A $50 Billion London Investor Takes a Contrarian View on Trump

(Bloomberg) -- The conventional wisdom that President-elect Donald Trump’s policies will be inflationary may be misguided, according to one of the world’s biggest investors in the clean-energy transition.

Impax Asset Management Group Plc, which oversees roughly $50 billion from its base in London, is betting that Trump will probably do everything in his power to prevent an uptick in inflation, after consumer prices proved key in his Nov. 5 election win.

It’s a view that has profound implications for portfolio allocations.

“Our view at the moment is that higher inflation isn’t a guarantee as the consequences of inflation for Trump’s core voters would be sufficiently unpalatable that he surely will be reflecting carefully on his policy choices,” Ian Simm, the chief executive of Impax, said in an interview.

Simm says that for an investor concerned with the transition to a low-carbon economy, it’s “almost more important” to focus on the outlook for inflation, and how that will affect long-term bond yields, than it is to “fret about” Trump’s threats to rescind Biden-era green policies such as the Inflation Reduction Act.

“We’re not running for the hills,” Simm said. “We’re sticking with equities and expecting that mid-caps will be benefiting from the mean reversion that’s been long overdue after the rise of the mega-cap tech stocks.”

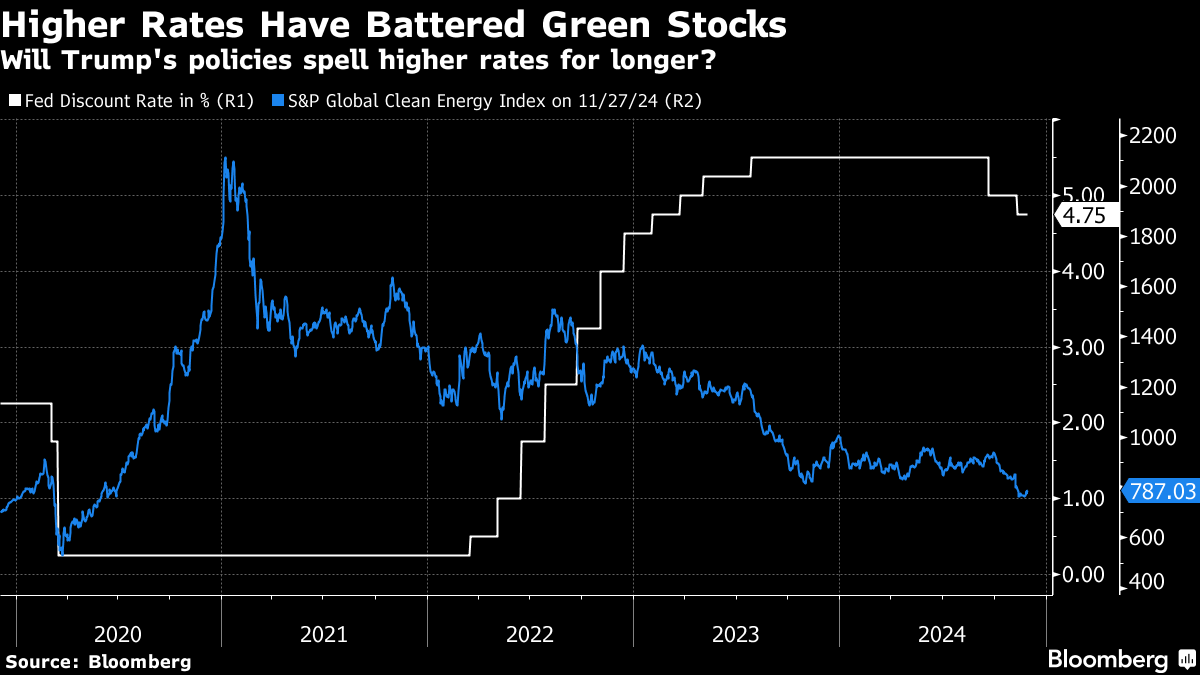

Trump has pledged to cut taxes and impose tariffs, as part of a policy package that economists spanning Larry Summers to Joseph Stiglitz have warned will be inflationary. Higher inflation implies higher interest rates for longer, posing a particular threat to the capital-intensive green sector.

Impax isn’t the only major investor with a green focus to speculate that the president-elect’s rhetoric may not be matched by equivalent policy changes. Parnassus Investments, the largest US sustainable investor, says its “long-term strategy remains unchanged,” despite the new political backdrop in the US.

“The potential impacts to market sectors will depend on how campaign rhetoric translates to policy implementation,” Todd Ahlsten wrote in a recent online post. “For instance, proposed tariffs may affect consumer prices and retail performance, while changes in healthcare policies could influence drug pricing negotiations. Our investment team is closely monitoring these developments to assess their implications for current and prospective holdings.”

And Hamish Chamberlayne, head of global sustainable equities and a portfolio manager at Janus Henderson Investments, suggests that the Trump era may even offer an opportunity for green investors.

“While market sentiment is negative and there are understandable expectations for a slowdown in sustainability-related investment themes, we believe, if history is any guide, we could actually be approaching a compelling time to invest,” Chamberlayne said in an article published on the asset manager’s website.

