First Solar Fights Foreign Subsidies While Cashing In on Its Own

(Bloomberg) -- Long before panel-maker First Solar Inc. asked the US to penalize rival imports it says illegally benefit from foreign subsidies, the company began receiving similar incentives from some of the same countries.

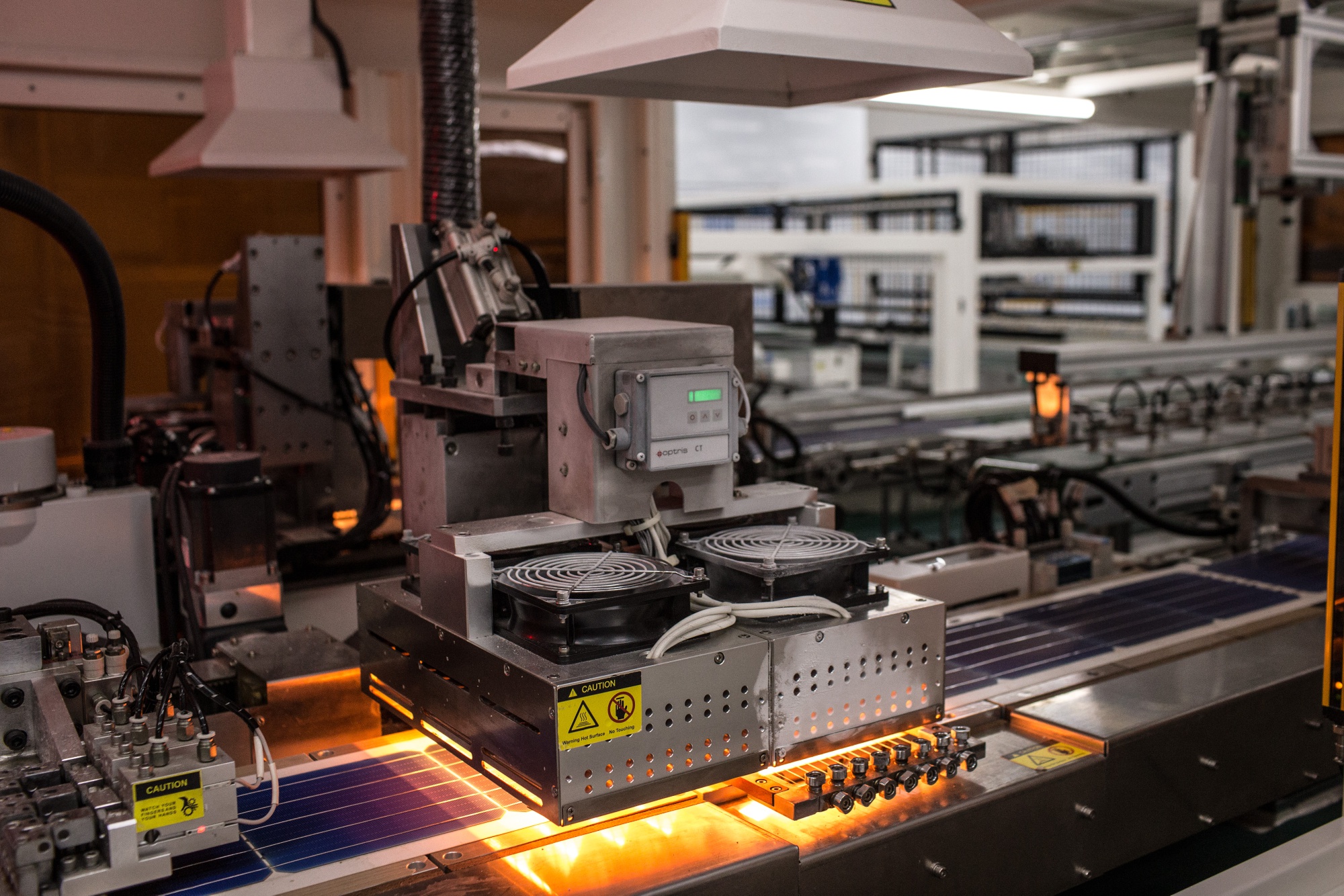

America’s biggest solar manufacturer — which in April joined other companies seeking tariffs on solar cells from Cambodia, Malaysia, Thailand and Vietnam — has for 16 years reported a tax holiday awarded to its Malaysian subsidiary in US regulatory disclosures. The perk “generally provides for a full exemption from Malaysian income tax” and expires in 2027, according to a May filing.

First Solar’s Vietnamese subsidiary, meanwhile, benefits from government incentives that lower its tax bill from the typical 20% corporate rate — including zeroing it out completely through 2023. In the May filing, First Solar said the incentive will reduce its corporate rate to 5% through 2032 and 10% through 2036.

The fact that First Solar is asking for tariffs while receiving foreign subsidies of its own highlights the complexities of global solar supply chains at a time when the US and other countries are trying to jump start domestic manufacturing. It also cuts to a core issue in the high-stakes US trade investigation of solar imports: At what point are government subsidies unlawful?

“It’s a classic ‘Do as we say, not as we do’ kind of situation,” said Alex Schaefer, a partner at Crowell and Moring LLP who represents Illuminate USA, a joint panel-making venture in Ohio between Chicago-based renewable developer Invenergy LLC and China’s LONGi Green Energy Technology Co. “On the one hand, they’re wringing their hands and complaining about the unfair leg up that their competitors are getting by virtue of these programs.” But on the other, they’re “taking advantage of those same programs.”

First Solar and its allies say Chinese companies with factories in the four Southeast Asian countries are using subsidies to flood the US with cheap equipment and crush the competition. First Solar doesn’t dispute that it — like other American manufacturers — benefits from tax holidays in Malaysia and Vietnam. The difference, said executive vice president Jason Dymbort, is that First Solar doesn’t sell its foreign-made panels below production cost and some of its competitors do.

“There is an essential distinction between imports sold at a fair price — which First Solar does — and imports that are dumped,” like those “from Malaysia and Vietnam manufactured by Chinese companies,” Dymbort said by email.

First Solar and the other members of the American Alliance for Solar Manufacturing Trade Committee — including Hanwha Qcells USA Inc. and REC Silicon ASA — have identified a handful of tax incentives offered by the Malaysian and Vietnamese governments they say warrant countervailing duties. The targeted incentives include a five-year, 70% exemption on corporate income taxes in Malaysia for companies that win “pioneer status” classification under a 1986 policy. The benefit grows to 100% over 10 years for “strategic” projects. Under another targeted initiative, manufacturers located in special Malaysian economic zones can secure a 15-year, 100% exemption.

The committee notes that Chinese companies Jinko Solar Co. and JA Solar Holdings Co. have cited “favorable incentives as a reason for opening new manufacturing facilities” in Malaysia.

The committee’s complaint also outlines a host of income tax preferences offered by the government of Vietnam to solar manufacturers and other industries, including reductions of up to 50%.

Under US trade law, foreign subsidies can be countered with duties when they constitute a specific financial contribution to a company that benefits the production or export of merchandise, as long as domestic companies show they have been harmed — or could be — as a result.

In a preliminary determination June 7, the US International Trade Commission already said it found reasonable evidence that domestic solar manufacturers were being hurt by cheap photovoltaic cells and modules imported from the four Southeast Asian countries. The government probe could lead to the imposition of initial countervailing duties on imports in as little as three months.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GB Energy Faces New Doubts as UK Declines to Affirm Future Funds

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands

Germany Set to Scale Down Climate Ambitions