Tourist Investors Are Ditching Climate Tech for AI

(Bloomberg) -- Generalist investors’ rush into buzzier artificial intelligence has added to funding woes for climate-tech startups at just about the worst time for an industry racing to combat the effects of climate change.

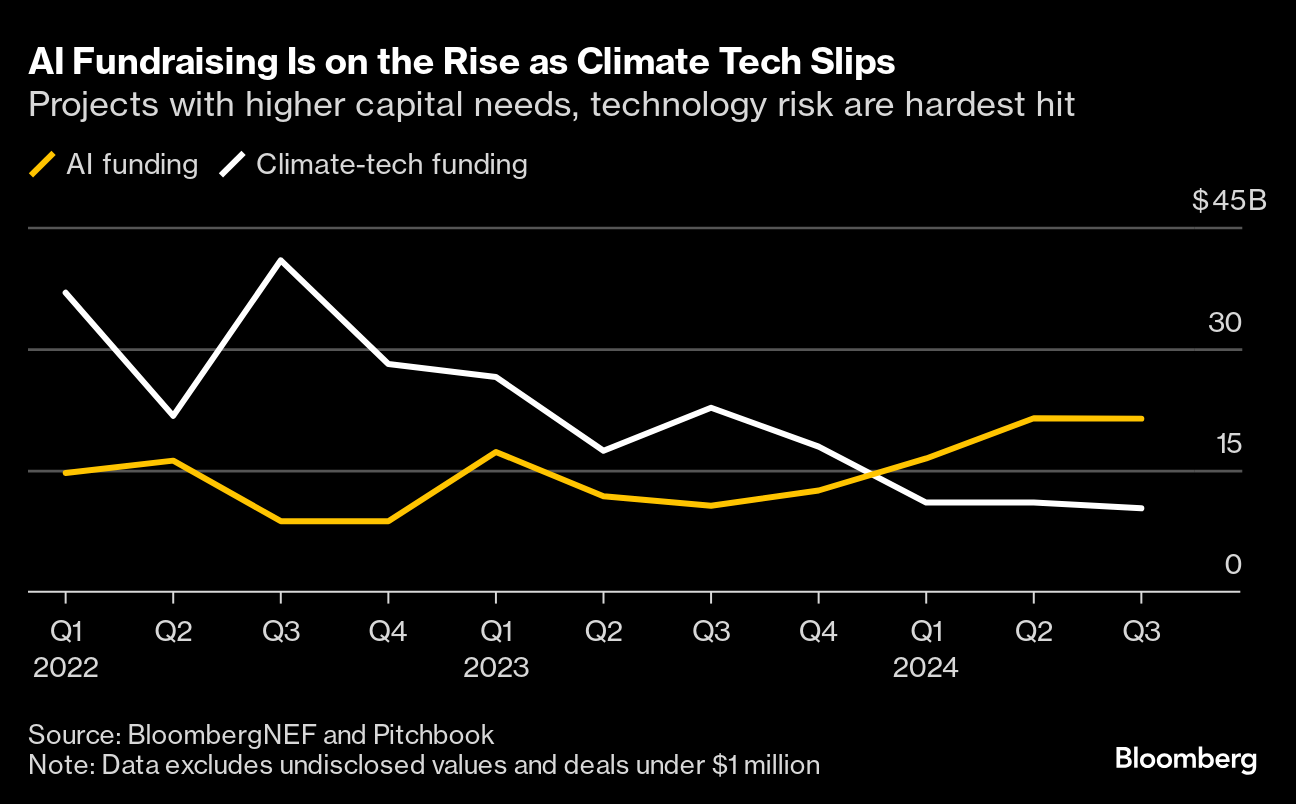

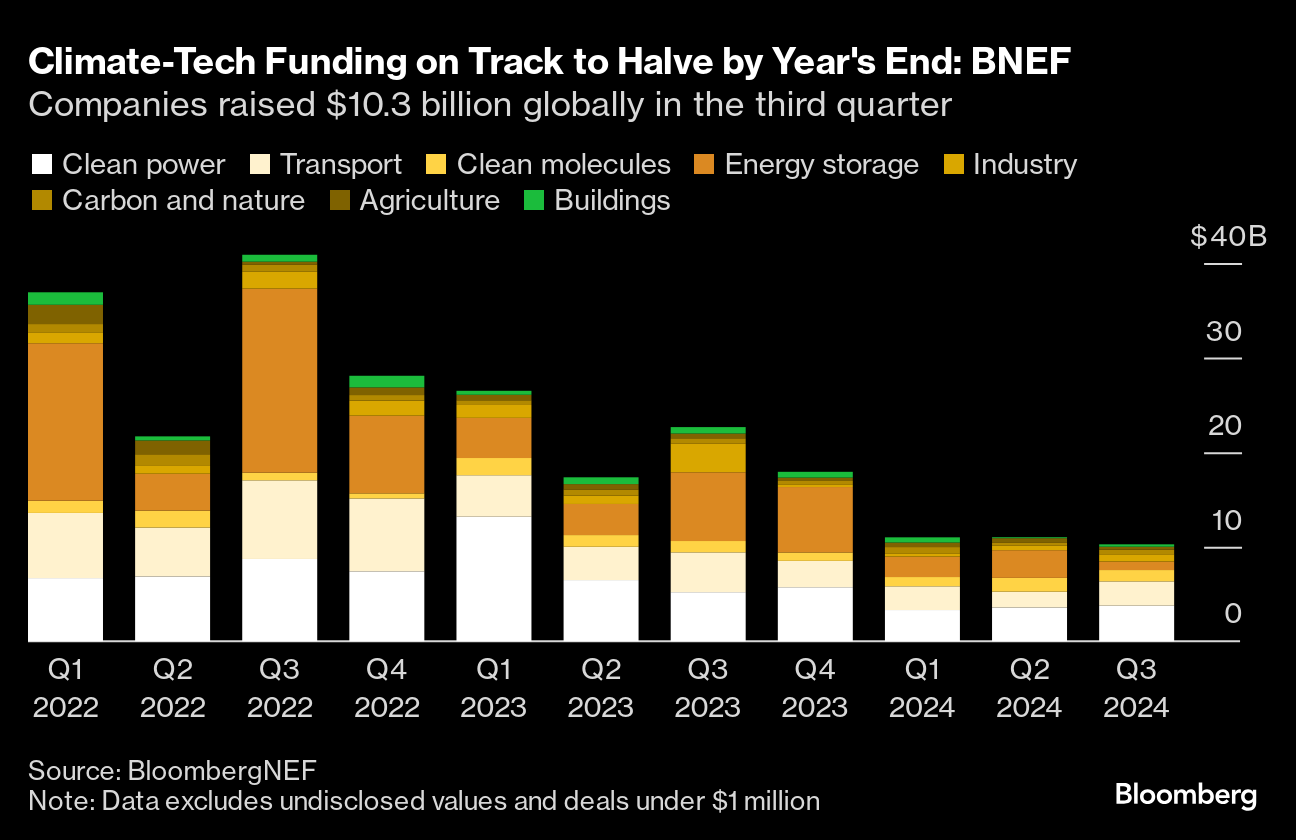

Globally, climate-tech companies raised roughly $10.3 billion in equity across public and private markets in the third quarter, putting full-year funding on track to fall about 50% this year, data from BloombergNEF show. Meanwhile, capital for AI has climbed, with startups in that space raising more than $21 billion in the quarter, Pitchbook estimates.

It’s not just competition from AI that’s impacting climate-tech funding, which began inching lower even before the generative AI frenzy in 2023 amid high interest rates, elevated inflation and geopolitical upheaval. Still, it’s a contributing factor, and a slowdown in funding for climate tech at such a critical time for the nascent sector could have irreversible consequences. The opportunity for limiting the catastrophic impacts of climate change was already shrinking, underscoring the need to speed spending on novel climate technology. Now, with AI threatening to keep fossil fuels online for longer, there’s even less room for error.

Related: AI Data Center Energy Needs Are Straining Global Power Systems

“The best science indicates that we have a narrow window through which to operate, but that we have to do it fast,” environmentalist and author Bill McKibben said at a pre-election event in Rhinebeck, New York. The very near-term future, especially the outcome of the upcoming presidential election in the US, is “the last meaningful chance we have to really intervene.”

Part of the reason some investors are stepping back is the fact that a lot of climate-tech startups are either already in or approaching the most capital-intensive, hardware-focused stages of development. Commercializing never-before deployed technologies is expensive and risky, unless favorable policy support can help bring down costs and drive demand.

