Green Hydrogen Goes From Hyped to Humbled on Eye-Popping Costs

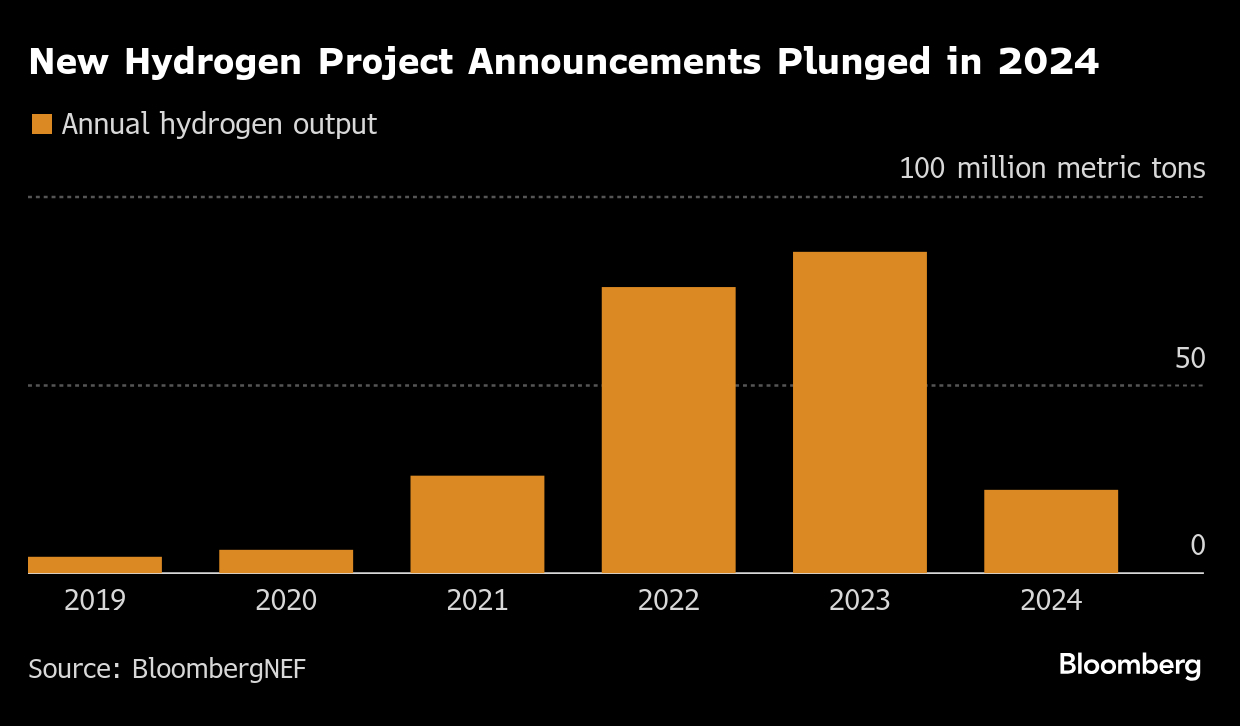

(Bloomberg) -- A raft of projects to produce green hydrogen, a fuel billed as critical to reaching net zero, have been abandoned this year as expectations for tumbling costs failed to materialize.

Governments and major energy companies have touted the gas as a way to clean up a swath of industries. But the uneconomic cost of production has forced multiple developers to scrap plans, leaving the nascent sector struggling to attract the billions of dollars it needs to meaningfully cut carbon emissions.

“There’s been a reality check in terms of the costs that hydrogen projects entail,” said Gniewomir Flis, an independent hydrogen analyst. “The industry has over-promised and under-delivered. It’s only natural that there is a sort of swing back and a natural cooling of some of the excesses that were promised.”

Green hydrogen, made by using renewable electricity to split molecules in water, has been promoted as a potential solution to cut emissions from just about anything that currently relies on coal or natural gas, such as steel production, shipping and even home heating.

“Hydrogen is the Swiss army knife of energy,” Eric Toone, technical lead on the investment committee of Breakthrough Energy Ventures, said this month on Bloomberg’s podcast. “If you have enough hydrogen and it’s cheap enough, you can do anything.”

Low-carbon versions of the fuel can also be produced using equipment to capture emissions, or potentially by extracting it directly out of the ground.

