Colombia Races for US Climate Funds But Has China as Back Up

(Bloomberg) -- Colombia is hurrying to land a deal with the US that would unlock the first tranches of cash for a $40 billion climate investment plan before Donald Trump takes office. If that push fails, then China could be an option.

Susana Muhamad, Colombia’s climate minister, said she would go to Washington in the coming weeks to try and secure initial finance for an ambitious strategy to overhaul her country’s fossil fuel-based economy in favor of green investments. The outlook for the deal is now more complicated that Trump won this month’s election, she said.

It’s a race against time for the package, which mimics the Just Energy Transition Partnerships (JETPs) that have been signed between rich and developing countries, with a goal of speeding up the move away from fossil fuels. Colombia is looking for as much as $10 billion to come from international financial institutions and developed countries. The move may set a template for other countries looking to transition away from fossil fuels.

Colombia’s investment plan is aimed at replacing fossil-fuel export revenues that are expected to decline after the country ended new oil and gas exploration two years ago. The country will look for other sources of finance — including from China — if the talks in the US fail to deliver, according to Muhamad. President Gustavo Petro has made the climate transition a key pillar of his administration.

“If we’re not able to close a deal now for Colombia in the next six months, then the chances the plan survives depends on the next elections and then the uncertainty kicks in,” she said in an interview at the COP29 climate summit. Colombia has elections due by 2026. “President Petro has asked us to start talking to China. Colombia will be looking north, south, east and west.”

China wouldn’t rule out investing in Colombia’s plan, but would need a mechanism to do so in line with broader climate finance negotiations, according to a person familiar with the matter. China doesn’t see itself as the first to fill gaps left by the US, the person added.

Colombia is just one of the countries currently scrambling to lock in climate commitments from the US in the two months before Trump takes office. At the Organization for Economic Co-operation and Development, the Biden administration is making a last-ditch push for an international agreement restricting export-credit agency financing of foreign oil and gas projects, supporting an initial proposal made by the European Union.

Role of Banks

It’s also unclear how Trump sees the US role in various multilateral development banks for which it is one of the major shareholders, such as the Inter-American Development Bank, which is marshalling Colombia’s climate finance plan. The US is playing an informal role as the main coordinator.

All of this feeds into larger fears that climate finance is starting to dry up. Negotiators in Baku are trying to reach a deal at COP29 to significantly scale up the amount of funds the rich world provides to poorer nations to help them transition and protect their economies from the impacts of climate change. Developing countries have said wealthy nations have been slow to deliver on past funding promises.

Listen on Zero: Colombia’s Plan to Quit Fossil Fuels

While a number of countries have JETP programs in the billions of dollars, the system designed to provide a financing model for the future has been beset by delays and political turbulence. Colombia’s plan is seen as one example of how that process can be improved upon, mainly by recipient countries outlining their exact needs so investors have clear projects to put money toward. Other countries, like the Philippines, are also weighing similar investor friendly approaches.

Colombia is among 13 countries that have endorsed the Fossil Fuel Nonproliferation Treaty, which calls for ending the expansion of new fossil-fuel projects — something scientists say is necessary to meet global climate goals.

Still, the country is taking a risk and failure would send a stark signal to other fossil-fuel producing countries that are keen to accelerate their green transitions.

Already Colombia’s economy has struggled after investment fell dramatically across sectors last year and gross domestic product grew less than 1%.

“We are putting a high bet forward,” Muhamad said. “This change in politics can create a delay and hinder the process.”

(Updates with China comments on financing deal in the sixth paragraph.)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GB Energy Faces Doubts as UK Declines to Affirm Future Funds

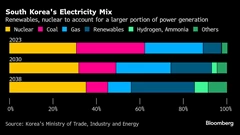

Korea Cancels Planned Reactor After Impeaching Pro-Nuke Leader

Brazil’s Net-Zero Transition Will Cost $6 Trillion by 2050, BNEF Says

SolarEdge Climbs 40% as Revenue Beat Prompts Short Covering

EU to Set Aside Funds to Protect Undersea Cables from Sabotage

China Revamps Power Market Rules In Challenge to Renewables Boom

KKR increases stake in Enilive with additional €587.5 million investment

TotalEnergies and Air Liquide partner to develop green hydrogen projects in the Netherlands

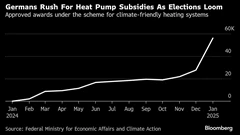

Germany Set to Scale Down Climate Ambitions