World’s Largest Nuclear Plant Sits Idle While Energy Needs Soar

(Bloomberg) -- 日本語版: 世界最大の原発、柏崎刈羽再稼働で軋轢-エネルギー問題緩和期待も

On Japan’s windy western coast, in a region known for heavy snowfall and sake brewing, the world’s largest nuclear plant sits idle.

The Kashiwazaki Kariwa Nuclear Power Plant, a sprawling 4.2-million square meter complex by the sea, was once the crown jewel in Japan’s strategy to boost atomic power to 50% of the country’s energy mix by 2030. Inside, a framed certificate from Guinness World Records acknowledges the facility’s potential output of 8.2 gigawatts as the most globally.

Right now that output — enough to power more than 13 million households — is zero. The seven reactors at KK, as the facility is known, were shuttered after the 2011 tsunami and meltdown at the Fukushima Dai-Ichi plant in eastern Japan that prompted the government to rethink its dependence on nuclear energy.

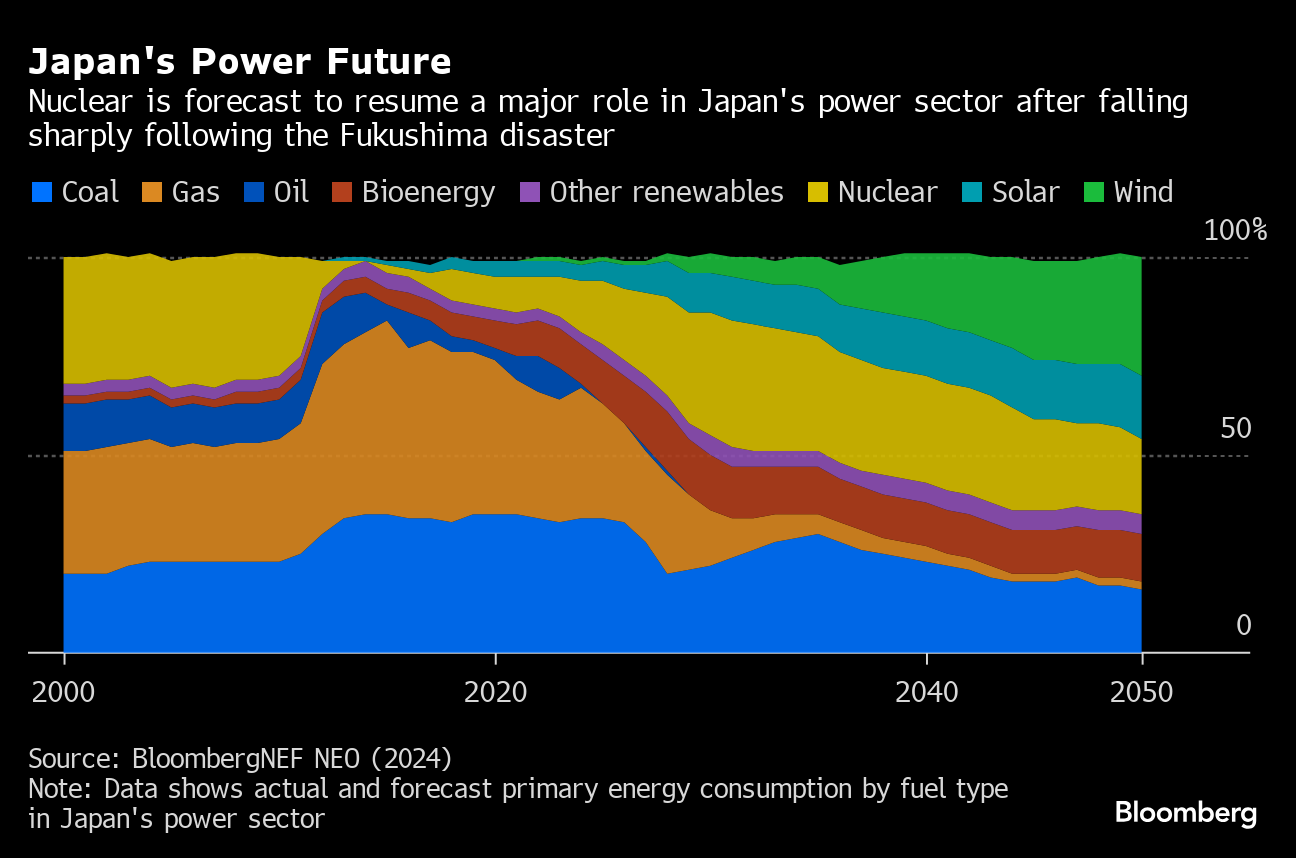

That decision is proving costly: resource-poor Japan spends more money importing coal, liquefied natural gas and other energy sources — about 27 trillion yen ($172 billion) last year — than it makes exporting cars. Japanese households and businesses have been pressed to conserve power during peak-demand periods. And the country’s stubborn reliance on fossil fuels threatens to put its promises to address climate change out of reach.

Now, with the country looking to boost the economy by courting chip makers like Taiwan Semiconductor Manufacturing Co. and energy-hungry AI data centers, a debate is heating up over whether KK and its owner, Tokyo Electric Power Co. — the operator during the Fukushima disaster — deserve a second chance.

