American Farmers’ Next Hot Commodity Is Canola for Biofuels

(Bloomberg) -- Canola oil — invented in Canada 50 years ago as a healthier, shelf-stable cooking fat — may soon venture beyond the world’s kitchen cupboards to a spot in the airways.

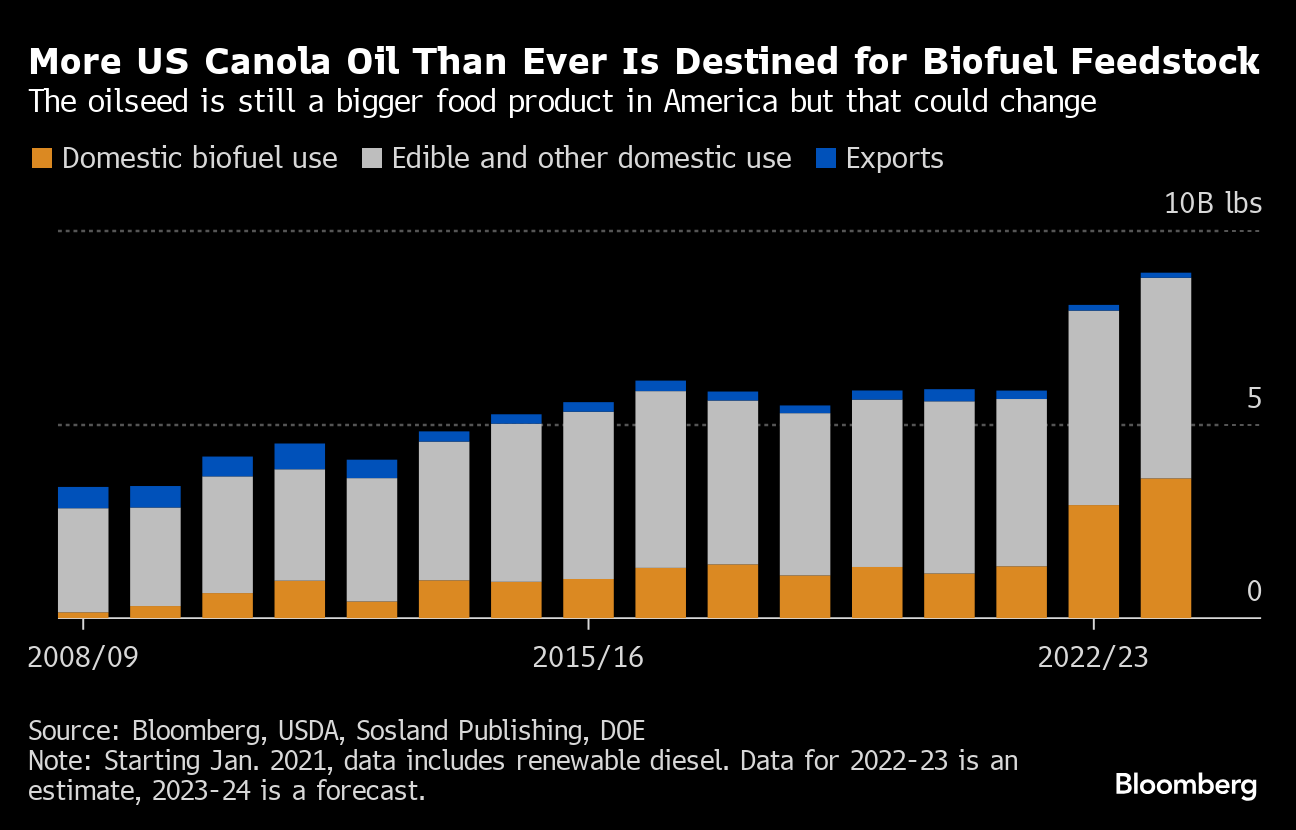

A growing number of energy and agriculture firms in the US have been boosting spending in an effort to plant and crush more canola, an oilseed that could play a big role in the nascent renewable fuel markets — so long as a contentious election doesn’t derail President Joe Biden’s biofuel push before Americans can finally crack the crop.

