Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

(Bloomberg) -- The amount of new capital for climate tech investing climbed globally in 2024, a hopeful sign that the sector is poised to grow despite still-high interest rates and likely regulatory changes ahead in the US.

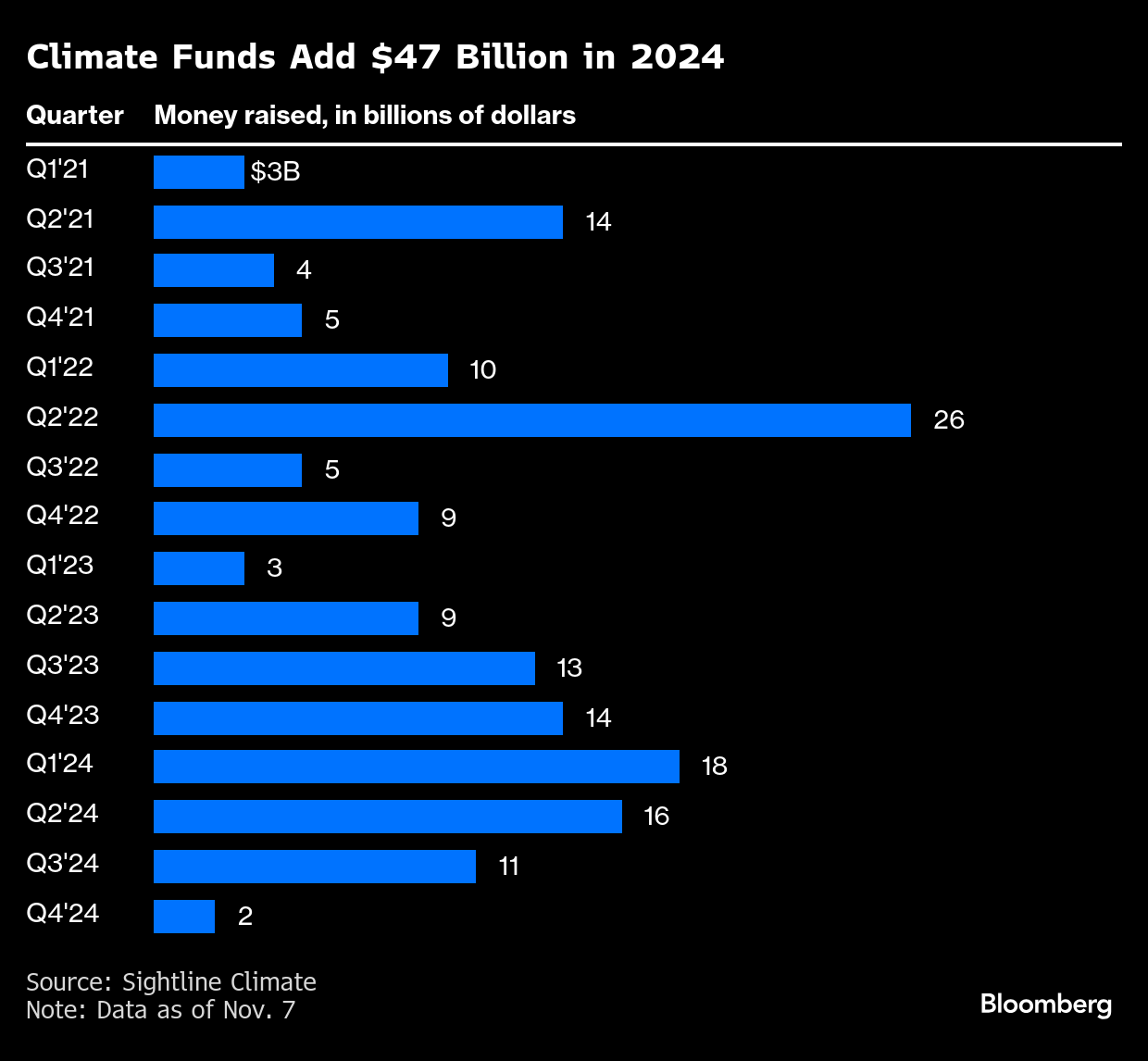

Climate funds added $47 billion in assets under management, a 20% bump over last year, according to a report released Thursday by market intelligence firm Sightline Climate. Much of the uptick was driven by financial heavyweights like Brookfield Corp. and TPG Inc. raising a second, third or even fourth climate-targeted fund.

“These mega-funds coming out for their second fund is a positive signal in many cases because it's a proof point that their first fund was successful,” said Kim Zou, the CEO and co-founder of Sightline Climate.

