To Meet Climate Goals, Gulf Countries Will Have to Overhaul Everything

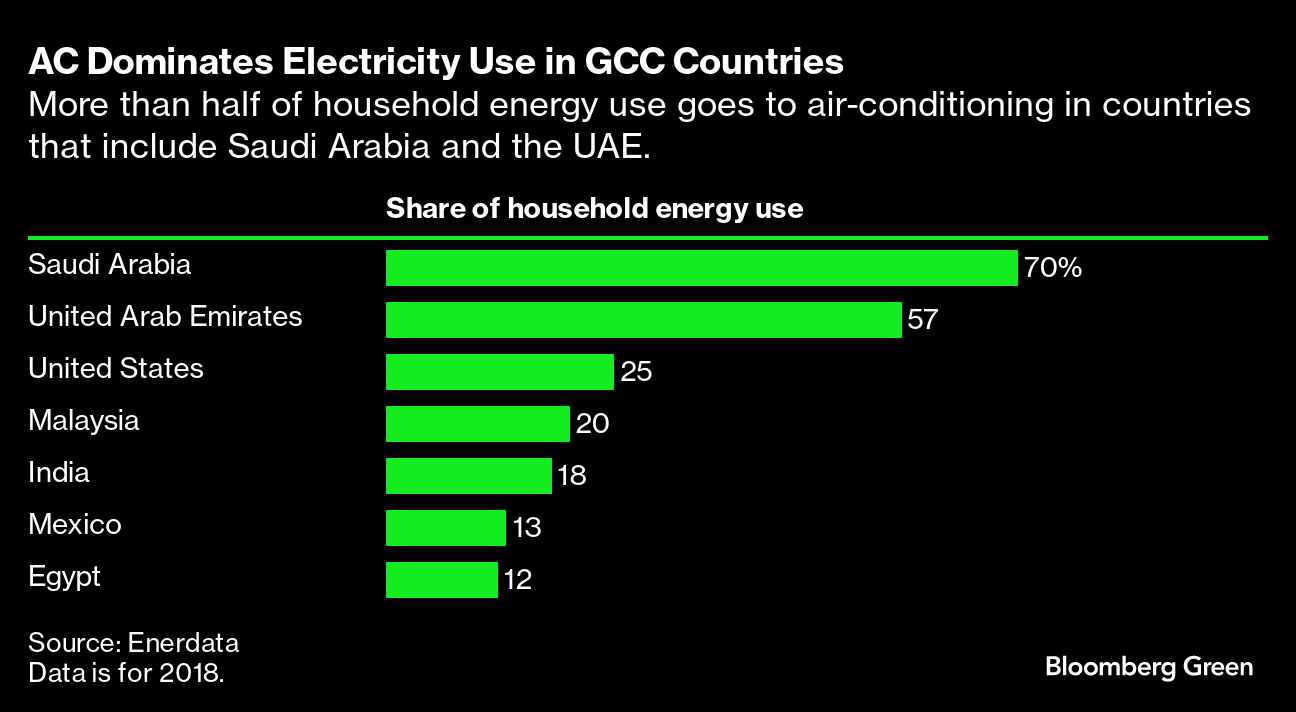

(Bloomberg) -- In Dubai, it’s normal to leave your air conditioning running at all times, even if you go away for weeks. Qatar has the largest air-conditioned outdoor jogging tracks in the world. Across the United Arab Emirates, water is so cheap that some people run the shower just to listen to it.

