California Subsidizes Some of the Dirtiest Oil in the US

(Bloomberg) -- In California’s San Joaquin Valley, old-fashioned pump jacks eke out a trickle of crude that’s among the dirtiest in America. Powering the oil field equipment are solar panels that generate state carbon credits potentially worth nearly $2 million(1).

EB Natural Resources Management Corp., the local oil producer that built the solar plant, is among a handful of little-known companies that produce the most emissions-intensive crude in the US, according to an analysis by Bloomberg News. Yet the solar array offers an incentive to keep pumping at a time when California is aggressively trying to phase out fossil-fuel use.

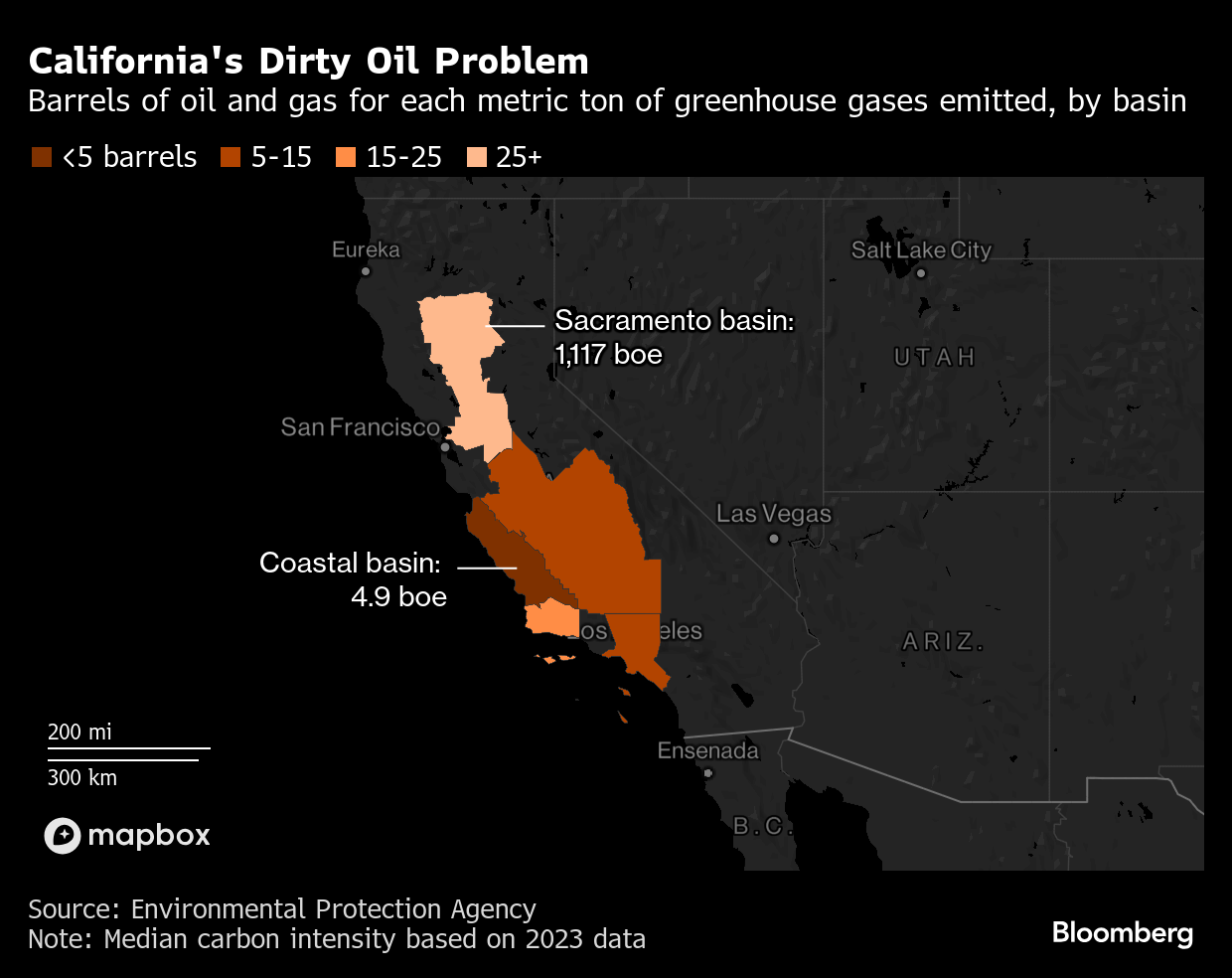

The situation exposes a paradox in the state’s carbon-trading system: By offering oil producers credits for their renewable energy use, California effectively is subsidizing drillers who produce as few as five barrels of oil and gas for every metric ton of greenhouse gases they emit, according to Bloomberg’s analysis. That compares to a US average of about 165 barrels of oil per metric ton.

