Weak Carbon Prices in Oil-Sands’ Home Seen Slowing Climate Gains

(Bloomberg) -- Falling prices for carbon credits in the Canadian province of Alberta are threatening to become a drag on efforts to slash emissions from the oil industry, the country’s top source of greenhouse gases.

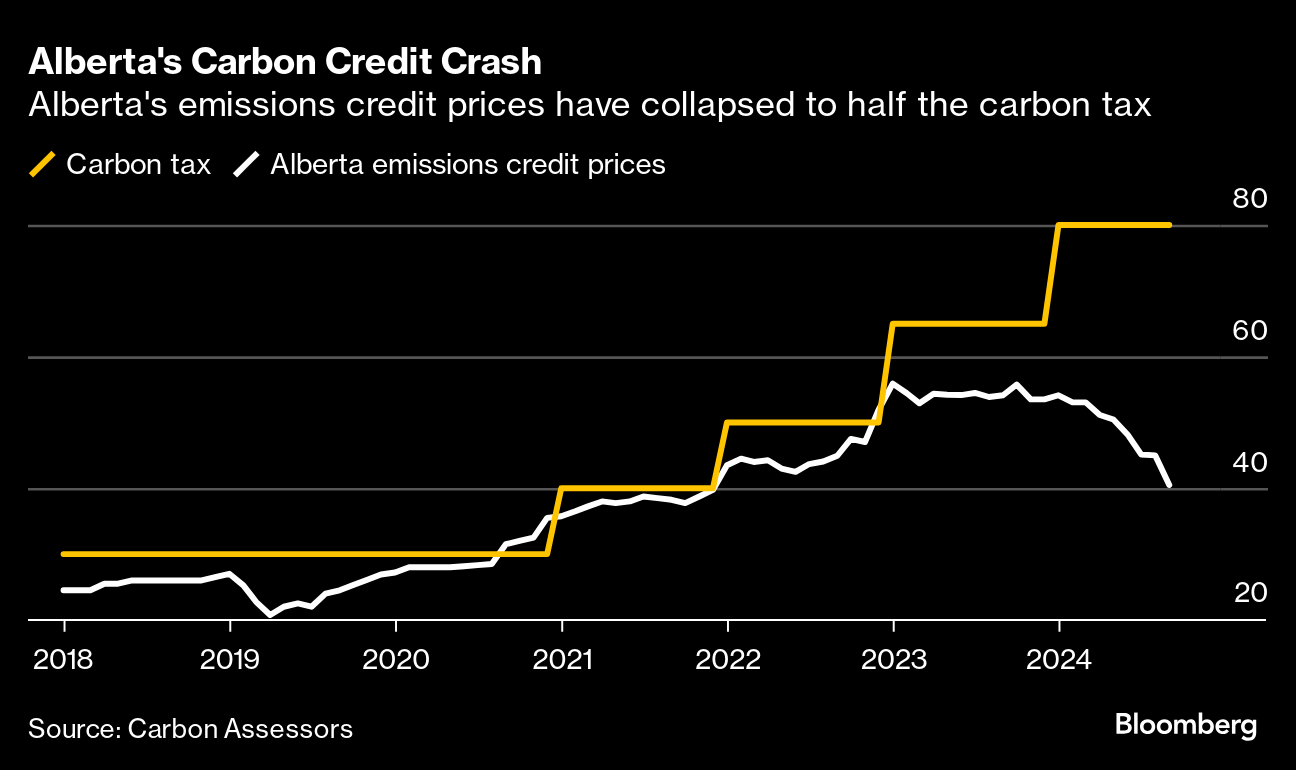

Credits and offsets in Alberta’s carbon market are trading at about C$40 per metric ton, half of the effective industrial carbon tax price of C$80 per ton, said Albert Ho, manager of the TIER business line at Carbon Assessors, a price tracker.

