Shortages Hobble India Push for Cleaner Car Fuel Amid Delhi Smog

(Bloomberg) --

India is cutting back its supply of cheap gas for vehicles as it struggles to cope with domestic production shortages, a move that could add to toxic air woes in major cities including New Delhi.

Supply constraints have left retailers like Indraprastha Gas Ltd. and Mahanagar Gas Ltd. increasingly reliant on more expensive imports — or costly production from new Indian fields, which have proven more technically challenging. Both have begun to raise prices for compressed natural gas, or CNG, which powers cars, buses, taxis and rickshaws across India.

New Delhi, one of the world’s most polluted cities, was pushed into CNG well over two decades ago after a Supreme Court ruling that demanded the conversion of all public buses to cope with worsening air quality. It later banned all non-CNG cabs in the capital region. While the fuel is not entirely “green,” it does emit fewer smog-related pollutants and has a slightly lower carbon footprint than conventional alternatives.

Now, as the city lives through some of the most toxic smog days on record, proponents fear that consumers previously attracted by low running costs may begin to look more closely at the disadvantages, including long queues at filling stations and fewer models to choose from.

“This may deter the adoption of CNG vehicles and could even lead to a shift back to diesel and petrol, undermining efforts to promote cleaner transportation options,” said Amit Bhatt, managing director for India at the International Council on Clean Transportation.

CNG vehicles have proven popular with India’s price-sensitive consumers, surging more than 13-fold between 2019 and now. Sales of vehicles powered by diesel and gasoline have fallen by 20% and 13%, respectively, during that period, according to data compiled by the transport ministry.

“We need differential pricing policy to incentivize cleaner fuels and disincentivize polluting fuels,” said Anumita Roychowdhury, executive director at the Centre for Science and Environment.

With its limited low-cost gas funneled to industrial use, India’s deliveries to retailers have been cut by as much as 40%, according to exchange filings by the companies. That fuel, from older fields, is currently priced at $6.5 per million British thermal units — against about $10 for new local fields and $13 to $14 per mmbtu for imports.

Mahanagar Gas has said it will explore options as it tries to ensure stability for its price-sensitive customers, but scarcity has already pushed prices for some areas up by more than 2% this week. Further increases will be necessary to maintain margins, analysts say.

India wants to increase the role of gas in the energy mix, and the government has announced plans to significantly increase the number of CNG stations across the country over the current decade from roughly 7,000 today, mostly in the north and west. That target may now be at risk.

“The move also doesn’t gel with the government’s aim to almost triple the compressed natural gas station network in the country by 2030,” said Sabri Hazarika, analyst with Emkay Global Financial Services Ltd.

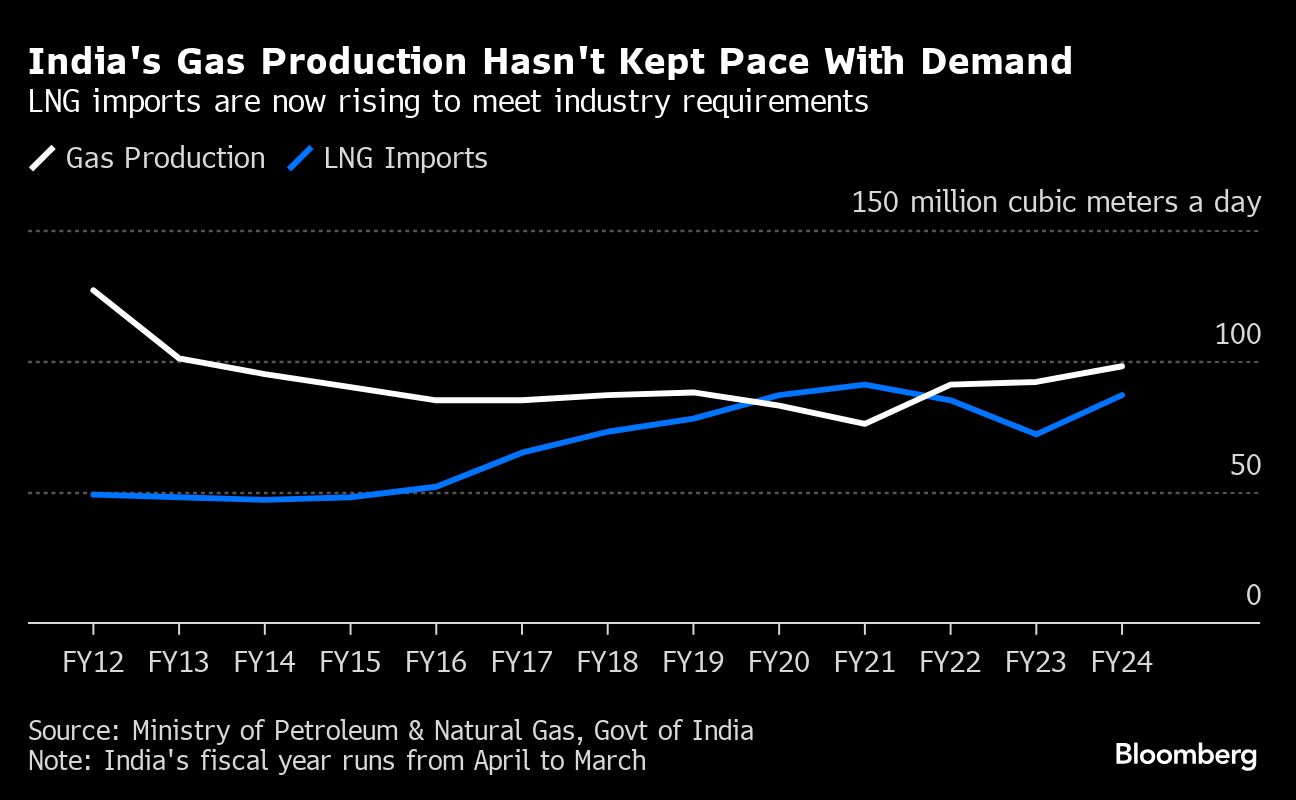

The underlying problem is the paucity of India’s homegrown output, which has not kept pace with a growing economy. Daily gas production has risen only about 3% in the decade through March, while consumption has jumped 30%, according to the oil ministry.

That has been felt by consumers, with CNG prices in Delhi rising 73% since 2021. Gasoline is up just 13% and diesel has increased by close to a fifth, shrinking the price gap between gas and conventional fuels.

“Lower prices have been working in our favor, despite long waiting times at fuel stations,” said Sukhdeep Singh, a taxi driver who was getting fuel for his car at a CNG outlet in New Delhi. “But if our costs jump without any commensurate increase in passenger fares, it will make life really very difficult for us.”

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Masdar closes deal to acquire Terna Energy

Namibia Says EU Initiative’s Delay Affects Green-Bond Plans

China’s EV Boom Threatens to Push Gasoline Demand Off a Cliff

TotalEnergies accelerates decarbonisation of its platform at La Mède

SolarEdge Is Cutting 12% of Its Staff After $1 Billion Writedown

Bhutan Studying Green Financing for $23 Billion Hydropower Plan

Australia Says It Is On Track to Meet 2030 Emissions Cut Targets

TotalEnergies, bp, Equinor and Shell join forces to help increase access to energy

Cyclone-Prone Malawi Eyes First Energy Storage to Bolster Grid

EV Battery Maker Calls for Cheaper EU Energy to Counter China

Watch/Listen

Enhancing efficiency and accelerating decarbonisation through AI and digital innovation

China’s natural gas market: transitioning amid renewable goals and carbon neutrality

Nabors: transforming drilling and rig operations with digitalisation