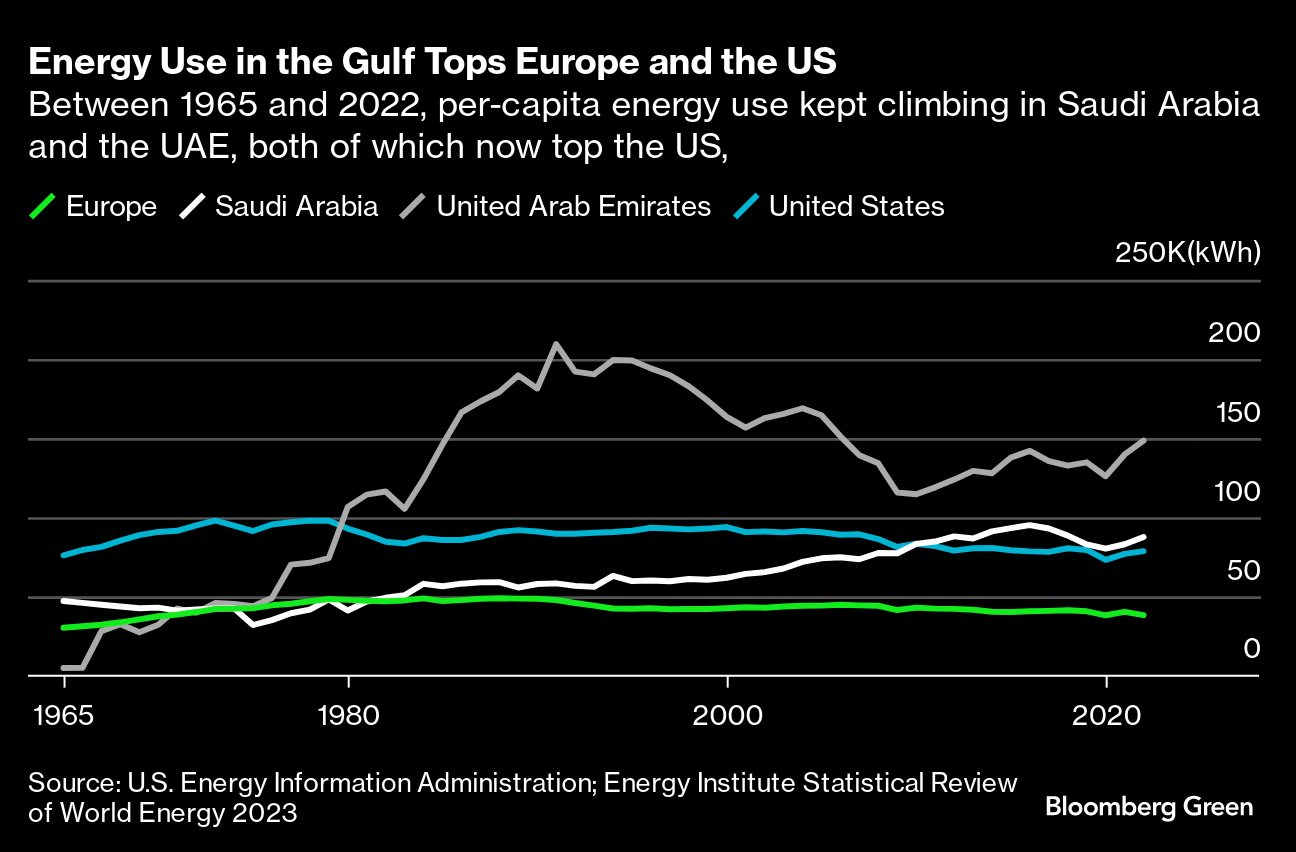

The monarchies that make up the Gulf Cooperation Council — Saudi Arabia, Kuwait, the UAE, Qatar, Bahrain and Oman — built their cities on hot, arid lands, including the world's largest continuous sand desert. In summer months, temperatures top 50C (122F), contributing to some of the highest levels of per-capita energy use in the world: Qatar ranks first, Bahrain fourth, the UAE fifth and Saudi Arabia 14th. That footprint will grow as the population of GCC countries, including foreign workers, swells from 59 million today to an estimated 84 million by 2100.

The extra people are key to economic growth in a region that has long relied on state-owned oil for income. But to accommodate them while meeting stated climate goals, Gulf countries would have to make major adjustments. Governments and companies will need to dramatically increase renewable energy capacity, while winding down reliance on fossil fuels. Environments will have to be adapted for more people and more intense heat, without increasing emissions or leaving the poor behind. The average resident will have to acclimate to higher energy prices and, for the first time, lower consumption.

None of this needs to happen overnight: The UAE and Oman have committed to net-zero emissions by 2050, and Bahrain, Kuwait and Saudi Arabia by 2060. (Qatar has no net-zero goal.) But when Dubai kicks off the COP28 climate conference later this month, the yawning gap between Gulf countries’ stated goals and present reality is sure to come up.

“Dubai is a microcosm of the predicament we’re in globally, whereby the economy runs on extracting, burning and dumping,” says Glada Lahn, a senior research fellow at the UK think tank Chatham House. “It’s tremendously successful along one key measure — standards of living — yet extremely unsustainable. The social contract depends on continuous consumption.”

When Eman Alseyabi, 23, wants to let off steam during hot summers in Abu Dhabi, she heads to the mall. Outdoor temperatures in the UAE capital routinely reach 43C (109F), but the website for Snow Abu Dhabi, which opened in Reem Mall in June, promises “a temperature of -2°C and a snow depth of 500 mm” (19 inches). Its 20 attractions, spread across 9,700 square meters (104,000 square feet), include a sledding hill and a toboggan ride.

