Ex-BlackRock Executive Seeks Unity to Fight Climate Change

(Bloomberg) -- Paul Bodnar, BlackRock Inc.’s former chief of sustainable investing, said climate activists need to stop “demonizing” the fossil-fuel industry for advances to be made on the environmental front.

“There’s too much demonizing between industry and the environmental community right now,” said Bodnar, who now serves as director of sustainable finance at the Bezos Earth Fund. “It’s like a fight to the death. It needs to be a little bit more of a cooperative posture.”

While speaking Monday at the GreenFin 24 conference in New York, Bodnar pointed to coal mining as an industry that’s created livelihoods and generated taxes that communities depend on — as well as investments.

Bodnar’s comments follow those of executives including KKR & Co. co-founder Henry Kravis, who said last week that climate activists underestimate the difficulty of shifting the economy to clean energy. “They don’t understand the facts,” he said after activists interrupted his speech to criticize KKR’s fossil-fuel investments.

In an interview after his presentation, Bodnar said green activism has been framed as a struggle between good and bad. “The narrative to some extent is the old economy is evil and the green economy of the future is wonderful and there’s nothing in between,” he said.

Instead, there needs to be a “social compact” that recognizes that while high-polluting assets need to be retired, they also produce cheap energy for many people and have been an engine of development, he said.

As the world seeks to expedite the transition away from fossil fuels to meet climate goals, it needs to be done “in a way that minimizes value destruction for workers, communities and investors,” he said.

“The more we make it into a battle between left and right or good and evil, the more friction we’re introducing into the energy transition,” Bodnar said.

Bodnar said some parts of the US are experimenting with rate-payer backed bond securitization programs, where power companies work with public utility commissions to retire coal plants early and establish agreements to deliver green electricity. These programs can save money for rate payers and tax payers alike, he said.

Meanwhile, some in the finance industry wrongly consider projects that focus on adapting to climate change such as water pumps, air conditioning and wildfire analytics as a “line item in a government budget,” Bodnar said. These businesses represent “the next wave of climate investment that you’re going to see products designed around,” Bodnar said.

“It’s a little bit of a blind spot for capital markets today,” he said.

Bodnar previously worked in the Obama administration as a special assistant to the former president and a senior director for energy and climate change at the National Security Council. Before that, he worked at the US State Department as a lead negotiator for climate finance.

Bodnar’s comments come as efforts to shift away from fossil fuels have been stymied by Russia’s attack on Ukraine and increasing power demands tied to artificial intelligence.

Green energy stocks, as measured by the iShares Global Clean Energy fund, have slumped almost 60% from the peak levels of 2021. The decline has occurred as high interest rates, soaring prices for raw materials and persistent supply-chain challenges have hurt the wind and solar industries. At the same time, sales of electric vehicles have slowed as higher borrowing costs weigh on consumers. This week, EV maker Fisker Inc. filed for bankruptcy.

(Adds comment from Bodnar in fifth paragraph.)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GB Energy Faces New Doubts as UK Declines to Affirm Future Funds

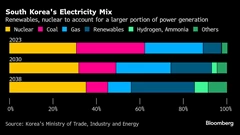

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands

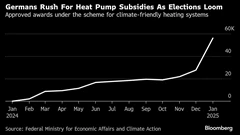

Germany Set to Scale Down Climate Ambitions