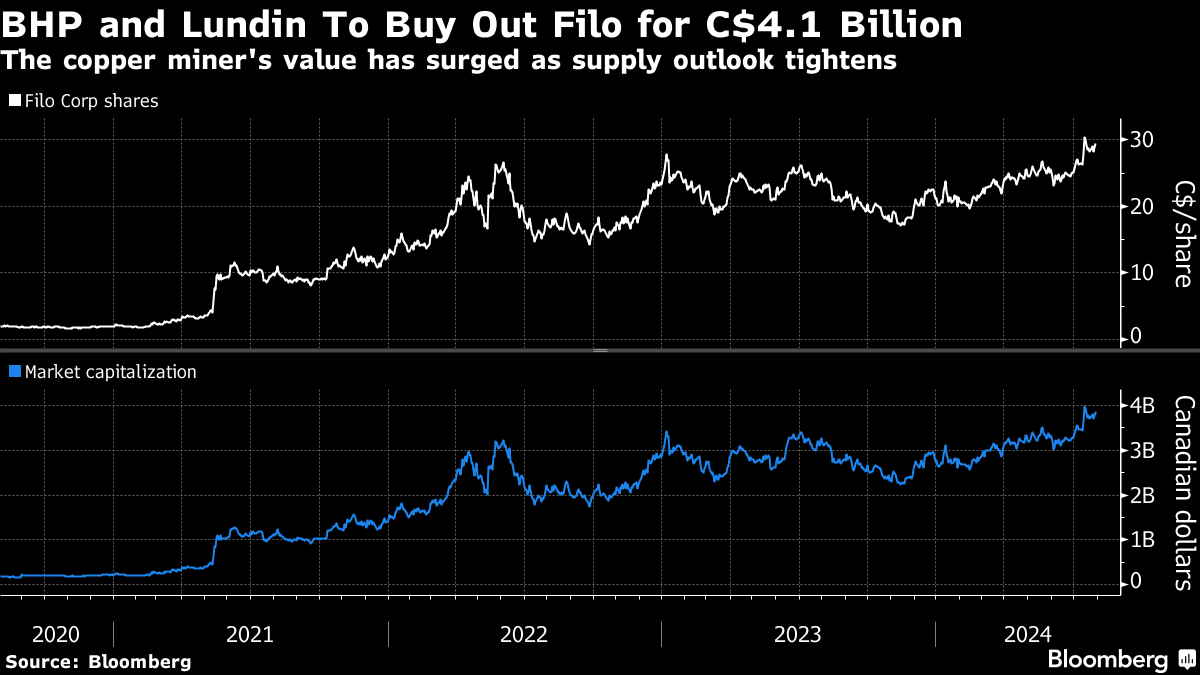

BHP Swoops On Filo in $3 Billion South American Copper Deal

(Bloomberg) -- BHP Group Ltd. — fresh from being rebuffed by Anglo American Plc — swooped to buy Filo Corp., teaming up with Lundin Mining Corp. in a $3 billion deal to gain South American copper assets.

Growth in copper has been a focus for much of Chief Executive Officer Mike Henry’s tenure. The world’s No. 1 miner has spent the past few years running the rule over its main rivals, making its biggest acquisition in a decade and — in recent months — taking a $49 billion punt at Anglo.

The strategy reflects a recognition that the company is too dependent on commodities such as iron ore and coal and doesn’t have enough copper, an essential metal for the energy transition. It also mirrors a wider reality across the global industry, as the top producers rush to expand in copper at a time when large new mines are hard to find and increasingly costly to build.

The deal announced Tuesday will give BHP a 50% stake in Filo — which owns a big copper project that straddles the Argentina-Chile border — as well as half of Lundin’s neighboring Josemaria operation, with the intention to combine both ventures to cut costs.

The hefty price tag for undeveloped mines that won’t be in production for years and will require billions of dollars to develop shows how seriously the largest miners view copper expansion and how few projects of this size there are to buy.

Combining two neighboring sites to make a bigger and more efficient mine is also in vogue across the industry, with Glencore Plc’s CEO championing the need to consolidate assets in places such as Canada and Chile.

The industrial metal is increasingly coveted for its use in wind and solar energy equipment and wiring for electricity grids and data centers.

BHP’s cash payment for the proposed transactions is expected to be about $2.1 billion. The total price for Filo is around C$4.1 billion ($3 billion), or about C$33 per share. That compares with Canada-listed Filo’s closing share price of C$27.98 on July 12, before a Bloomberg report that it was a takeover target.

Lundin Mining worked with Rothschild & Co and Morgan Stanley on the deal, while Filo was advised by BMO Capital Markets. BHP worked with TD Securities on the transaction.

BHP’s shares fell 1.3% in Sydney.

Copper prices surged to a record in May, but have dropped by almost a fifth since then, largely due to concerns over a deteriorating Chinese demand outlook. Consumption is expected to increase in the longer term, with BHP’s Henry previously saying it would double over the next two decades.

“This transaction aligns with BHP’s strategy to acquire attractive early-stage copper projects and enter into strategic partnerships with parties where complementary skills and experience can deliver long-term economic and social value,” he said in a statement.

While Anglo’s copper portfolio is already in production, BHP will have to start from scratch with Filo del Sol and Josemaria, in a region where there’s little infrastructure.

Josemaria is the more advanced of the two projects, with potential first production later this decade, according to CRU Group analyst Craig Lang. Given the challenges associated with securing producing copper assets, there are likely to be more similar acquisitions in the future, he said.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GB Energy Faces New Doubts as UK Declines to Affirm Future Funds

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands

Germany Set to Scale Down Climate Ambitions