A Rush for Greener Offices in Asia Is Leaving Hong Kong Behind

(Bloomberg) -- A lack of green offices is posing a fresh risk to Hong Kong’s beleaguered property sector amid a slump that’s already wiped billions of dollars from real estate values.

Faced with record vacancy rates and dwindling revenues, developers are reluctant to invest in expensive building upgrades to boost climate credentials and are as a result falling behind competing financial centers across Asia — just as demand picks up for more sustainable office space.

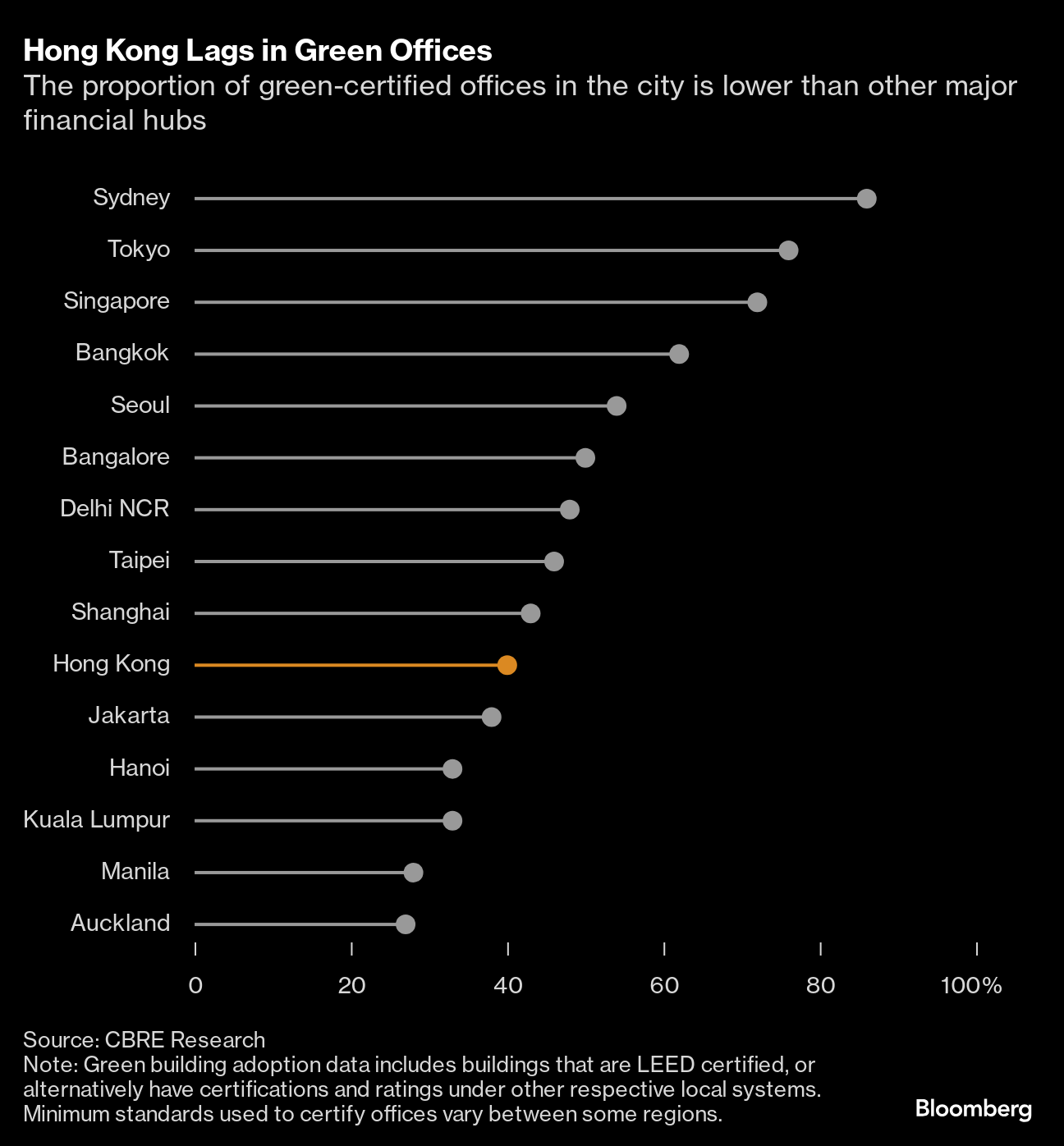

Only 40% of Hong Kong’s premium office spaces are green-certified, compared with more than 70% in Singapore, Sydney and Tokyo, according to real estate consultancy firm CBRE Group Inc. Evaluated by global or local rating systems, the buildings are typically assessed on criteria including energy and water efficiency.

The slow pace of that transition has implications for Hong Kong including the risk of “losing its competitive edge as a leading business hub in Asia,” said Andrew Lau, ESG director at real estate consultant Colliers International Group Inc. Though he has warned clients that temperature increases could mean parts of some existing buildings become unlettable within five years, they are still reluctant to make changes. Already on one occasion he witnessed bank staff spraying water on air-conditioning units during summer to cool them, he said.

With companies increasingly prioritizing sustainability in their operations, cities offering greener office spaces are getting more attention, Lau said. “This shift could lead to a talent and investment drain from Hong Kong to other cities that are more proactive in this area.”