Put two Snow Abu Dhabis together and you’ll get Ski Dubai, a 22,500-square-meter indoor ski resort in the Mall of the Emirates, featuring a faux mountain roughly 25 stories high. Oman also has a giant ski resort, and Saudi Arabia is racing to build its own.

Fossil fuels make the GCC’s penchant for malls with ski slopes possible. Gulf countries have some of the cheapest oil production in the world, and — thanks to government subsidies — some of the cheapest gasoline domestically. Electricity, also subsidized by the government, costs consumers in GCC countries roughly 6¢ per kilowatt hour, compared to around 30¢ in Europe and 20¢ in the US. One IMF paper estimates that Saudi Arabia’s energy subsidies were worth about $7,000 per person last year, equivalent to 27% of the country’s economic output.

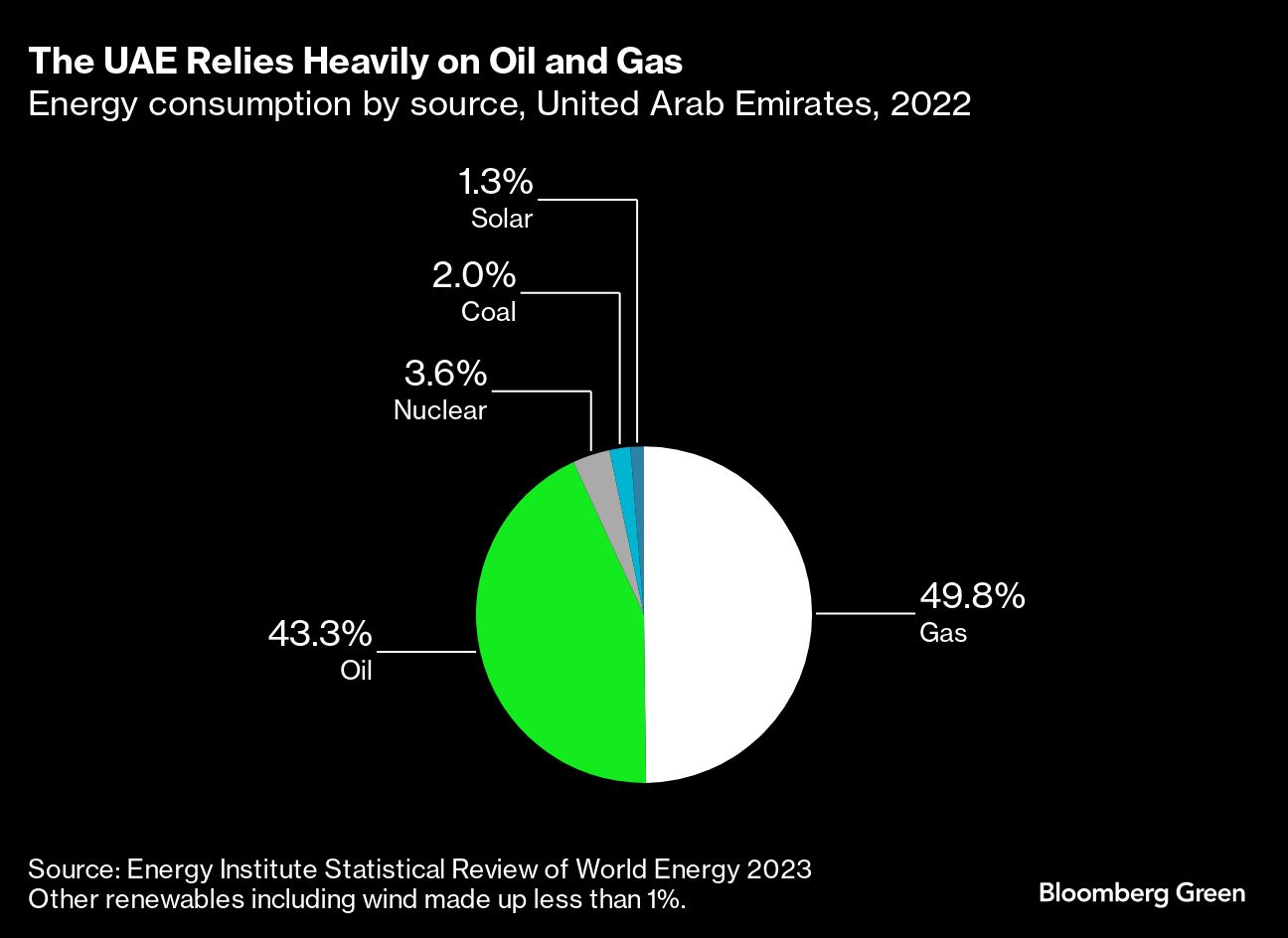

Gulf economies are likewise heavily dependent on oil and gas, which is responsible for 30% of GDP in the UAE and 40% in Saudi Arabia (and which heavily finances other sectors in both countries). By 2027, four regional energy companies — Saudi Aramco, Abu Dhabi National Oil Company (Adnoc), Kuwait Petroleum Corp. and Qatar Energy — are set to boost hydrocarbon production capacity by another 21% over 2021 output. That should allow them to book a collective $981 billion in profit, according to Bloomberg NEF, compared with $689 billion for the eight largest oil majors across the US and European Union.

To continue to add people without sacrificing economic security, or the planet, Gulf countries will thus have to accomplish two Herculean tasks: remaking their domestic energy supply to rely more on renewables, and remaking their economies to rely less on earnings from oil.