The weak carbon-credit prices — caused by factors ranging from early successes slashing emissions to Prime Minister Justin Trudeau’s uncertain political future — threaten a key source of revenue that companies rely on for costly decarbonization projects. That’s already making some companies more cautious in proceeding with such ventures and casting doubt on Canada’s ability to meet its climate targets. The oil and gas sector —dominated by Alberta’s oil sands — was Canada’s largest greenhouse gas emitter in 2022, accounting for about 31% of the nation’s emissions.

“The payout term on many of these projects is years,” Russell Graham, president of Trido Energy Services Inc., said of companies’ decarbonization initiatives. “Not having clarity on pricing or policy going forward adds another level of uncertainty and puts up another barrier.”

Alberta’s carbon credit market — called the Technology Innovation and Emissions Reduction, or TIER, program — applies to industrial facilities that emit greenhouse gases equivalent to at least 100,000 metric tons of carbon dioxide a year or that import more than 10,000 tons of hydrogen a year, since the imported fuel’s production typically results in emissions elsewhere.

Each June, those companies can pay into a TIER fund at a price that follows the mandated federal carbon tax or use credits they have bought or accumulated to meet their obligations. The credits can be held for five to eight years, depending on their vintage.

Credit prices steadily rose in pace with the tax until early 2023, then leveled off at about C$55 before declining even as the tax has risen, Carbon Assessors’ Ho said.

While the federal carbon price is set to continue rising to C$170 ($125) a ton by 2030, the price of TIER credits is being depressed by the risks that Alberta won’t adhere to the scheduled carbon price increases or that more credits will be created than companies need to offset their emissions, said Grant Bishop, founder and self-professed chief nerd at KnightFork, an energy and carbon markets data start-up.

“There is concern that the future prices are going to be low,” Bishop said. “That resonates in present pricing.”

Whether the federal industrial carbon price will exist at all in the future has also been called into question. Canada must hold a federal election by next year at the latest, and recent political developments raise the possibility that may happen even sooner.

Polls show the Conservative Party of Canada is favored to win after almost nine years of Liberal rule in Ottawa under Trudeau. Conservative leader Pierre Poilievre has called for the carbon tax to be eliminated on consumers, but he has remained vague on the future of the carbon tax on industries.

“There are people waiting to get some clarity out of the federal Conservatives,” said Trido’s Graham, whose company helps firms reduce methane emissions in exchange for a percentage of the credits generated.

The risk to the carbon price has prompted oil-sands companies — which are planning a C$16.3 billion carbon capture system to slash their emissions — to seek contracts that would guarantee a minimum price to support their investment. But discussions have been slow, companies including Cenovus Energy Inc. have said. Earlier this year, Edmonton, Alberta-based Capital Power Corp. decided not to proceed with a carbon capture project because of poor economics.

Companies might want to cut emissions more than the 2% a year the TIER program generally requires because of the incentives or to help them comply with other federal regulations, KnightFork’s Bishop said. The required emissions benchmarks should be adjusted each year to keep pace with actual emissions cuts, he said.

Alberta’s TIER market will probably survive even if a future Canadian Conservative government eliminated the federal carbon price, the Bank of Montreal said in a report in November.

“However, the federal price on carbon, and therefore the fund price, would be risked,” the bank said. “If the fund price were lowered substantially, those holding inventory could see significant writedowns.”

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Uranium Fever Collides With Industry's Dark Past in Navajo Country

Colombia’s Bold Push to Go Green Has an Unintended Trade Off: Gas Imports

Constellation Energy Soars on $16.4 Billion Calpine Deal

In Hottest Year Ever, US Homes Used a Record Amount of Power to Keep Cool

Toxic Traces of Lead Mining in Missouri Are Hard to Erase

UK Power Prices Climb as Light Winds to Tighten Market on Friday

Verbund Says It Has $103 Billion Solution for Austria’s Malaise

UK Power Prices Skyrocket as Freezing Weather Tightens Market

US Nuclear Regulator Pursues ‘More Efficient’ Reactor Approvals