Southeast Asia Solar Boom at Risk From US-China Trade Stress

(Bloomberg) -- The future of Southeast Asia’s booming solar industry, which produces the most panels in the world after China, is being thrown into doubt as the US looks set to impose hefty tariffs on the region.

Chinese firms that set up factories there over the last decade are now being accused of skirting US import levies on their home market. At least three — including Longi Green Energy Technology Co. and Trina Solar Co. — have scaled back operations in Thailand, Vietnam and Malaysia, which, along with Cambodia, are being targeted by Washington.

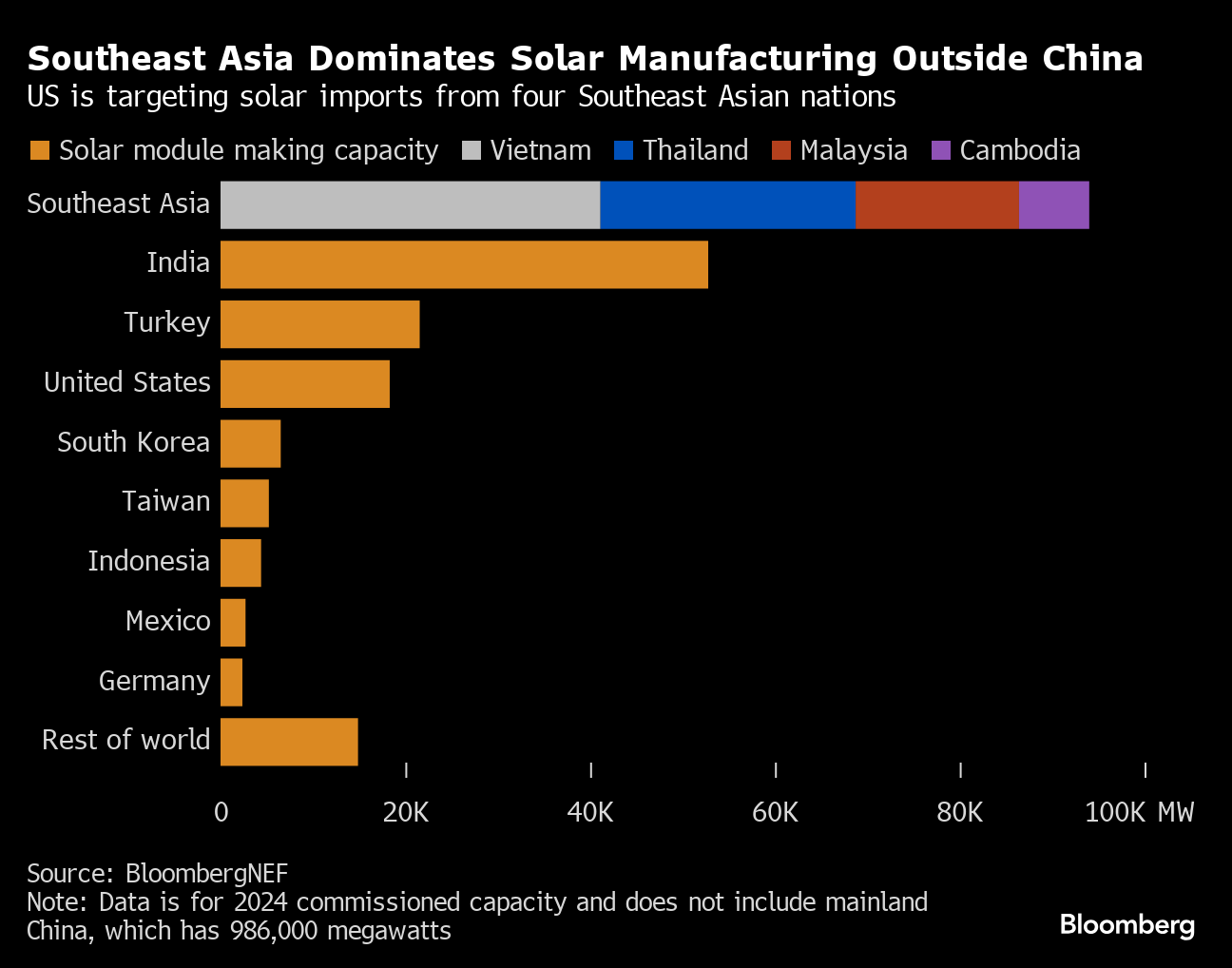

The four countries account for more than 40% of solar module production capacity outside of China, according to BloombergNEF, and other Chinese firms with facilities there are hunting for markets to replace the US.

“The mood of the suppliers is to pack the lines, especially the cell lines, and move them to either Indonesia, Laos or the Middle East,” said Yana Hryshko, the head of global solar supply chain research at Wood Mackenzie Ltd. Some Chinese manufacturers are waiting to see what the tariff level will be before deciding if they need to relocate, she said.

The uncertainty underscores broader turbulence in clean energy supply chains as the US, Europe and others seek to claw back some market share from China, which dominates the production of solar equipment as well as electric vehicle batteries. The Chinese solar firms are also struggling with a worsening domestic glut that’s already seen a number of smaller players go under.

A US investigation last August concluded that some Chinese manufacturers — who initially started investing in Southeast Asia after the US imposed tariffs on panels imported directly from China in 2012 — were illegally bypassing those levies. The ruling led to import taxes of varying levels being imposed on five companies in the region.

Some US firms are now asking Washington for further tariffs of as high as 272% on all solar products from the four countries, although BNEF said in May they would likely be between 30% and 50%. That compares with levies of 25% on China, which the White House is planning to double.