It’s not just Japan taking a renewed look at nuclear: In one scenario, the International Atomic Energy Agency forecasts that capacity to generate electricity from nuclear plants could rise 24% by 2030 and 140% by 2050 from 2022 levels. At least 15 countries are building new reactors, led by China, which has 24 under development, BloombergNEF said in an April report. India wants to triple its nuclear capacity by the early 2030s. Even oil giant Saudi Arabia is in talks with the US about building out its civilian nuclear program.

None have a facility like KK.

“It’s very important for Japan to be able to count on Kashiwazaki Kariwa again,” Rafael Mariano Grossi, director general of the IAEA, said in a March interview in Tokyo. “How many countries have that idle capacity? Many countries wish they just had it.”

Yet restarting idled reactors — let alone building news ones — is proving politically difficult. Nuclear plants can provide carbon-free power consistently, unlike more intermittent wind and solar, but new facilities often take more than a decade to build and they generate waste that remains hazardous for thousands of years.

In 2017, two idled reactors at KK won approval from the nation’s nuclear regulator to resume operations, yet neither the company nor the national government set a date on when that could happen since they have yet to secure the local government’s endorsement. The regional assembly for Niigata prefecture, where KK is based, is slated to meet next month and will likely consider whether to support a restart.

The stalemate comes just as Prime Minister Fumio Kishida’s government embarks on a major review of its energy strategy, a process that takes place at least every three years and involves a panel of company executives, academics, politicians and industry groups. Members will debate a target for the share of electricity generation from nuclear plants, and likely consider complaints that Japan isn’t doing enough to boost clean energy.

