It Will Take More Than Record Payouts to Spur New Power Plants

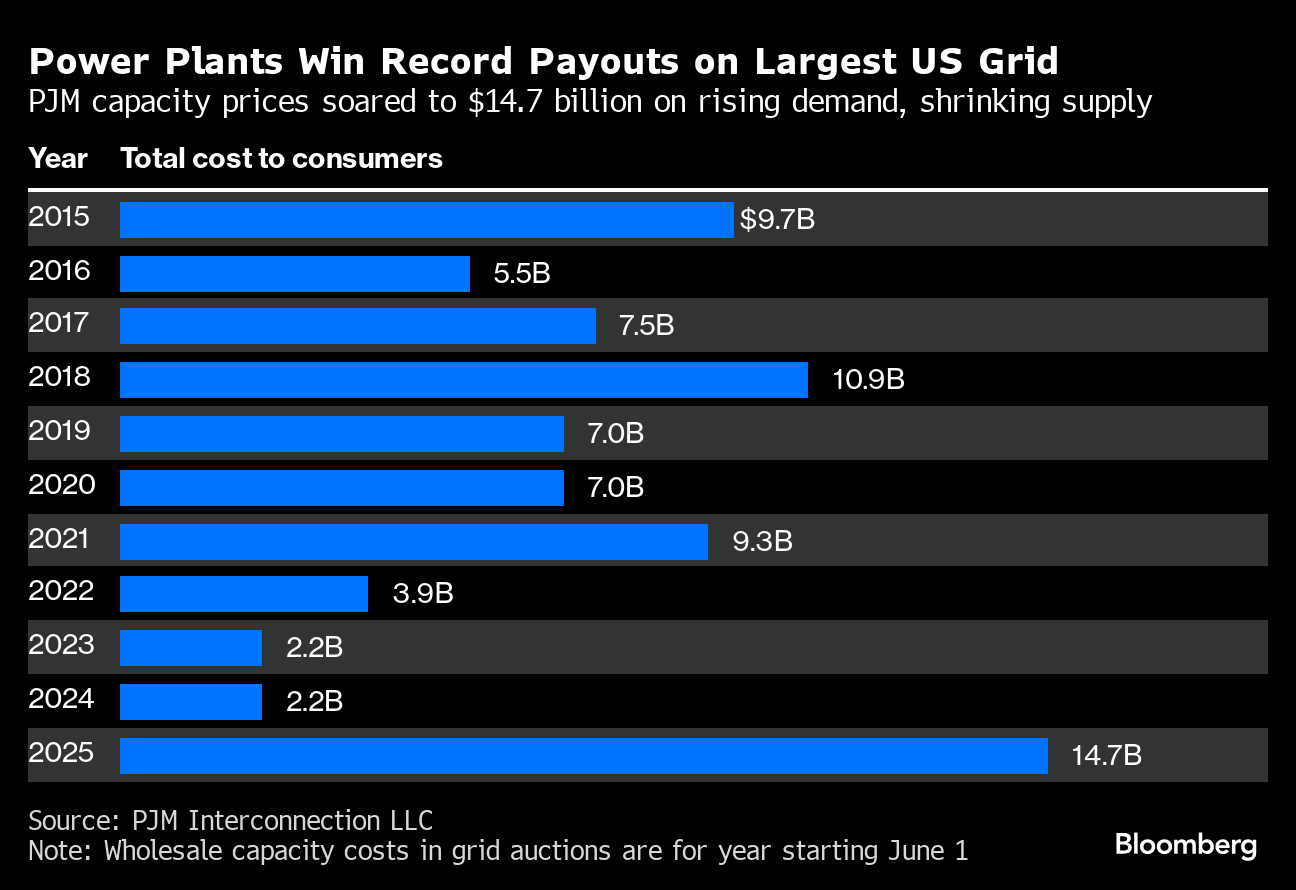

(Bloomberg) -- Power plants on the largest US electric grid just won record payouts in an auction intended to boost the system’s reliability. But experts say it still won’t be enough to spur big investment in projects needed to meet growing demand.

The reason: It often takes at least three years to build natural gas-fired projects capable of providing round-the-clock power — and very few are in development within the grid’s territory, which spans from Washington to Chicago.

The years-long construction process means that the auction results alone aren’t “enough to make a 30-year investment,” said Ryan Levine, head of US power and utilities equity research at Citigroup Inc.

If that proves so, it could very well toughen the grid’s ability to bolster a system that’s been strained by extreme weather. And now its operator faces a burst of electric demand thanks to data centers, new factories and electric vehicles. This is happening just as several old coal-fired power plants are being retired, adding to concerns about the grid’s reliability.

The auctions typically are a critical way to incentivize existing plants to stay online and encourage developers to build new ones, according to grid operator PJM Interconnection LLC.

This year’s auction, however, was different from most that preceded it. Earlier annual auctions assured payouts that began about three years down the line, enough time for some projects to be built. But because the latest auction was delayed, the payouts announced last week will be for the year that starts in June. (PJM plans to host auctions every six months now, including in December, in a move to return to three-year horizons, which better match project-development time.)

“The energy supply is tight, which is what we have been predicting — and while we are moving things through the queue to get replacement power online, nothing is getting built,” said Susan Buehler, a PJM spokesperson, in an email. “The market should work as it is now.”

There are other impediments to project development in PJM’s territory. Higher interest rates have affected financing costs. Project developers have sometimes struggled to access equipment or labor for projects in recent years.

Supply and financing are among the issues that have thwarted all 38 gigawatts of renewables projects approved by PJM from coming online over the past 15 months, according to Buehler.

Then there’s the ability to connect to PJM’s system. It will take through the third quarter of 2025 for another 72 gigawatts to clear PJM’s interconnection queue (its process to determine the necessary grid requirements to add new power generators).

That timeline of third quarter of next year means new requests to connect gas plants won’t be reviewed until 2026 — and facilities are unlikely to come online before 2031, said Paul Sotkiewicz, president of consultancy E-Cubed Policy Associates LLC and PJM’s former chief economist.

Ultimately, developers are unlikely to invest as much as $1 billion on projects unless they have confidence they can make solid returns. Executives at power-plant owners Vistra Corp. and NRG Energy Inc. said in conference calls with analysts Thursday that one auction isn’t enough to start construction of new gas plants, especially an auction that’s behind schedule.

Last week’s auction, coming on top of strong demand-growth trends, was enough for privately-held Calpine Corp. to restart development plans in PJM. The Houston-based developer will be watching for regulatory changes and signs of supply-chain and labor issues before making an investment decision, said spokesperson Brett Kerr.

Developers will also be looking for elevated prices to show up in multiple auctions. Also, cheaper, faster options to bring on supply will likely be pursued before building a new gas plant. “If we are going to meet rising demand, all new capacity resources need to be on the table,” including expansion at existing plants, said Paul Segal, chief executive officer of Manhattan-based developer LS Power.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GB Energy Faces New Doubts as UK Declines to Affirm Future Funds

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands

Germany Set to Scale Down Climate Ambitions