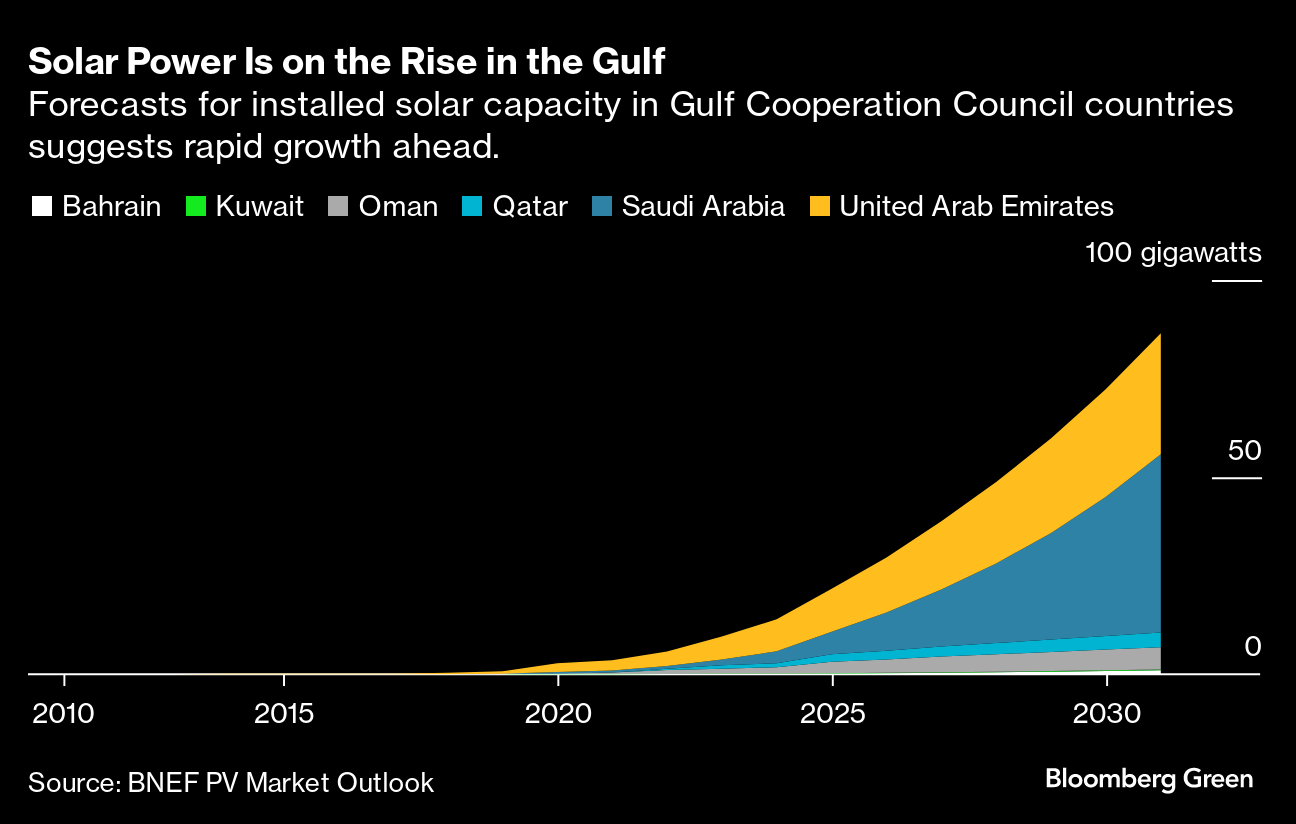

All six GCC states have some sort of renewable energy target. The UAE, which plans to produce 30% of its power from renewables and nuclear by 2030, switched on the Arab world’s first commercial nuclear plant in 2020 and is investing $54 billion in research and infrastructure over the next seven years. Saudi Arabia’s goal is to generate 50% of its electricity from renewables by 2030, while Oman plans to be at 30%. Bahrain and Qatar’s goal is 20%; Kuwait’s is 15%. If all of these goals are met, more than 80 GW of solar capacity alone would be added to the region by the end of 2030, just over the total electricity generation capacity of the UK.

Gulf nations also need renewables to help bring down the cost of desalination, an energy- and carbon-intensive process for removing salt from seawater. In the UAE, water consumption is 500 liters per capita per day, one of the highest rates in the world. (The European average is around 150 liters.) More than 40% of that water comes from desalination. Across the Gulf region, desalination capacity is expected to almost double by 2030.

But stacked up against the renewables rush in the developed world, GCC countries are significantly behind. Renewable energy accounts for less than 1% of power generation in Bahrain, Saudi Arabia, Qatar and Oman; it has reached 7% in the UAE. Norway, by contrast, which exported $177 billion in oil and gas in 2022, derives over 70% of its domestic energy from low-carbon sources.

Gulf country leaders are starting to talk about a future in which they won’t depend on oil revenue. Ahead of COP28, the UAE in particular has begun to shift its rhetoric. Sultan Al Jaber, president of COP28 and head of Adnoc, is asking delegates from the nearly 200 countries attending to set targets for tripling renewables by 2030.

But Gulf countries also very much intend to increase oil and gas capacity, and are banking on carbon capture technology to help them increase output. Saudi Arabia is spending billions to raise its daily oil production capacity to 13 million barrels by 2027, compared with 12 million now, and to boost its gas output by more than 50% this decade. Last year, Adnoc announced a $150 billion investment over five years in oil and gas projects.

