Goldman Analysis Sheds Light on Rise of Commodities in ESG

(Bloomberg) -- The days of equating ESG with the blacklisting of commodities are over, it seems.

In a fresh study, analysts at Goldman Sachs Group Inc. have found that fund managers are increasingly including oil, gas and mining stocks in portfolios that are registered as ESG.

The development coincides with a regulatory rethink of how to frame environmental, social and governance strategies, opening the door for ESG investors to hold assets that might be green one day, even if they aren’t yet. It also follows protracted attacks by the US Republican Party, which has repeatedly accused the ESG industry of blacklisting fossil fuels.

Goldman’s research looked at funds registered under the European Union’s Sustainable Finance Disclosure Regulation, which is the world’s biggest ESG investing rulebook. SFDR has two sustainable fund categories: Article 8 (the broadest) and Article 9 (the strictest). The analysis found that fund managers are generally more exposed to oil, gas and mining stocks now than they were 12 months ago.

Among Article 8 funds, a category that Bloomberg Intelligence estimates covers more than $7 trillion of assets, 51% now hold at least one oil and gas company, up from 47% a year ago, Goldman’s analysis found. When it comes to metals and mining, 46% of Article 8 funds hold at least one company in the industry, while the equivalent figure for Article 9 managers is 32%, the analysis shows. That’s up about 5% to 6% from a year ago, Goldman found.

Though ESG funds continue to be overall underweight commodities, “we see more willingness to own metals and mining companies,” Goldman analysts including Evan Tylenda and Grace Chen wrote in the report, which was published this week. And there’s evidence that ESG fund ownership of oil and gas stocks has “increased slightly,” they said.

SFDR is currently in the middle of a major overhaul following a lengthy consultation period. The revamped version is expected to make greater allowance for transition investing, meaning fund managers will be able to hold formerly controversial assets provided they can show their ownership is helping improve a holding’s ESG profile.

Changes in the ESG regulatory backdrop in Europe “will spark the advent of improved mainstreaming of transition/improver funds as credible sustainability strategies, which could drive flows towards companies traditionally excluded,” the Goldman analysts said.

What BloombergNEF Says:

