France and Germany Urged to Fix Nuclear Rift as Clock Ticks Down

(Bloomberg) -- Germany rejected the latest proposal to overhaul the European Union’s power market over fears that France could use it to unfairly benefit its nuclear industry and undercut prices across the bloc.

Time is running out for the two countries — the EU’s largest economies — to resolve their dispute over the role of nuclear power in Europe’s energy transition, or risk stalling the region’s green agenda.

Spain, which holds the EU’s rotating presidency, is seeking a compromise among the bloc’s 27 countries at a gathering of energy ministers in Luxembourg on Tuesday. However, the chances of a deal rest almost exclusively on France and Germany, which are still far apart on the matter. A deadline to complete the task before next year’s elections is rapidly approaching.

“The result for me is very disappointing,” said Robert Habeck, Germany’s economy minister. “If we can’t agree on a level playing field for existing installations, then Germany can’t vote for this proposal.”

At stake is a key piece of legislation the EU hopes will drive capital into accelerating the rollout of renewable energy, reducing the role natural gas plays in setting the region’s power prices and leaving the bloc less dependent on Russian supplies. Record energy costs last year upended the region’s economy, exposing its vulnerability to power and gas providers.

Analysts and industry groups say an agreement is needed so that the bloc can move ahead on other aspects of the transition as the continent recovers from last year’s energy crisis.

“It is high time to strike a compromise on this,” said Simone Tagliapietra, an analyst at Bruegel, a Brussels-based think tank. “While Germany and France agree on 80% of EU energy and climate issues, nuclear has long represented a key rift among the two, often engulfing several EU debates in this space.”

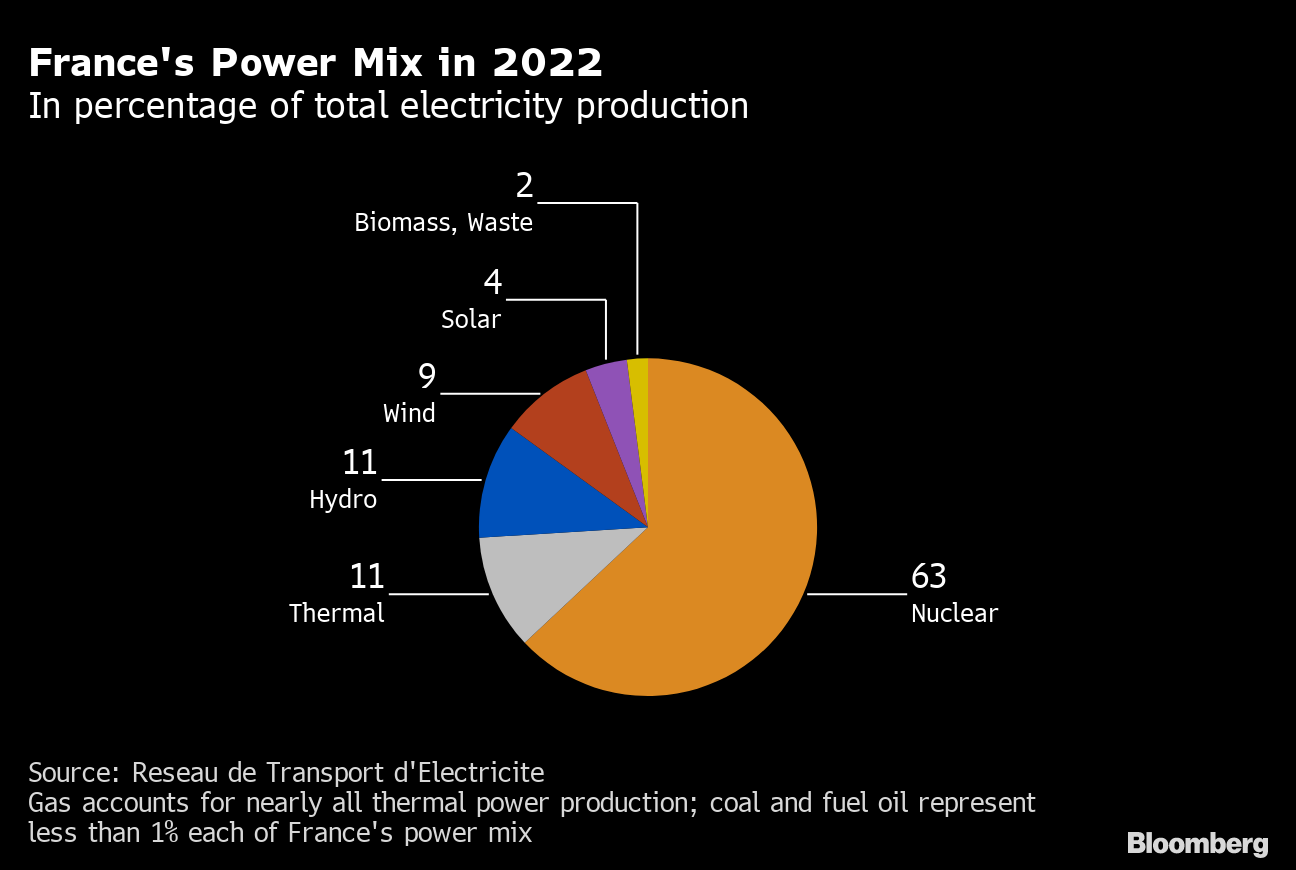

The two European economic powerhouses disagree over the extent to which government funds should be allowed to extend the life of nuclear reactors. France is heavily dependent on an aging atomic fleet for its power, while Germany has completely phased out nuclear energy.

France accused some countries of trying to diminish the role of nuclear power during the transition.

“What some are trying to do is to structurally degrade the competitiveness of nuclear power to the benefit of renewables,” said Agnes Pannier-Runacher, France’s energy transition minister. “We can’t end up with a zero sum game”

Spain is seeking a compromise that would allow France to keep the units in service, while easing fears that it could undercut power prices in the rest of Europe. That proposal, seen by Bloomberg, omits existing nuclear power facilities from rules governing the use of so-called contracts for difference — a tool used by governments to help subsidize clean technologies.

Germany is worried that France would still be able to support facilities run by state-owned Electricite de France SA unilaterally and with fewer restrictions, thereby distorting the continent’s single market. Both countries have presented fresh proposals to try and break the deadlock.

Industry Push

EU elections next June mean that all laws will need to be finalized at least two months prior, and member states still need to negotiate with the European Parliament on electricity market reform — itself an often protracted process.

President Emmanuel Macron said that French and German negotiating teams would seek an agreement this month. In theory, Spain could bypass one of the two by winning the support of a majority of member states. In practice, such a move is politically challenging for such an important reform.

There’s still hope for a deal, even if an agreement isn’t reached Tuesday. EU leaders are scheduled to meet later this month, where they would likely try to use more political impetus to break the deadlock. The EU parliament has already agreed its position.

The electricity industry is also getting impatient with the delay, with the rules having first been proposed in March.

“We see an urgent need for a significant rollout of renewable and low-carbon technologies,” Leonhard Birnbaum, president of Eurelectric, an industry group, said in a letter to energy ministers seen by Bloomberg. “We have no additional time to lose.”

(Updates with context throughout.)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GB Energy Faces New Doubts as UK Declines to Affirm Future Funds

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands

Germany Set to Scale Down Climate Ambitions