Ironically, increasing oil exports while adding renewable capacity at home will help with GCC countries’ net-zero goals. Like Norway, the Gulf benefits from a quirk in international carbon accounting: Oil and gas it extracts doesn’t count against its own carbon-reduction metrics, but against the country where the oil is burned.

Continuing to sell oil and gas for decades, no matter where it’s ultimately used, will likely be catastrophic for the climate. To reach net zero globally by 2050, and maintain even a chance at limiting warming to 1.5C, International Energy Agency projections call for no new oil and gas beyond projects already approved in 2021.

“The biggest impact that [the UAE] has is through their oil and gas sector,” says Tom Evans, a policy adviser at the UK-based think tank E3G. “Even though they’re aiming domestically for much more renewable energy, the oil and gas expansion plans from Adnoc are still the problem.”

Gulf states are effectively betting on being the last fossil fuel exporters left in the game, a strategy that comes with its own risks. “The export of oil and gas is the absolute foundation of the economies here still, despite some diversification,” says Robin Mills, founder of Qamar Energy, a Dubai-based consultancy. “If oil and gas demand falls or prices fall, then they have a big problem.”

As part of the plan to diversify their economies, Gulf monarchies are embarking on ambitious projects to become international hubs for aviation, tourism and entertainment.

That charm offensive comes with billions of dollars in spending. Qatar built super stadiums (with outdoor air conditioning) to host last year’s World Cup. In January, Beyonce played an exclusive concert at the opening of yet another luxury hotel in Dubai, and the Gulf region is home to four lucrative Formula One races. Soccer icon Lionel Messi recently signed a contract worth up to $25 million to promote tourism in Saudi Arabia, now one of the world's top buyers of footballers. After years of strict religious laws, the country began issuing tourist visas in 2019.

Jessica Morgan, 30, who moved to Abu Dhabi from London last summer to edit a local magazine, says she likes being part of a fast-growing country. “I have a swimming pool, a gorgeous garden and lots of outdoor space. I am near some of the most amazing attractions in the world,” Morgan says.