Scaling AI requires infrastructure buildout and capital investment, too, but it doesn’t necessarily ask of its investors the same appetite for technology risk as climate tech, which is still relatively immature with more than a few unknowns. Some AI companies, meanwhile, are generating billions of dollars in revenue, making the sector an appealing investment for generalist VCs looking for a clearer path to profitability.

“We know how to build a data center,” said tech billionaire and OpenAI backer Vinod Khosla. The same cannot be said for some early-stage climate technologies like , which remains years away from the market,still in the early stages of deployment — though both could see more interest as investors seek opportunities to meet the intense energy demands for AI.

Because the climate-tech sector is such a diverse industry — spanning everything from carbon sequestration and energy storage to decarbonizing steelmaking and breeding drought-resistant crops — not all corners have been impacted to the same degree. The standout climate companies with solid unit economics, strong demand and a clear path to commercial success are still raising big rounds. Iron-air battery startup Form Energy Inc., for one, just raised a rare argeted funds whose explicit mission is addressing climate change are also still quite active in the space, added Kim Zou, co-founder and chief executive officer of market intelligence firm Sightline Climate, noting that it’s more the “tourist investors” who are transitioning away.

Enthusiasm for climate-related AI and software companies has also been building, said Andrew Sparks, a partner at Goodwin and co-chair of the law firm’s climate technology practice. That’s likely because they’re less capital-intensive than companies attempting to build, say, a greener concrete factory.

“Sometimes that’s a little bit of an easier pitch, so those companies have seen a lot of interest,” he said.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Danish Investor Raises €12 Billion for Renewable Energy Fund

What It Will Take for Rich Countries to Reach Net Zero: You

Bill Gates’ Climate Group Lays Off US and Europe Policy Teams

Trump’s EPA Takes Aim at Biden Curbs on Power Plant Pollution

Deals Seeking $45 Billion in Climate Funds Seen Managing US Exit

TotalEnergies and RWE join forces on green hydrogen to decarbonise the Leuna refinery

Shale Pioneer Sheffield Warns Oil Chiefs of Grim Times Ahead

Investors Learn Brutal Lesson From Sweden’s Wind Farm Woes

RFK Jr. Pressed by Farm and Food Groups to Use ‘Sound’ Science