It’s an irony with implications beyond the Golden State. California, with its ambitious climate goals, has long been a model for slashing emissions. But it’s also a state disconnected from the main oil-refining and -producing regions of the US, largely reliant on imports by tankers and local production to keep gas tanks running. That’s given drillers a foothold in a state that is, at times, openly hostile to the oil industry. And it underscores a challenge the rest of the US is facing: How to combat global warming when rising oil demand continues to keep even the dirtiest crude flowing from the ground.

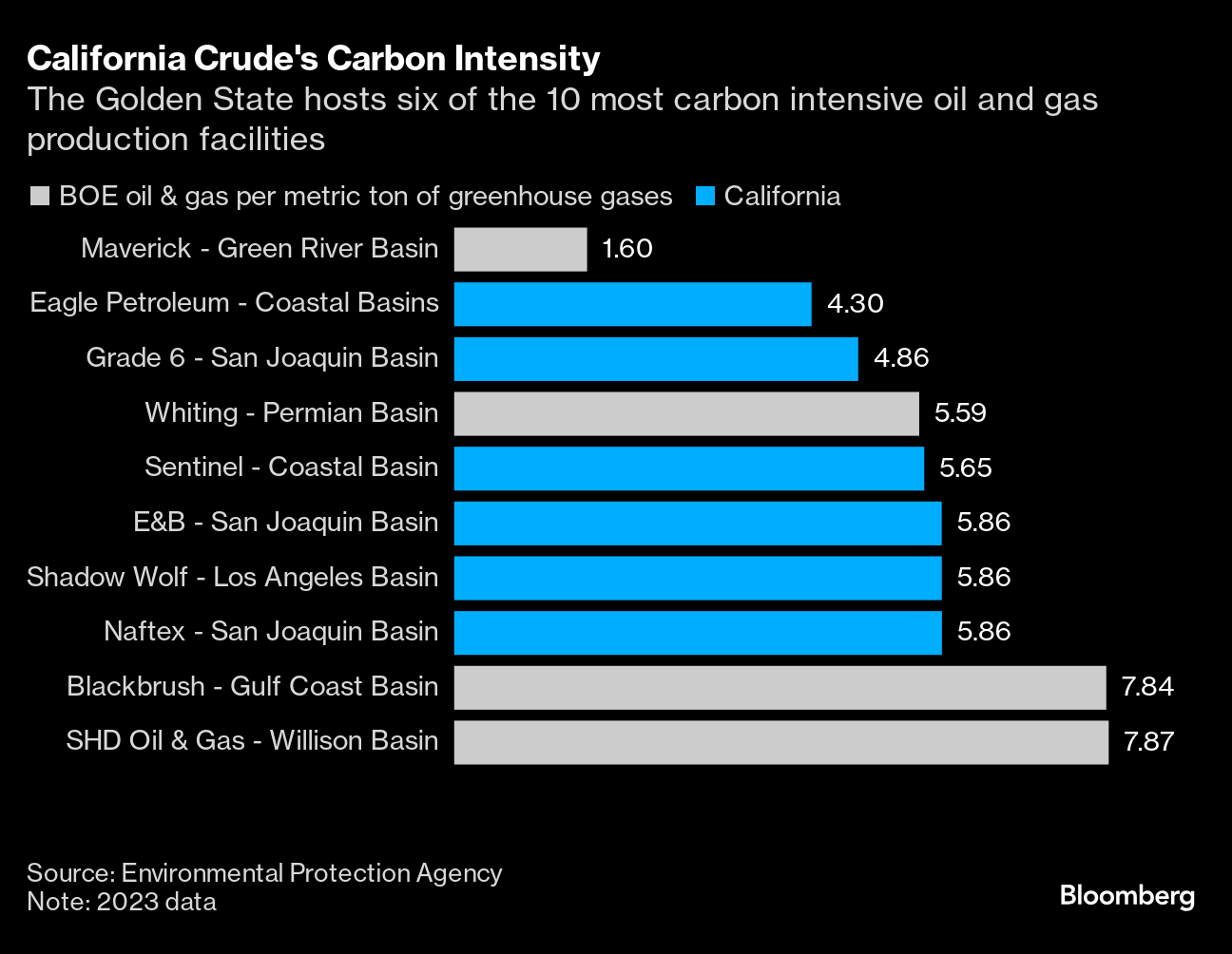

An analysis of data from the Environmental Protection Agency and California Air Resources Board show not only that California is home to some of the most polluting oil, but that drillers behind solar projects that receive credits under the state's carbon-trading system, called the Low Carbon Fuel Standard, or LCFS, are operating some of the most carbon-intensive oil and gas facilities in the US.(2)

Closely held Sentinel Resources Inc., EB Natural Resources Management Corp. and Grade 6 Oil LLC manage assets that were among six of the 10 most carbon-intensive oil and gas operations in the country. Sentinel and EB Natural Resources built solar plants, making them eligible to participate in the carbon trading system.