Many new arrivals come to work in the region’s growing entertainment and hospitality sectors. Breanna Alsouissi, 35, moved from Fort Worth, Texas, to the Saudi capital Riyadh this year, mainly for her husband’s job in golf. (Saudi Arabia recently spearheaded a controversial merger between the PGA and its homegrown LIV Golf, and has hired star golfers to design courses across the kingdom.) A branding and web designer, Alsouissi prefers the food, health care and lower cost of living in her new home. The risk of gun violence is lower, too. “I feel safer here in Riyadh than I did going out in Texas,” she says.

The heat is about the same in Riyadh as Fort Worth: Summer days above 38C (100F) are routine. But residential energy consumption in Saudi Arabia’s Qassim Province, just north of Riyadh, averages around 3,000 kWh per month per household, versus 1,200 kWh in Texas. Almost 40% of Texas’ grid is powered by renewables.

Even as international hospitality hubs, Gulf countries will have to contend with climate change. The GCC is warming about twice as fast as the global average, and maximum temperatures are predicted to exceed 130F (54C) by 2100. Continued warming will make summertime, already an exercise in moving from air-conditioned apartments to air-conditioned taxis to air-conditioned restaurants, unsurvivable without mechanized cooling.

“During the summer months, people here don't do a lot besides go out to eat and go shopping, because it's too hot,” Alsouissi says. In winter, when temperatures in Riyadh are closer to 65F (18C), her expat friends go on camping and hiking trips.

Over time, environmental commitments will also force residents of GCC countries to adjust their resource use. Between 2015 and 2018, the Saudi government raised electricity tariffs for some households by 260% per kWh. It has also launched public information campaigns to persuade people to use less water and energy.

In the UAE, the government ditched some fuel subsidies, started promoting public transit and introduced a corporate tax — notable in a country that tends to draw foreigners looking to avoid taxes at home. Earlier this year, a Dubai Electricity & Water Authority campaign asked residents to “Make Smart Summer Choices Your Habit,” including turning AC down to 75F (24C, versus the customary 18C) and watering plants during cooler times of day to reduce evaporation.

“It really is a big shift for individuals to have to be thinking, how much water are they using? How much electricity are they consuming?” says Will Todman, senior fellow in the Middle East Program at the Center for Strategic and International Studies.

Not everyone who moves to the Gulf is hitting the indoor ski slopes or living and working at 18C. Roughly half of GCC countries’ combined populations are made up of 30 million poorer migrant workers, mostly from India, Nepal, Pakistan and the Philippines. Many of them are employed in outdoor construction and oil jobs. The hours are long and the work is dangerous — particularly so at temperatures that can make you dizzy just crossing the street.

Food-delivery workers in the region have described heat so intense that they can’t see straight when driving, according to Human Rights Watch. One 2022 report estimated that as many as 10,000 migrant workers from south and southeast Asia die in the Gulf every year, with more than half of those deaths going unexplained. Another study in 2020 found that non-Kuwaiti men were two to three times more likely than Kuwaitis to die from hot temperatures, a disparity the authors attributed to the former group’s demanding outdoor work in agriculture, fisheries and construction..

Even those with access to air conditioning have to adjust. One taxi driver in Dubai, who owns his own car, told Bloomberg Green that he parks in a shady spot around noon to give himself and his overheating engine a break, something many people working for taxi companies aren’t able to do. Last year, over 105 million taxi trips were taken in Dubai, which plans to make all taxis hybrid, electric or hydrogen-powered by 2027.

While all GCC countries have rules limiting midday work outdoors, they don’t always enforce them, says Mustafa Qadri, founder and chief executive officer of Equidem, a nonprofit labor and human rights consultant based in the UK. Any influx of additional workers will make the need for improved access to water, nutrition, shading and training for extreme temperatures more acute.

“If that is the kind of heat that these workers are facing, then [the governments] have to be honest and acknowledge that if they don't do something radical, then those workers literally are going to die,” Qadri says. “They're going to have a shorter life, they're going to suffer so that people can be lucky enough to be comfortable inside.”

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Supreme Court Allows EPA Power Plant Pollution Curbs for Now

Google Says Nuclear Is Key to Around-the-Clock Clean Power

Morocco to Double West Sahara Green Power Output for World Cup

Iberdrola and Masdar complete wind turbine installation at Baltic Eagle offshore wind farm

AI Boom Sparks $2 Billion Bet on DataBank Led by Australian Pension Fund

Kazakh Uranium Miner Investors to Vote on Huge Deal With China

Companies Are Dropping Carbon Offsets, But Still Buying the Worst Ones

Amazon Prefers Renewables in Asia as Nuclear Still Elusive

Northvolt Founder’s Next Big Green Bet Has a Power Problem