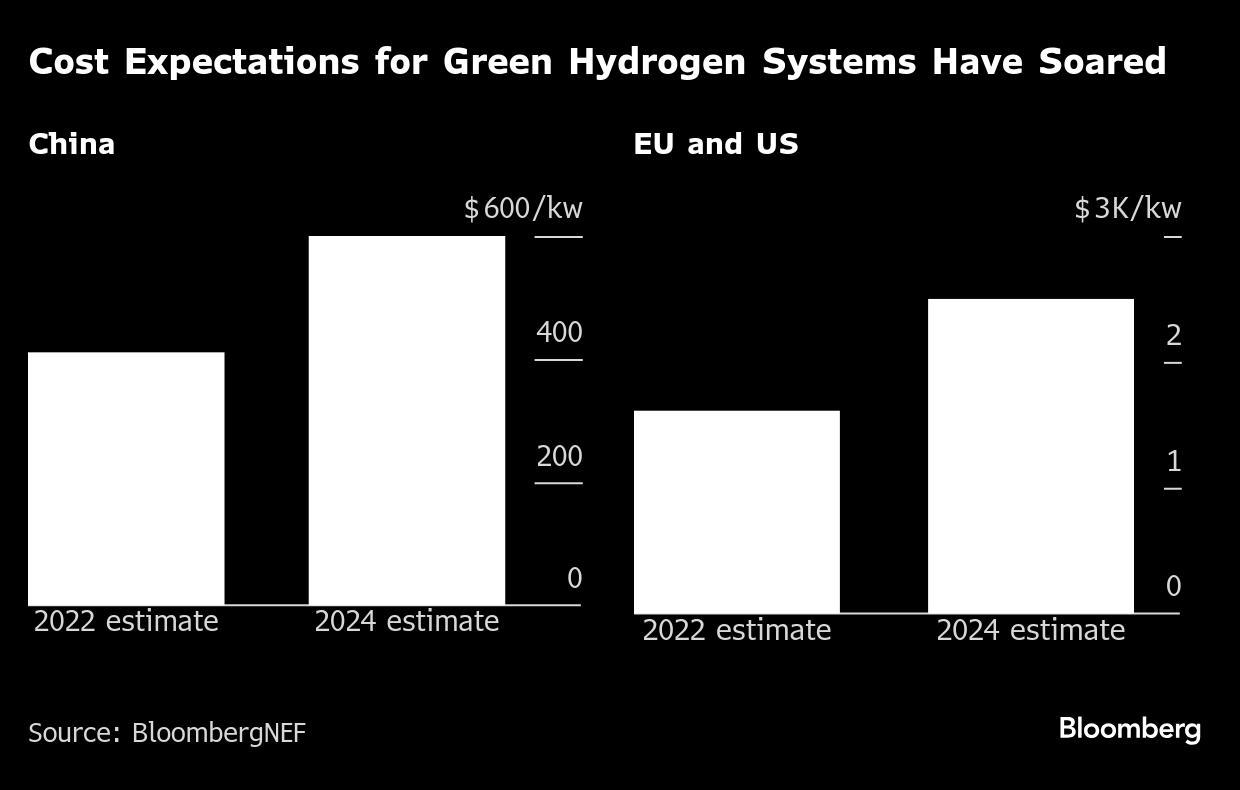

But development has remained more expensive than many expected. Analysts at BloombergNEF increased their cost estimates for green-hydrogen projects in the US and European Union by 55% this year, compared with 2022 forecasts. That’s down to design and engineering processes that proved more complex than initially thought. In Europe, a jump in power prices also drove up input costs.

As a result, hydrogen produced using clean energy costs four times as much as that made from natural gas, according to BNEF. Hardly surprising, then, that the majority of projects don’t have a single customer stepping up to purchase the fuel. And without willing buyers, there can be no output.

“Commercial development of the offtake market of liquid e-fuels has progressed significantly slower than expected,” Orsted A/S Chief Executive Officer Mads Nipper said earlier this year when he scrapped plans for a $175 million Swedish plant to produce shipping fuel from hydrogen. “We have not been able to make long-term offtake contracts at sustainable prices.”

Other projects that have gone by the wayside include a hydrogen-ammonia export plant in Tasmania and more than a dozen early-stage developments planned by UK oil major BP Plc.

Shrinking Market

A year ago, the industry hype had triggered a wave of new hires. Ross Thomson, a managing consultant at recruiter Ably Resources Ltd. in Glasgow, saw huge demand for executive and engineering roles, and said his firm was seeking to fill more than 30 hydrogen-related jobs at a time. Now, it’s less than a dozen.

“There was quite a big drive for hiring, but over the last couple of months there’s been a decrease,” Thomson said in an interview. “I’m a strong believer hydrogen will take off, but not in the next few years.”

It would certainly help if state support were better planned and expedited. While governments have broadly trumpeted hydrogen’s potential, wrangling over the specifics of subsidies has slowed progress. In the EU, it took years for bureaucrats to define what qualifies as green hydrogen. The US, whose Inflation Reduction Act allows for generous aid, has gone through a similar process.

There are signs of modest growth in the sector. Clean hydrogen production is set to triple this year versus 2023. But that’s still only enough to meet about 1% of demand. Most hydrogen is currently made with natural gas or coal, generating carbon emissions in the process.

“We’ve seen what doesn’t work so far so we can focus on what does,” said Sami Alisawi, a hydrogen analyst at BNEF. “The hype is gone. Now you could say the real work begins.”

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

What It Will Take for Rich Countries to Reach Net Zero: You

Bill Gates’ Climate Group Lays Off US and Europe Policy Teams

Trump’s EPA Takes Aim at Biden Curbs on Power Plant Pollution

Deals Seeking $45 Billion in Climate Funds Seen Managing US Exit

TotalEnergies and RWE join forces on green hydrogen to decarbonise the Leuna refinery

Shale Pioneer Sheffield Warns Oil Chiefs of Grim Times Ahead

Investors Learn Brutal Lesson From Sweden’s Wind Farm Woes

RFK Jr. Pressed by Farm and Food Groups to Use ‘Sound’ Science

Tesla Is Flailing in China and BYD’s Rapid Rise Is to Blame