EU’s High Energy Costs to Persist in Net Zero Plans, Lobby Says

(Bloomberg) -- The European Union will still have higher power prices than the US and China under its best-case net zero scenario because of growing demand and inherent disadvantages, the bloc’s business lobby said.

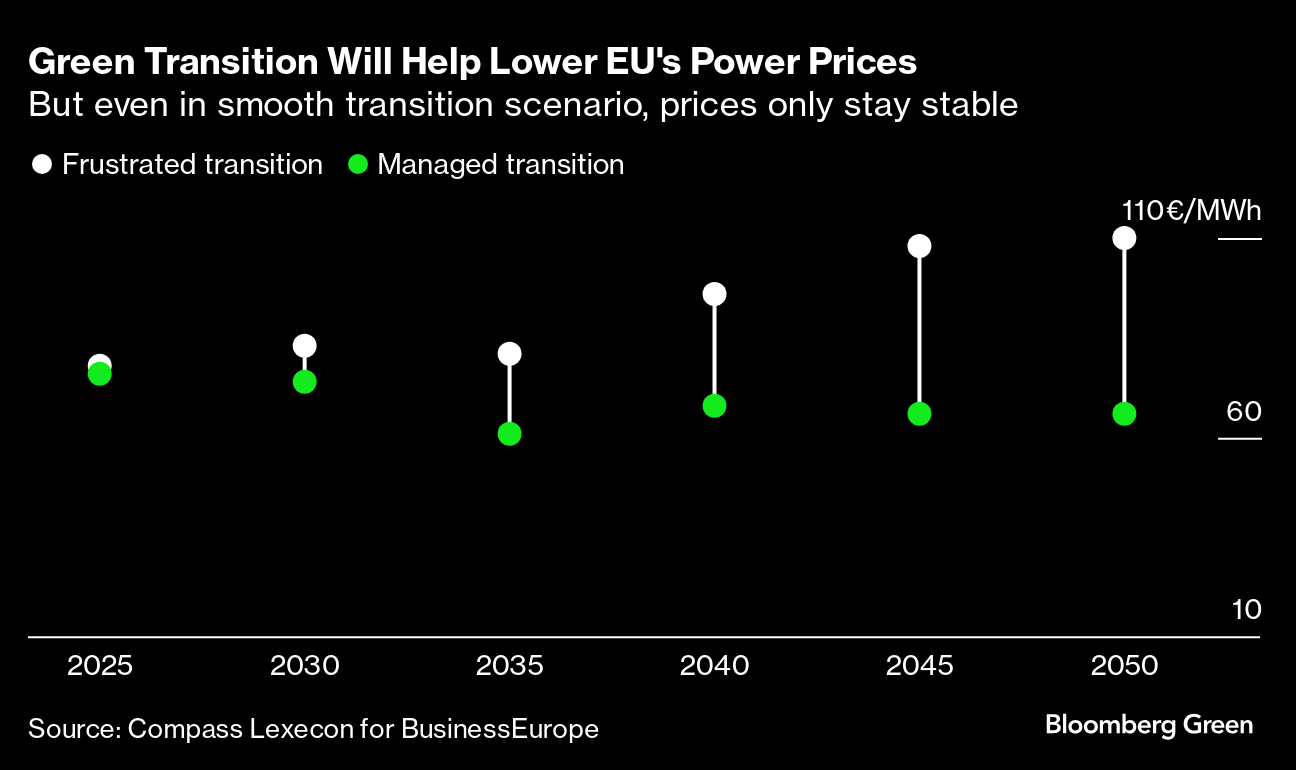

A study commissioned by BusinessEurope said the EU’s electricity generation costs will still be at least 50% higher than in those nations through to 2050 under a “managed scenario,” where climate goals are met without major hiccups. A “frustrated transition,” where key policies suffer delays beyond mid-century, could see costs as much as three times higher than in those main rivals.

“This will put European companies at a serious competitive disadvantage with these key competitors, which is why we need urgent action at EU level,” said Markus Beyrer, director general for BusinessEurope. “Securing energy at competitive prices will be central to preserving Europe’s industrial base.”

The EU pays significantly more for its energy as a result of its dependence on imports — a situation exacerbated by Russia’s invasion of Ukraine and diminishing gas supplies from Moscow. That’s given rise to concerns that Washington and Beijing can undercut Europe when it comes to fueling traditional industries, such as steel, or innovative clean-tech sectors such as wind and batteries.

Cutting energy costs is one of the main priorities for the heads of major industrial companies in Europe. Policymakers have made competitiveness for renewable sources one of the cornerstones for the next European Commission, but companies say they are drowning in red tape.

One of the EU’s key tools is a carbon border levy that aims to put a price on CO2 emissions embedded in imports from countries that don’t have a strong emissions trading system. If that proves ineffective in helping the bloc’s industry, BusinessEurope said lawmakers should reconsider phasing out free carbon allowances for manufacturers.

The lobby also recommends greater integration of renewable and low-carbon energy sources across the bloc, securing the hydrogen value chain, streamlining the permitting process and fostering decarbonization through demand-side incentives.

BusinessEurope includes the main business lobbies of each member state plus the UK. The study published Thursday was developed with economic consultancy Compass Lexecon.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GB Energy Faces New Doubts as UK Declines to Affirm Future Funds

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands

Germany Set to Scale Down Climate Ambitions