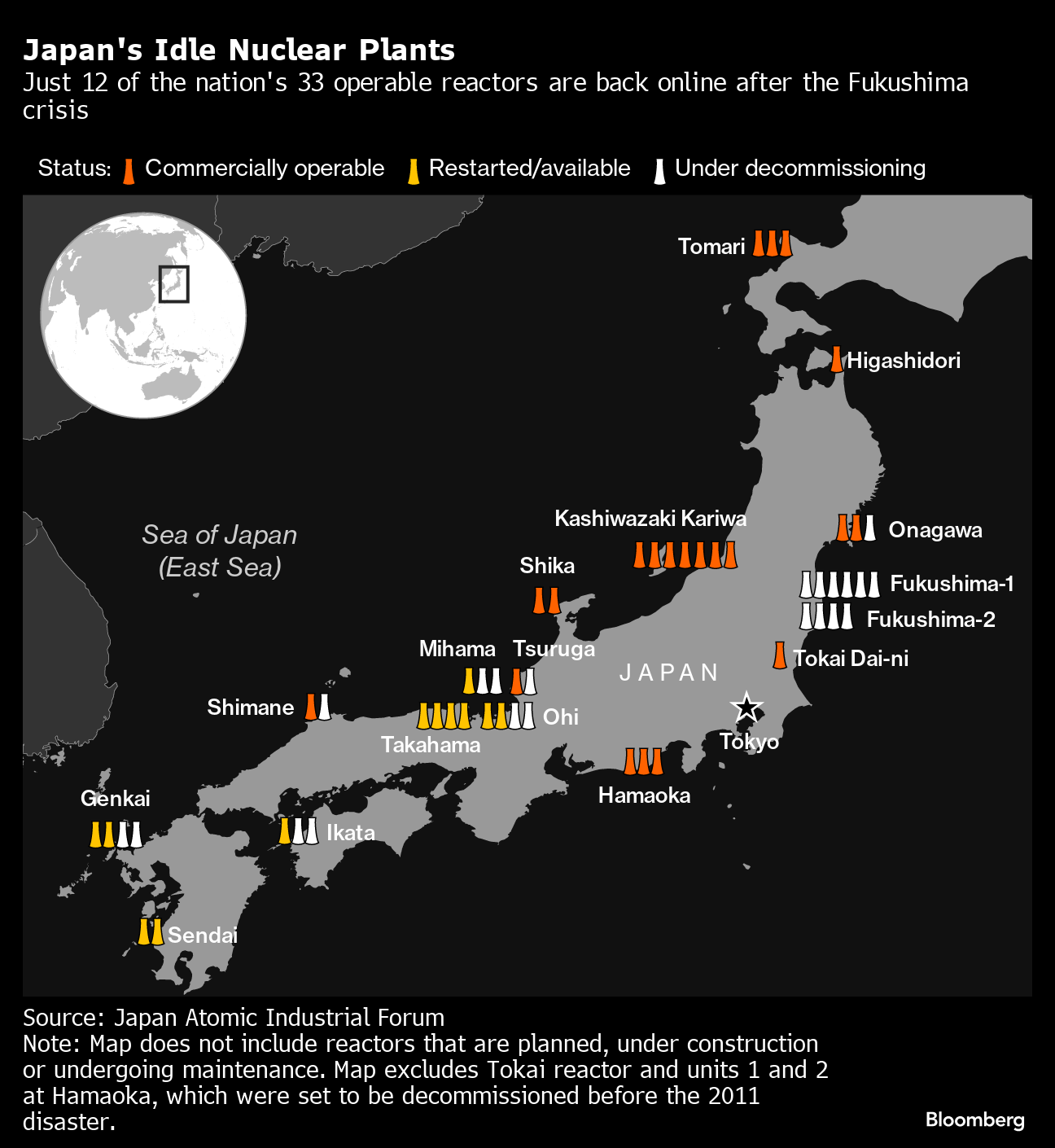

There’s little argument that Japan needs a new way to power its $4.1 trillion economy. Russia’s invasion of Ukraine and conflicts in the Middle East have underscored the risks of depending on imported energy, which Japan relies on for 70% of its electricity generation. Meanwhile, 21 nuclear reactors around the country sit unused.

“We need to secure a stable electricity source for our customers — it’s important to have some source that’s not dependent on overseas fuel imports,” Tepco President Tomoaki Kobayakawa told reporters in April.

While Japan has restarted other nuclear reactors — 12 since 2011 — restarting anything at KK, under Tepco’s management, carries a potent symbolism.

Confidence in Tepco was undermined in 2007 when a magnitude-6.8 earthquake damaged KK, causing radioactive material to leak and leading to an investigation by the IAEA. The company responded by reinforcing the reactor buildings, among other measures.

The Fukushima disaster four years later delivered a bigger blow. The company failed to cool the facility’s reactors after a shutdown sparked by the earthquake and tsunami, causing a release of radiation. More than 150,000 people were displaced and some areas remain inaccessible. The incident is considered the world’s worst nuclear disaster since the 1986 Chernobyl meltdown, with a total cleanup cost pegged at about 23 trillion yen.

Then in 2021, the nuclear regulator temporarily barred Tepco from operating KK after security lapses, including when an employee used a badge of another staff member to enter the central control room. Authorities lifted that ban in December.

The company says it has addressed safety concerns. Its website lists eight ways it’s working to make KK “the world’s safest nuclear power plant.” They include erecting 15-meter-high (49-feet) seawalls and flood barriers, building a reservoir to hold 20,000 tons of water — the equivalent of 30 Olympic-sized pools — to help cool reactors in an emergency.

Despite that, safety fears surfaced again this year when a magnitude-7.6 tremor struck the nearby Noto Peninsula on New Year’s Day. While KK was minimally affected, local officials say the episode raised red flags.

