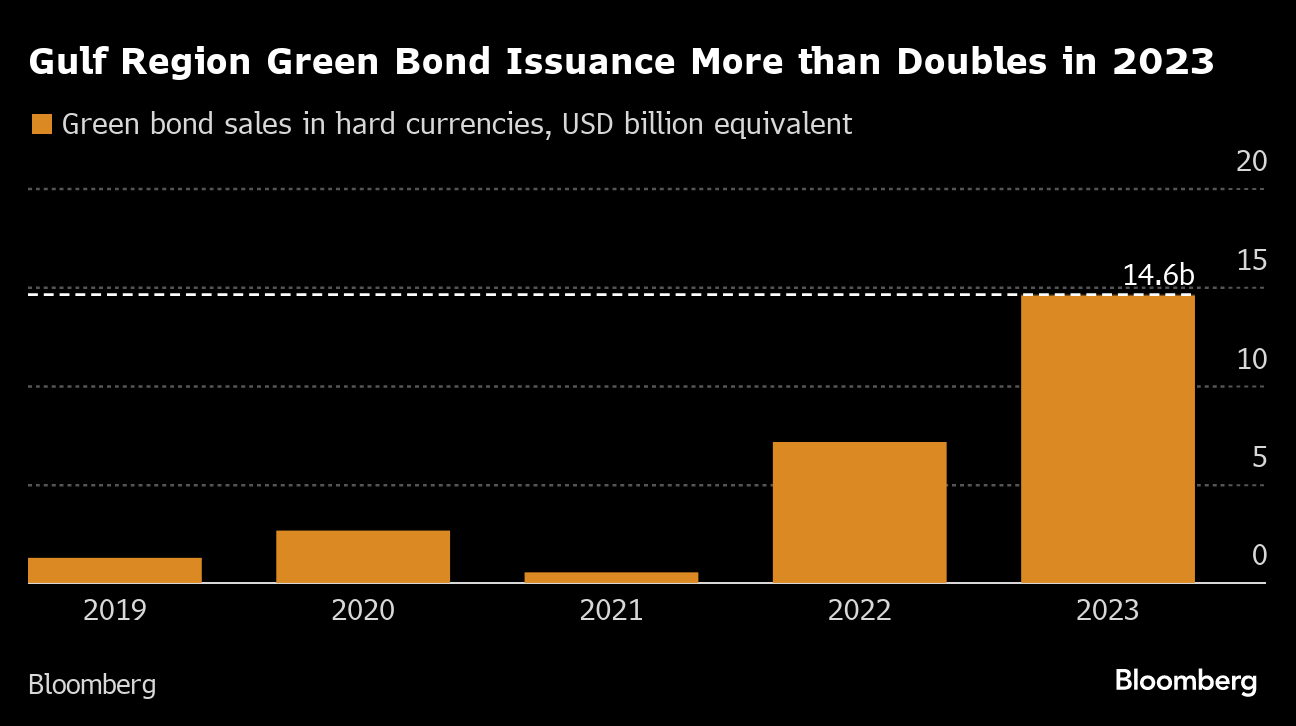

Issuance in the Gulf States has reached $14.6 billion year-to-date, according to data compiled by Bloomberg, with the majority coming from borrowers in the UAE. Another big chunk of the amount is a $5.5 billion multi-tranche bond by Saudi Arabia’s Public Investment Fund in February.

The jump in sales comes as the largely oil-dependent nations in the Gulf Cooperation Council burnish their green credentials ahead of the COP28 climate summit, starting at the end of November. While the amount raised pales in comparison to issuance in Europe, it’s more than double what was sold in the region in 2022.

“With COP28 happening in the UAE this year a lot of issuers have accelerated or initiated ESG financing frameworks, given the increased focus in the region on energy transition agenda,” said Khaled Darwish, HSBC Bank Middle East Limited’s head of debt capital markets for Central Eastern Europe, the Middle East and Africa.

The UAE was the first GCC state to declare a target to reach net zero carbon emissions by 2050, and is aiming to produce 30% of its power from renewables and nuclear by 2030. Still, it has faced criticism for plans to also raise oil production capacity and for naming Sultan Ahmed Al Jaber, chief executive officer of Abu Dhabi National Oil Co., as head of the climate conference.

Despite some diversification efforts with renewables, oil and gas remain significant for Gulf countries, complicating matters for sovereign debt issuers, according to Sergey Dergachev, head of emerging-market corporate debt at Union Investment Privatfonds GmbH in Frankfurt.

While there has been a lot of ESG-labeled issuance in the GCC, there are some nuances, he said. A lot of issuance comes predominantly from banks, and the use of proceeds often goes to energy efficiency and green building-related projects. Dergachev said he didn’t believe oil and gas companies have plans to heavily issue green debt.

Still, recent transactions by Gulf issuers have had a good reception. Abu Dhabi Islamic Bank PJSC’s $500 million Green Sukuk, for instance, was 5.2 times covered. And it’s not just regional investors who are buying the deals — 43% of a $750 million green bond issued by Emirates NBD Bank PJSC in early October was bought by UK and European investors.

In the lead up to COP28, “UAE’s sustainable bonds continue to see strong demand in the dollar market with deals 2-3 times oversubscribed, resulting in more attractive pricing,” according to Bloomberg Intelligence senior ESG credit analyst Christopher Ratti. However, he said that the surge in green bond sales is likely to diminish after the conference.

Hard currency sales already slowed significantly in October after the Israel-Hamas war started, with just two green bonds issued in the Gulf, the $500 million note raised by Abu Dhabi Islamic Bank and a $750 million bond from sovereign investor Mamoura Diversified Global Holding PJSC.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GB Energy Faces New Doubts as UK Declines to Affirm Future Funds

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands

Germany Set to Scale Down Climate Ambitions