The California Independent Petroleum Association, which represents EB and other state producers, disputed the EPA’s published emissions data.

“EPA data is unaudited, unverified, and largely based on estimates, default values, or, in many cases, entirely unreported,” said Rock Zierman, chief operating officer of the association. “Relying on such flawed data to draw conclusions is misleading and inaccurate.” An EPA spokesperson, in response, said that emissions reporting is mandatory and subject to a multi-step data verification process.

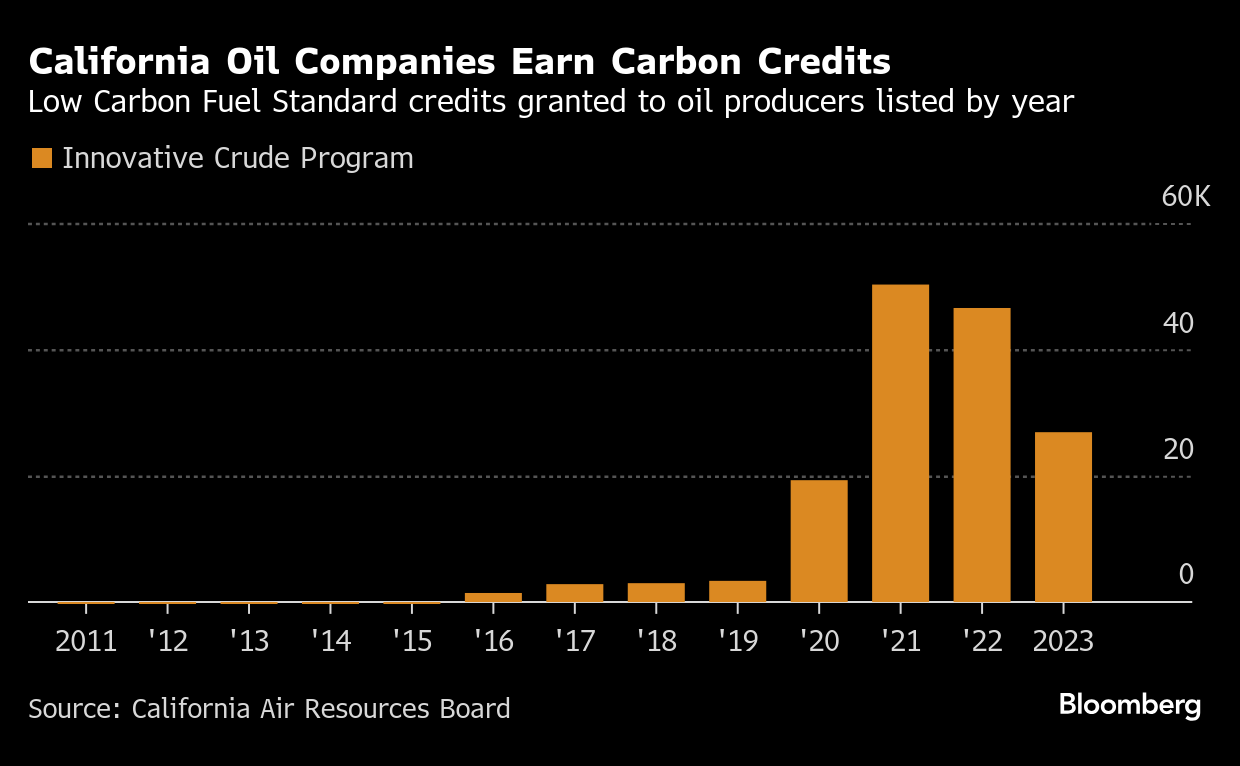

The LCFS, created 15 years ago to cut emissions, requires oil refiners to buy credits generated by lower-carbon fuel producers, mostly ethanol and biodiesel companies. It includes a carve-out for local drillers, giving them credits for using “innovative crude oil production methods” that cut emissions at the well site. Since 2016, oil drillers have submitted 18 solar projects and 15 have been approved, according to state data.