“After the January 1 quake, we saw how difficult evacuations can be,” Niigata assembly member Ryugo Tsuchida said in an interview. He argues nuclear power has no place in such a seismically-active country. Niigata Governor Hideyo Hanazumi and other local leaders have called on Tokyo to pay for road upgrades in case evacuations are needed.

Even with new safety measures in place, residents in Niigata don’t have much to gain from restarting KK. Electricity for the prefecture is generated by a different utility company, Tohoku Electric Power Co. If KK resumes, the energy it produces would benefit customers in Tokyo, more than 200 kilometers away, while local residents would bear the risks.

Before Fukushima, many rural municipalities in Japan were persuaded to accept nuclear plants because of subsidies from the national government. Those payments offered a financial buffer against the depopulation trend plaguing rural Japan as the country ages and younger people flock to bigger cities.

Many local leaders are now rethinking that tradeoff.

Sitting in his office in Kashiwazaki City with a view of the snow-capped mountains, Mayor Masahiro Sakurai — who will have to decide whether to formally endorse a restart — offers some backing for the proposal.

“I’ve never been in the camp of actively promoting the use of nuclear power, but I’m of the stance that we should accept its use” until alternatives, potentially including offshore wind, can play a bigger role, he said. Sakurai favors two of KK’s seven reactors resuming and has called on Tepco to consider decommissioning the rest, citing the risks of having so many in one location.

Yet even if KK and all of Japan’s other shuttered nuclear facilities are restarted, that would only provide a temporary salve. The country needs all 10 reactors awaiting regulatory approval to come online just to meet its current 2030 target of having 20%-22% of its energy come from nuclear, BNEF analysts including Mariko O’Neil wrote in a Feb. 1 report. And most of those reactors will have a limited lifespan.

“Half the current fleet is set to reach the end of its operational license within the decade,’’ according to the report. “The government will have to do more than just accelerate its restart program if nuclear power is to play a role in Japan’s long-term, low-carbon energy future.”

Japan’s electricity utilities agree that entirely new reactors are needed. The sector’s main industry group, the Federation of Electric Power Companies of Japan, in April called for a clearer policy from Kishida’s government to help guide investments.

Legally, idled reactors need to meet new, post-Fukushima safety standards and win the nuclear regulator’s approval to restart. But politically, companies like Tepco typically seek out the consent of the prefecture’s governor and assembly, and citizen lawsuits or protests can slow that down.

Takaaki Sasaguchi, whose 125-year-old sake brewery stands on the outskirts of Niigata’s biggest city, served as mayor of the small town of Maki, where Tohoku Electric had planned to build a nuclear power plant. Sasaguchi secured a public referendum which overwhelmingly rejected the proposal. Tohoku scrapped the project in 2003.

Sasaguchi said Niigata’s residents should have the same right to vote on KK’s restart.

If the plant goes back into operation, “it will impact the lives of all the Niigata residents,” the 76-year-old said. “A governor alone can’t make a decision on such an important issue, nor can the prefectural assembly.”

But momentum seems to be building.

Investors are already positioning for nuclear’s revival. Tohoku Electric jumped the most since 2013 on Tuesday on prospects for its Onagawa No. 2 reactor to resume, while Kyushu Electric Power Co. raised 30 billion yen amid strong demand for the nation’s first environmental bond tied to the financing of atomic power projects.

Japan’s trade ministry — which oversees the country’s energy policy — dispatched a high-ranking official in March to speak with Niigata Governor Hanazumi about a restart. And Tepco has loaded nuclear fuel into unit 7 at KK.

Analyzing previous reactor restarts in Japan, BNEF forecasts that Tepco could resume operations at KK’s No. 7 reactor in October. For now, there’s still no official target date.

The saga with KK highlights the delicate balance many nations face, trying to juggle concerns about health and safety with national energy demands and climate change targets. Another dramatic incident like Fukushima could deal a devastating blow to efforts to get additional nuclear power online and set climate change targets back further.

Back at his office in Kashiwazaki, Mayor Sakurai acknowledges the pros and cons of seeing at least some of KK’s reactors restart.

“Of course there are concerns about radiation from potential accidents,” the 62-year-old said. “But there are real threats from climate change — from death by heatstroke and floods and wildfires. Nuclear is still necessary to combat this.”

©2024 Bloomberg L.P.