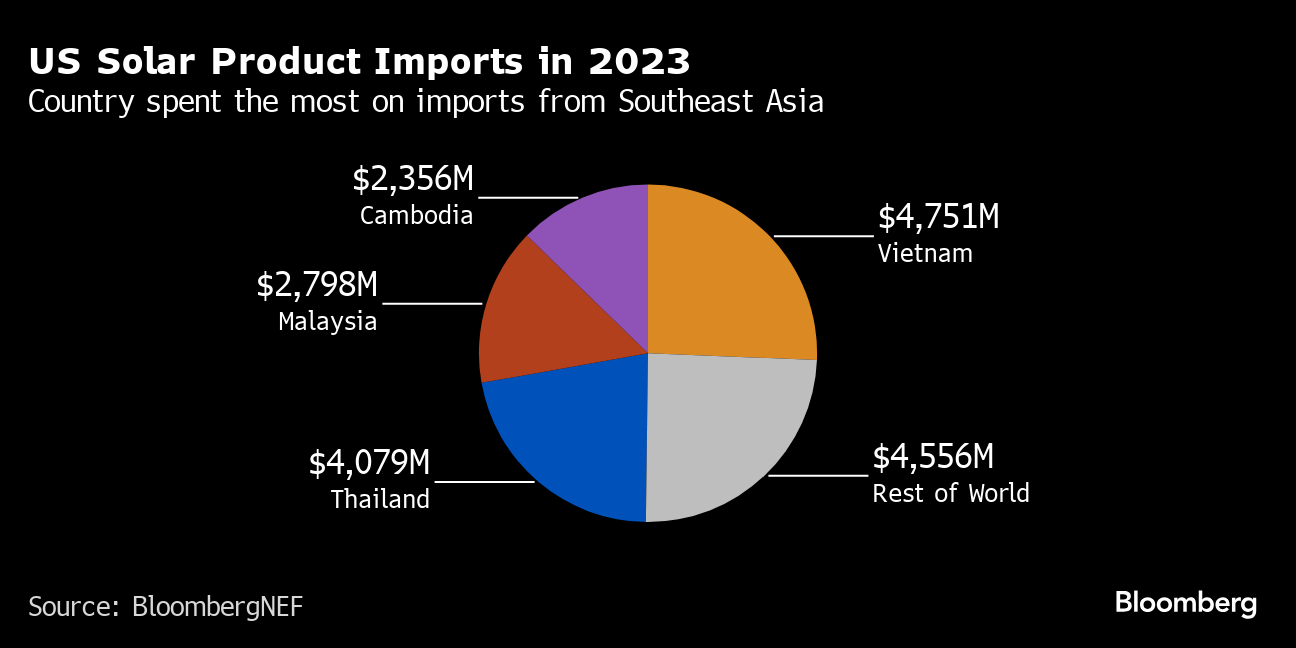

Washington moved closer to instituting the tariffs in June, with the US International Trade Commission passing an initial vote determining manufacturers are being harmed by cheap imports from Southeast Asia. US solar panel imports from Southeast Asia surged 36% to a record last quarter as buyers raced to lock in supply before tariff waivers ended.

Since then, Chinese and Malaysian publications have reported that Longi halted five production lines in Vietnam and began winding down operations in Malaysia, Trina is planning to shut some capacity in the region, and Jinko Solar Co. closed a plant in Malaysia.

A Longi spokesperson said in June that it had made adjustments to plans for output at several factories, in part because of the trade policy changes. The company said in a subsequent exchange filing that its factory in Malaysia is still shipping cells to the US, and it has no plan to move capacity as demand from other markets including India and Canada would be sufficient to support the Southeast Asian plants.

Trina’s Thailand cell factory is still operating normally, and it will decide what to do with its Southeast Asian facilities depending on the outcome of the latest round of the US probe, it said in a statement. Jinko didn’t respond to a request for comment, while JA Solar Co. said its plant in Vietnam is operating normally.

Not all Chinese factories in Southeast Asia will shut down, as products from there can be shipped to India, Europe and elsewhere, according to Dennis Ip, an analyst at Daiwa Capital Markets. Some older facilities might be closed, but newer plants should be able to survive if they can find alternative markets, he said.

The stricter line from the US comes as both major political parties there take a tougher stance against Beijing in the run-up to the election in November. As well as imperiling Southeast Asian production, it could jeopardize Washington’s decarbonization efforts, given more than three-quarters of its solar product import came from the region last year.

While the tariffs will most likely be imposed early next year, it could be sooner if there was an electoral advantage for the Democrats to do so, said Deborah Elms, head of trade policy at the Hinrich Foundation, an Asian-based nonprofit organization that works to advance sustainable global trade. However, US solar manufacturing isn’t ramping up as quickly as hoped, meaning there could be less scrutiny, she said.

Efforts to limit the perceived circumvention of US restrictions on Chinese imports are likely to continue, and this is especially true if Donald Trump gets elected, Elms said. He is “extremely focused” on countries that the US has trade deficits with, and this includes many Southeast Asian nations, she said.

(Updates with US solar imports data in the ninth paragraph.)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Spain’s Nuclear Shutdown Set to Test Renewables Success Story

How Climate Tech Investing Is Being Shaped by Trump’s Tariffs and Orders

China Announces Quartz Discovery Vital to Chips to Rival US Mine

Chinese Battery Makers See Tariff Pain Added to Domestic Woes

AI Data Center Growth Means More Coal and Gas Plants, IEA Says

Trump Signs Orders to Expand Coal Power, Invoking AI Boom

Clean Power Offers Safety to China Investors Rattled by Tariffs

US Solar’s Hoarding Habit Will Help Blunt Sting From Trump Tariffs

Trump Team Proposes Ending Clean Energy Office, Cutting Billions