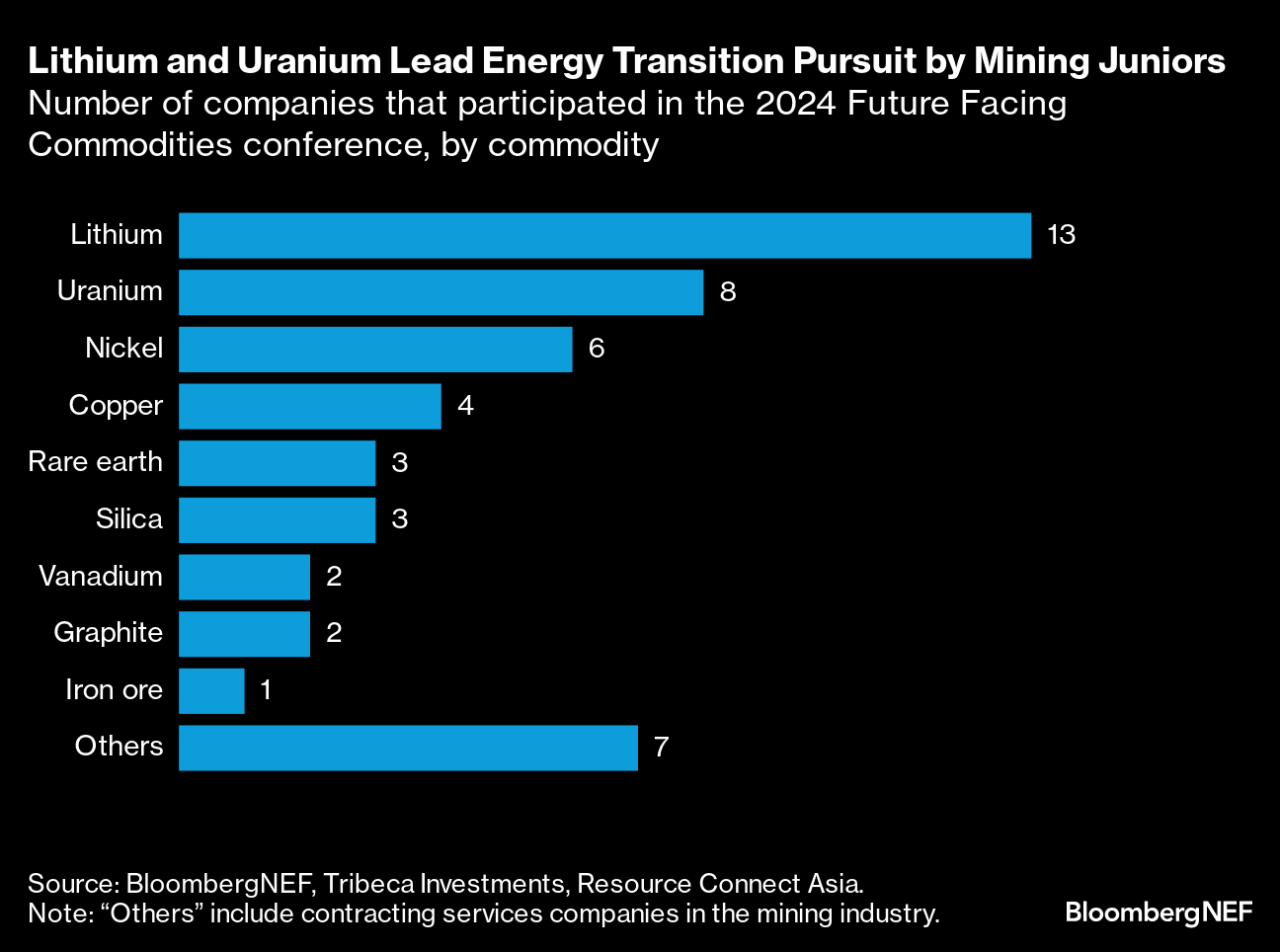

Uranium is increasingly seen as one of the important minerals for the energy transition as nuclear energy becomes integral to decarbonizing the power sector. Supply and demand estimates for yellowcake used in nuclear power generation point to a deficit from now to 2040.

Click here for the full report by BNEF’s Allan Ray Restauro.

The findings follow signs of a wider retreat from ESG in recent years, amid lackluster returns and mixed evidence of any positive environmental or social impact.

In the first half of 2024, Article 8 and 9 funds had a combined $17 billion of outflows, compared with $68 billion of inflows for non-sustainable equity funds (a category known as Article 6 within SFDR), the Goldman analysis found. The picture is different in the bond market, however, with sustainable fixed-income funds generating $115 billion of inflows, compared with $75 billion for non-sustainable funds, the analysts said.

What’s more, there are signs of improvement in recent months, with Article 8 and 9 funds seeing “modest net inflows” in both May and June, they said.

And despite net outflows during 2024, assets under management in Article 8 and 9 funds are close to “all-time highs,” the analysts said.

(Adds BNEF analysis after ninth paragraph.)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Want Solar Panels on Your Roof? How to Navigate Market and Tariff Chaos

New Danish Nuclear Power Fund Targets Raising €350 Million

US Green Steel Startup Raises $129 Million Amid Trump Tariff Uncertainty

Spain Signals Openness to Keeping Nuclear Power Plants Open

Musk Foundation-Backed XPRIZE Awards $100 Million for Carbon Removal

As Tesla Falters, These New EVs Are Picking Up the Pace

Fashion Is the Next Frontier for Clean Tech as Textile Waste Mounts

High-Powered Solar Cells Are Poised to Replace Batteries

New Jersey Forest Fire Shuts Stretch of Garden State Parkway