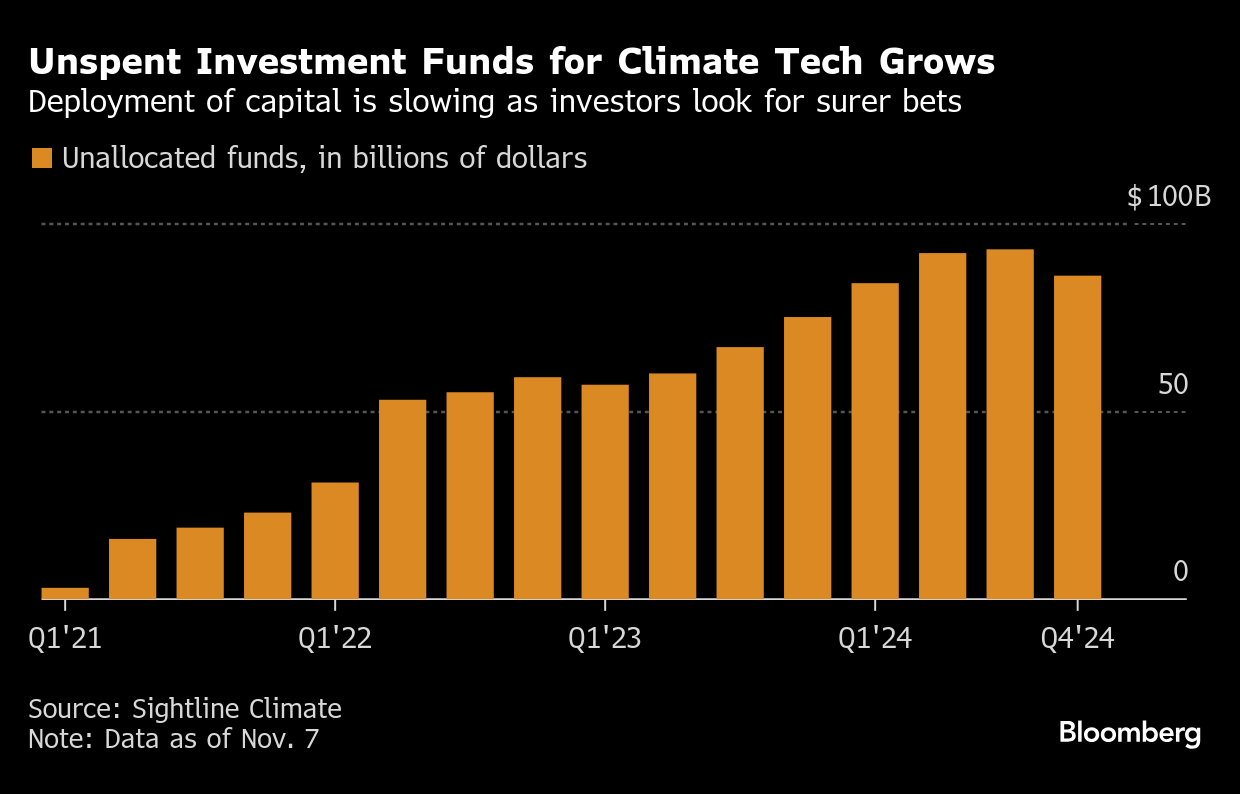

While the money added climbed, the number of investors who participated in a climate deal shrank by 18% and the deployment of capital slowed. Funds have roughly $86 billion in dry powder, a sign investors are backing away from riskier bets in favor of proven technologies and companies.

“We’re watching the market navigate from ‘spray and pray’ to ‘hey, maybe we should actually think about this,’” the report’s authors write.

That mindset has spawned an expanding role for infrastructure funds that back energy transition projects, like constructing offshore wind farms or production plants for sustainable aviation fuel. Investors see those types of projects as less risky because they have contractually guaranteed revenue streams, providing “downside protection over upside potential,” the report says.

The same pattern of reducing risk is playing out in other ways: This year saw a 9% year-on-year decline in the number of new, climate-focused VCs as limited partners have been less willing to bet on investors without proven track records.

The Sightline report warns that Trump’s trade policies could have a chilling effect on the climate tech ecosystem. The president-elect has promised to raise tariffs on China, which supplies cheap solar panels, EV batteries and wind turbines. He’s also threatened to roll back clean energy subsidies.

But other policies could support clean energy deployment. A focus on deregulation and government efficiency may streamline permitting, an area where many renewables projects get stuck, Zou said. The stock market also celebrated Trump’s victory — a signal that IPOs may pick up, including for climate-focused startups. With the federal government possibly taking a step back, at least some investors are also looking to fill the funding gap while finding deals.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Constellation Energy Soars on $16.4 Billion Calpine Deal

In Hottest Year Ever, US Homes Used a Record Amount of Power to Keep Cool

UK Power Prices Climb as Light Winds to Tighten Market on Friday

Verbund Says It Has $103 Billion Solution for Austria’s Malaise

UK Power Prices Skyrocket as Freezing Weather Tightens Market

US Nuclear Regulator Pursues ‘More Efficient’ Reactor Approvals

Trump Says He Wants No Wind Farms Built During Presidency

World’s Biggest Mini-Grid Firm Aims to Raise $400 Million, Plans IPO

Five Key Charts to Watch in Global Commodities This Week