Trump has said he’ll slap sweeping tariffs on imports from countries that trade with the US. He’s already announced 25% on products from Canada and Mexico, and a new 10% levy on China, tied to border security and drug trafficking. During the campaign, he floated 10% to 20% tariffs on all imports, including from Europe, and 60% duties on China. Trump says tariffs can achieve a range of policy goals, from retaliation for alleged unfair trade practices to national security objectives.

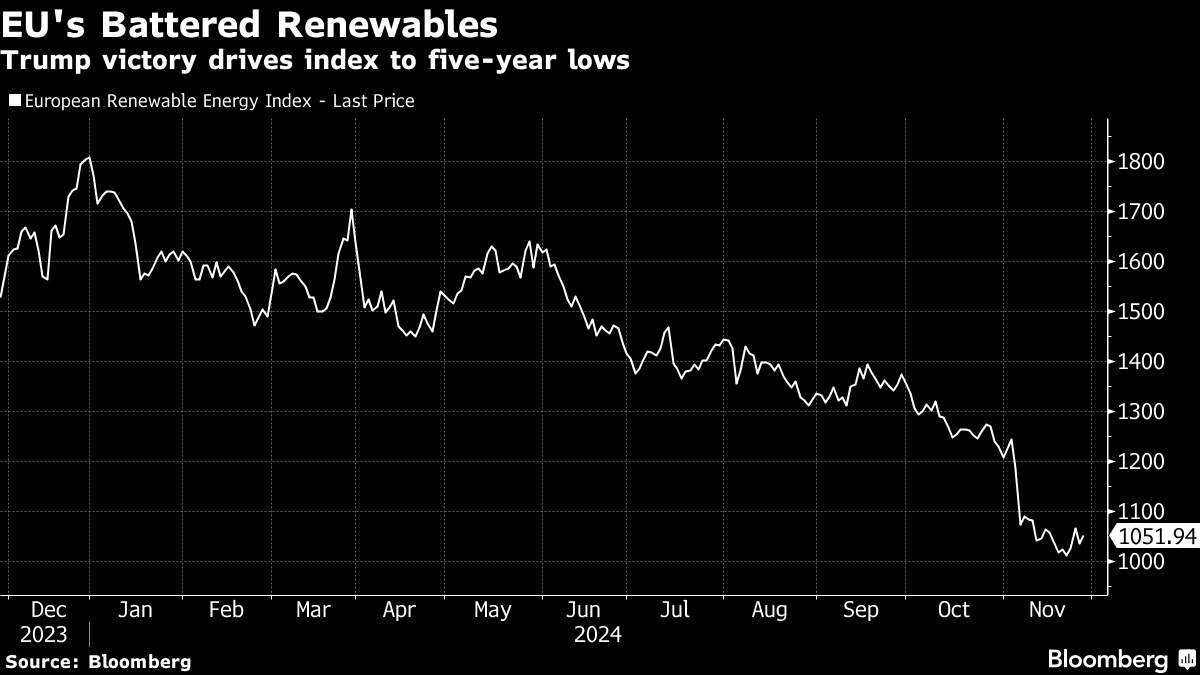

If enacted, the policies would deal a blow to the development of US clean-tech projects by adding billions of dollars in costs to everything from batteries to the steel used to build solar farms, according to an analysis by MIT Technology Review. Coupled with Trump’s pledge to scale back green incentives such as tax credits, clean-energy stocks have already seen a sharp selloff. The S&P Global Clean Energy Index has slumped further since the Nov. 5 election and now hovers close to a 4 1/2 year low. The European Renewable Energy Index is near a six-year low.

Simm says Impax is “definitely not changing our investment philosophy” on the back of the new political environment. “But the relative attractiveness of individual companies has shifted because of threats around key economic fundamentals, for example import tariffs for solar panels.”

Even in the case of solar, both Trump and President Joe Biden have already created incentives for companies to reshore production to the US, and the success of those efforts means further measures against China “are unlikely to impact existing supply chains materially but may see broader market disruption,” Impax said in an emailed statement.

The asset manager’s exposure is already very limited, with aggregate holdings in solar equipment stocks of just 0.1% of its total portfolio. Impax has also been making broader adjustments in recent months, after a stretch of losses. These include moving into Nvidia Corp. and into credit markets.

With government policies now a moving target, Simm says companies should be able to show how they adapt to potential disruptions in the political environment, rather than be expected to provide detailed plans about their transition to net-zero emissions.

“The events of the Nov. 5 election illustrate that there’s no guarantee that a smooth transition to a particular average planetary temperature increase such as 1.5C is actually going happen,” he said. “The situation is a good illustration of the uncertainty around this whole topic and why investors should be asking companies for how nimble, how flexible, their strategies are in the context of this uncertainty.”

(Adds Janus Henderson comment in 10th, 11th paragraphs.)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

US Green Steel Startup Raises $129 Million Amid Trump Tariff Uncertainty

Spain Signals Openness to Keeping Nuclear Power Plants Open

Musk Foundation-Backed XPRIZE Awards $100 Million for Carbon Removal

As Tesla Falters, These New EVs Are Picking Up the Pace

Fashion Is the Next Frontier for Clean Tech as Textile Waste Mounts

Nissan Commits Another $1.4 Billion to China With EVs in Focus

NextEra Energy reports 9% rise in adjusted earnings for Q1 2025 as solar and storage backlog grows

US Imposes Tariffs Up to 3,521% on Asian Solar Imports

India Battery-Swapping Boom Hinges on Deliveries and Rickshaws