About nine in 10 commercial real estate occupiers in Asia are targeting 100% green-certified portfolios by 2030, according to real estate consultancy firm Jones Lang LaSalle Inc. Some occupiers may even be willing to pay a rental premium for office spaces which use clean energy and eco-friendly construction materials.

But in Hong Kong, where property tycoons are reeling from elevated interest rates, poor economic sentiment and changing work habits, developers are putting off costly green upgrades.

Mounting construction and financing costs have developers “questioning the value of investing capital in greening aged buildings,” said Ada Choi, head of Asia research at CBRE. “Both the real estate industry and policymakers have to make extra efforts to boost the city’s competitiveness against its regional counterparts.”

Buildings are responsible for about 40% of global emissions — through construction materials like steel or cement, and energy consumption — and upgrading them is crucial to reducing pollution. As firms race to cut down their environmental impact, they are investing in greener structures to achieve commitments on climate change.

Singapore, which rivals Hong Kong as Asia’s premier business destination, is making faster progress. The city has set several targets to achieve by 2030, including the greening of 80% of its building space, and ensuring 80% of new developments meet stricter standards on lowering energy consumption.

As a result, there are over 4,200 green-certified buildings in Singapore compared with over 3,200 such buildings in Hong Kong, according to data from technology firm ESGpedia.

To spur building upgrades in Hong Kong, more regulations are needed, and the city needs to consider mandating developers to disclose energy performance of buildings, said Helen Amos, head of sustainability at JLL. Such rules, which have long existed in Singapore, Australia and Europe, would allow tenants to make better leasing decisions, she said.