Chevron Corp., crop trader Bunge Global SA and seed company Corteva Inc. just wrapped the first season of their joint program that encouraged Tennessee and Kentucky farmers to sow a winter crop of canola before planting soy or cotton. It went so well that they plan to expand acreage sevenfold in the next season starting this fall and expand into three additional states: Illinois, the top US soybean producer, as well as Indiana and Missouri, Corteva said.

Farther west, grain handler Scoular Co. is spending tens of millions of dollars to convert a former sunflower processing facility into one capable of crushing canola, soybeans and other oilseeds starting in October. Chevron and Bunge’s own flexible plant meant to handle a wide-range of oilseeds, including canola, is set to start operations in Louisiana in 2026.

“This is very new to a lot of people in our area,” said Kentucky farmer Jed Clark, who planted canola this past winter for the first time after signing on with the Chevron-Bunge-Corteva project. “Some of these types of crops can be come-and-go, but this seems like it will have longevity given the corporate support behind it.”

As the world prepares to trim its dependence on fossil fuels in the heavy transportation sector, producers of all varieties of oilseeds — from dominant soybeans to little-known pennycress — are jostling to become a feedstock of choice for climate-friendly jet fuel and diesel. Although renewable diesel and aviation fuel are still in the early stages of development, the markets are on track to grow fast.

That is, unless Donald Trump wins November’s US presidential election and looks to water down incentives to decarbonize the sector, which some see as a distinct possibility. On the other side, some critics of Biden’s administration had worried he’d champion electric vehicles at the expense of biofuel growth, despite his support for the sector. If Vice President Kamala Harris becomes the Democratic nominee, she’s likely to face similar scrutiny given her state of California’s ambitious goals to slash fossil fuel emissions and move to EVs.

If the market’s expansion continues as planned, the total US and Canadian market for oils, fats and greases used to make climate-friendly transportation fuels will be valued at more than $20 billion next year, according to estimates from Bloomberg Intelligence analyst Brett Gibbs. That’s up from about $6 billion in 2019. New end-use markets for commodity oilseeds is welcome news for US farmers, who are currently bracing for their biggest collective drop in income since 2006, according to the US Department of Agriculture.

“We’re seeing more and more demand in hard-to-electrify sectors, including trucking fleets as well as rail and marine,” said Stacey Orlandi, president of Chevron’s renewable energy group. “Those are just huge markets that all have this desire to go to lower carbon-intensity solutions.”

Soybeans, the largest US crop after corn, is a popular option for fuel feedstock due to its sheer pervasiveness. But most conventional soybeans are made up of only about 20% oil; canola’s oil share is about double that. Soy’s higher protein-meal content was a benefit when meat demand was soaring, since it was primarily used for animal feed. But it’s not as useful when making transportation fuels.

Canola, a play on the words and was originally bred by Canadian scientists as a healthier version of rapeseed. Canada is the world’s largest canola grower, after sowing its first genetically-similar rapeseed plants during World War II to supply lubricant for allies’ marine engines. The nation planted about 20 million acres of canola in 2023, almost ten times the size of the US’s record 2.3 million acres, primarily located in North Dakota, plus Minnesota and small patches of the Pacific Northwest. The US is a top buyer of Canadian canola, with imports of nearly 3 million metric tons of oil last year valued at about $4.6 billion.

In recent decades, US farmers have tried to boost canola production outside the core North Dakota stronghold but with little success. Most US and Canadian canola grown today is so-called spring canola, which is seeded in the spring and harvested around September, meaning it’s competing with other crops that might need to use the land during the summer growing season. The current push centers around producing more winter canola, which is planted in the fall and typically reaped in June, a period when some farmers’ fields might otherwise be fallow.