But some Californian oil is sludgy and difficult to pump, requiring carbon intensive production methods, such as steam injection. And imported alternatives are not necessarily cleaner. A new pipeline in Canada this year has increased California’s imports of heavy oil sands crude into the state, for example.

EB releases a single metric ton of greenhouse gases for roughly every six barrels of oil and gas extracted from wells in the San Joaquin Valley, making it the sixth most carbon-intensive onshore production in the US, according to EPA data from 2023. Most of the oil comes from the state’s Poso Creek Oil Field, state data show.

There, EB and a partner built a solar power plant and received approval for LCFS credits in 2020. EB’s partner is listed as Grade Water Power, whose website lists the same senior executives and phone number as Grade 6 Oil.

The solar panels have the capacity to cut emissions by as much as 23,600 metric tons a year, according to the project application. That would offset about 6% of the emissions reported by the EPA for EB’s San Joaquin operations.

Although the solar array doesn’t offset all of EB’s emissions, the rest are covered under the cap and trade program, the California Independent Petroleum Association said. "Emissions are subject to compliance obligations and require the submission of allowances to the State that are obtained either through direct allocation or market purchases. The program covers their GHG emissions, something that oil production outside of California cannot claim."

Still, the Poso Creek field where EB’s solar plant is located, is one of the more emissions-intensive in the state, according to California’s own rankings. The field, which is home to multiple producers, generates emissions equal to about 7.4 barrels of oil equivalent per metric ton, according to the Air Resources Board.

Englewood, Colorado-based Sentinel operates four solar projects across California that produce about 6 megawatts of electricity, the company said in an email. It pumps oil from its Arroyo Grande oil wells near the college town of San Luis Obispo that yield one metric ton of greenhouse gases for every six barrels of oil and gas produced, the fifth most carbon-intensive onshore production facility in the US last year, according to the EPA data.

Sentinel, like many oil companies in California, injects steam into oil field reservoirs to aid production, a major reason for the high carbon intensity of production because energy must be used to heat the water into a vapor.

“The field is currently in the early stage of the production cycle whereby oil production is lagging behind steam injection, resulting in the current higher emission ratios,” the company said. “Those ratios will significantly decrease over time as the cycle matures, steam decreases and oil production increases.”

Grade 6’s San Joaquin production facility is the third most carbon-intensive in the US, according EPA data. Grade 6 did not respond to emails or phone calls seeking comment.

To be sure, absolute emissions for some of these companies including EB and Grade 6 have been in decline in recent years at these EPA monitored facilities but so has their oil and gas production, leaving energy intensity little changed from year to year.

California’s Air Resources Board defends the LCFS program as an “effective piece of California’s transition from petroleum to increasingly clean fuels” by reducing emissions associated with steam injection, which increases carbon intensity, Lys Mendez, a spokesperson for the agency, said by email. “To be clear, this is not a state subsidy.”

The governor’s office says LCFS credits generate $4 billion of investment to make a cleaner transportation sector. “The governor is not turning back from a clean energy future while requiring unprecedented transparency from the oil industry,” Daniel Villasenor, a spokesperson for the governor, said in an email.

While LCFS credits earned by oil companies amount to less than a fraction of 1% of the total credits generated under the program, the nearly 27,000 generated last year would have earned more than $2 million at the average credit price, according to state data.

“This is a very ironic situation,” said Paasha Mahdavi, associate professor of political science at the University of California, Santa Barbara. "This entire standard was designed to reduce emissions in the state.” Instead, it’s “creating the unintended consequence of prolonging oil production.”

(Corrects article published Dec. 19, 2024, to remove a photo unrelated to the story. An earlier version of the article was also corrected to clarify in the second paragraph that E&B built the solar plant.)

(1) The maximum value of the project's carbon credits are estimated based on a total carbon displacement of 23,600 metric tons a year. One LCFS credit was valued at $75 in 2023. The solar farm built by Eamp;B and Grade would have generated as much as $1.8 million last year if it cut emissions by its full 23,600 metric ton potential.

(2) Bloomberg News calculated each company's emissions intensity using EPA data on carbon dioxide emissions and oil and gas produced by well. The EPA data, which is through 2023, only track onshore oil and gas production facilities in the US that emit large quantities of emissions each year, according to the agency website. Some basins include only one or two producers with sufficient emissions to be included in the data.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GB Energy Faces Doubts as UK Declines to Affirm Future Funds

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands

Germany Set to Scale Down Climate Ambitions