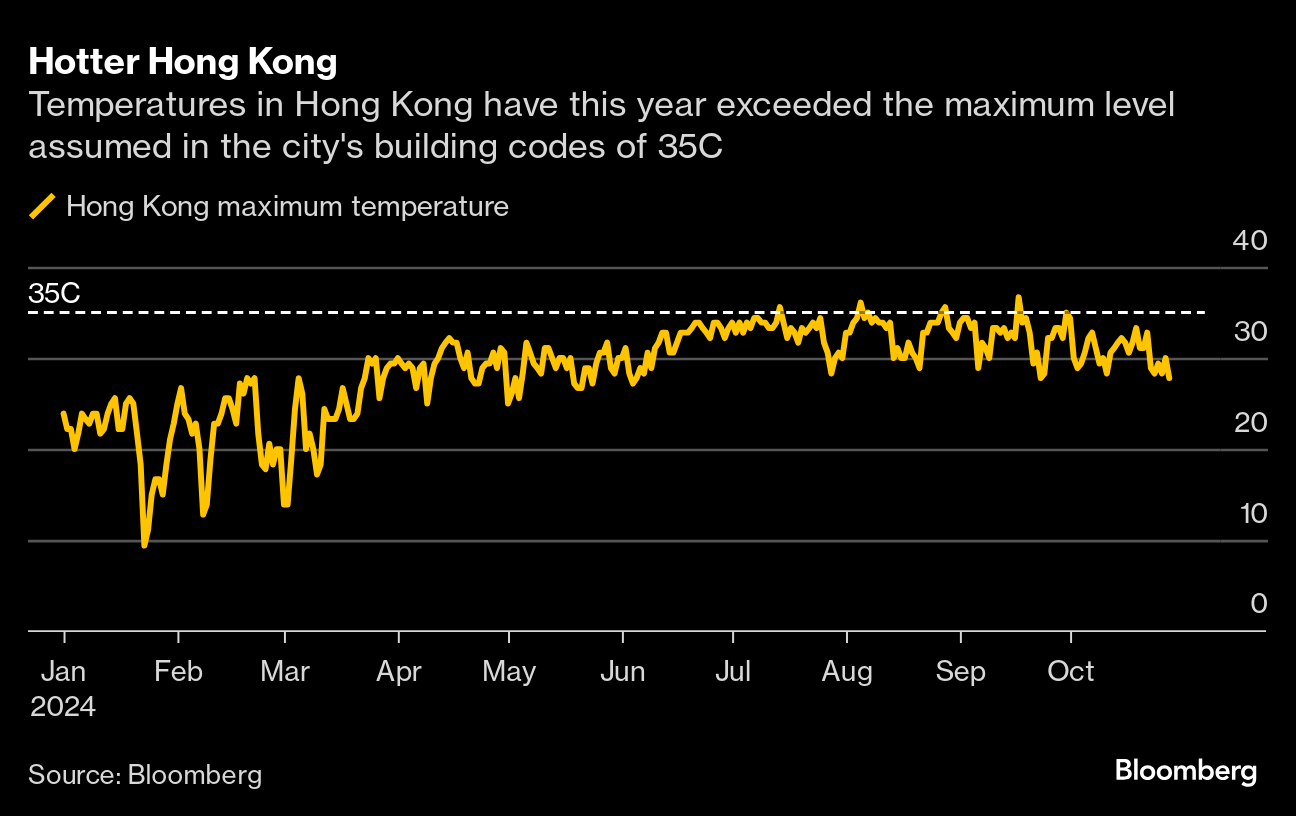

In addition, Hong Kong’s building code assumes a maximum outdoor temperatures of 35C (95F), a level which has been surpassed on several occasions this year. The city recorded its hottest summer on record last year, and its temperature in March this year reached the highest in 140 years.

The government is planning to amend its building energy efficiency ordinance, a government spokesperson said in an emailed statement, without providing a specific timeline. Changes could include mandating the disclosure of certain energy-related information and shortening the interval of energy audits.

Some developers in the city are seeking to lure tenants with greener developments. Airside, a new project built at the site of Hong Kong’s former airport, boasts of energy and water efficiency benefits. It’s also the first building in Hong Kong to receive seven green and smart building certifications. The project, owned by Nan Fung Group, has solar panels and a 6,000 square feet (557 square meter) urban farm. Tenants include MUFG Bank Ltd. and AIA Group Ltd.

Less than a year since its opening, Airside has leased 70% of its office space, the developer said. “Airside’s strong leasing momentum underscores the market’s recognition of the group’s leadership in sustainable development and smart office solutions,” said Nan Fung’s executive director Billy Hui.

Similarly, a new skyscraper by Henderson Land Development Co. has installed efficient systems for energy conservation and water consumption. The Henderson has attracted global tenants such as auction house Christie’s, which opened new regional headquarters at the site in September.

The building supports the firm’s “global commitment to conducting business responsibly,” said Christie’s Asia Pacific president Francis Belin.

©2024 Bloomberg L.P.