It can be a tough environment to get right: Winter needs temperatures to get cold but not encounter too many sub-zero days, or the plant risks so-called “winter kill.” A changing climate and worsening storms can make that kind of precise calculation difficult. Get it right, though, and the crop can yield about 20% more than spring canola due to a longer growing season, according to Barry Coleman, executive director of Northern Canola Growers Association in North Dakota.

A lack of processing capacity also hindered earlier efforts to grow more of the tiny brownish-black seeds to crush into oil. Companies today are more willing to invest in processing thanks to the promise that greener fuels will take off. The Scoular plant in Kansas will be able to crush 11 million bushels a year of canola and soybeans, said Sandra Hulm, senior vice president of the company’s renewables and oilseeds division.

“We believe this could grow well beyond the capacity of our facility,” she said, adding that there could be enough winter canola eventually in the wheat-heavy region to fill multiple processing plants. “The market will dictate how we invest in that landscape.”

The Chevron-Bunge-Corteva pilot that concluded its first season last month added about 5,000 new canola acres in the US, a sliver of the more than 85 million acres expected to be dedicated to soy this year. Yields surpassed expectations with an average of 54 bushels an acre. Next growing season, the companies are targeting as many as 35,000 acres, said Kendall Palmer, Corteva’s senior director of biofuels.

Ultimately, given the amount of fallowed land in the region, there’s an opportunity for several million acres in the Mid South for additional winter crops like canola, he said. The new Louisiana plant broke ground earlier this year, about two years after Chevron said it would contribute about $600 million in cash to its JV with Bunge.

“That represents a huge opportunity for the Southeast, because now you have a big player coming into the market demanding a product,” said Andrew Moore, a pioneer in the crop who’s family farm has been growing and processing winter canola and soybeans in northwest Georgia since 2006. “Farmers will have a regional processor and won’t have to send product to North Dakota or Canada for crushing.”

Until the plant is online, Bunge said it will tap into its global network to process the newly harvested canola. Farmers participating in the project are being offered premium prices, the crop trader said — an attractive perk when canola futures are down more than 20% in the past year.

As farmers add canola, they are finding it brings some welcome side benefits. With its deep roots that promote soil health, canola consistently boosts yields of the next crops. Wheat yields can increase as much as 20% following a canola harvest, according to Oklahoma State University agronomist Josh Bushong. Farmers also like how the dense oilseed suppresses weeds, including for crops like soybeans and corn that may follow in the rotation. Such “double cropping” — growing two or more crops back to back on the same land — improves soil health and reduces canola’s total greenhouse-gas output, giving it greater potential value in the low-carbon fuel markets it’s trying to tap into.

Related: Refiners Turn to Bio-Based Jet Fuel to Cushion Green-Diesel Pain

“They get the environmental benefit and the additional income,” said Luis Copeland, senior director for low carbon-intensity seeds at Bunge. “And the beauty of this is that when double cropping with soybeans, you are getting two-and-a-half times the amount of oil that’s so much needed for the demand that’s coming at us.”

Back in Kentucky, farmer Clark, who has signed on with the Chevron project for a second season, has discovered one more surprise perk of canola: Its signature yellow flowers this spring attracted onlookers. “In my 25 years, I’ve never had anyone stop in my office and ask if they could take pictures of my field.”

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Used Solar Panels Sold on Facebook and eBay Have Cult Following

Trump Halts NY Offshore Wind Project Work Amid Sector Review

Big Bets on Speculative Carbon Capture Tech Ignore Today’s Solutions

UK Grid Warns Record Low Power Use to Test Network This Summer

AI to Prop Up Fossil Fuels and Slow Emissions Decline, BNEF Says

UK Approves Grid-Queue Overhaul in Race to Clean Up Power System

Europe’s Hottest Year Turbocharged Extreme Weather Across Region

Khosla-Backed Energy Startup Nabs $258 Million to Help Power Data Centers

Peter Thiel Joins Board of Enriched Uranium Startup General Matter