Blaze Triggers Alarm Over Rapid Growth of Big Batteries

(Bloomberg) -- A fire on a bucolic stretch of California coast has threatened the rapid growth of an industry considered key to greening the power grid — and keeping the lights on.

Midway through the afternoon of Jan. 16, flames erupted from one of America’s largest battery installations, next to an old power plant in the seaside hamlet of Moss Landing. The lithium-ion batteries, bigger versions of the devices that run laptops and electric cars, pumped a thick column of white and gray smoke into the sky and forced the evacuation of nearby homes. The fire, about 75 miles (121 kilometers) southeast of San Francisco, burned for five days.

Now, it has become a rallying cry for people alarmed to find battery installations being planned in their neighborhoods. Electric utilities have been deploying big batteries at breakneck speed, seeing them as a way to store renewable power for when it’s needed and prevent blackouts during heat waves. In the past, they rarely faced the public opposition that greets other energy infrastructure proposals, from pipelines to wind farms. But that has changed.

“The fire and the toxins have really got the neighborhood terrified, absolutely terrified,” said Claudia Greco of Marine Park, Brooklyn. Developer NineDot Energy plans two battery facilities on Flatbush Avenue, one of them next to her home. She’s part of a local effort to block the projects. “Not only are you in danger of immediate conflagration — fire — but the toxic over-spread of the gasses from these batteries, which are numerous, will spread over the entire neighborhood,” she said.

A spokesperson for Vistra Corp., which owns the burned Moss Landing facility, cautioned against drawing conclusions from the fire until its exact cause is known. But the blaze could lead to tighter state-level regulation. New York legislators are considering a bill that would require new battery facilities above a certain size to be at least 250 feet away from homes, schools and farms. California, the first US state to deploy grid-scale batteries in large numbers, may ban such facilities from being installed inside enclosed buildings.

Still, industry analysts don’t expect the fire and its backlash to stop the spread of big batteries, because utilities have powerful incentives to keep installing them. They’ve helped both California and Texas endure blistering heat waves without rolling blackouts, and they’ve reined in wholesale power prices during periods of high demand. But future battery proposals could require more community engagement with potential neighbors and local officials. And not all will win approval.

“We consider this more of a hurdle than a hill,” said Timothy Fox, managing director of the ClearView Energy Partners research firm.

Nor is the backlash the biggest threat facing the industry. President Donald Trump’s tariffs could hit US battery installations hard, because the country remains heavily dependent on foreign-made cells. Almost 70% of imported lithium-ion batteries come from China, a key focus of his trade war.

Advocates of the technology note that new battery installations use a very different chemistry than the one at Moss Landing — a chemistry that is both cheaper and less prone to fires. The batteries that burned — made by LG Energy Solution — had nickel manganese cobalt (NMC) cells, whereas most new projects use lithium iron phosphate (LFP) batteries.

“That was a Gen-1 technology — that is not what we want to see,” said David Hochschild, chairman of the California Energy Commission, speaking at a BloombergNEF summit after the fire. “We’re totally focused on never having that happen again.”

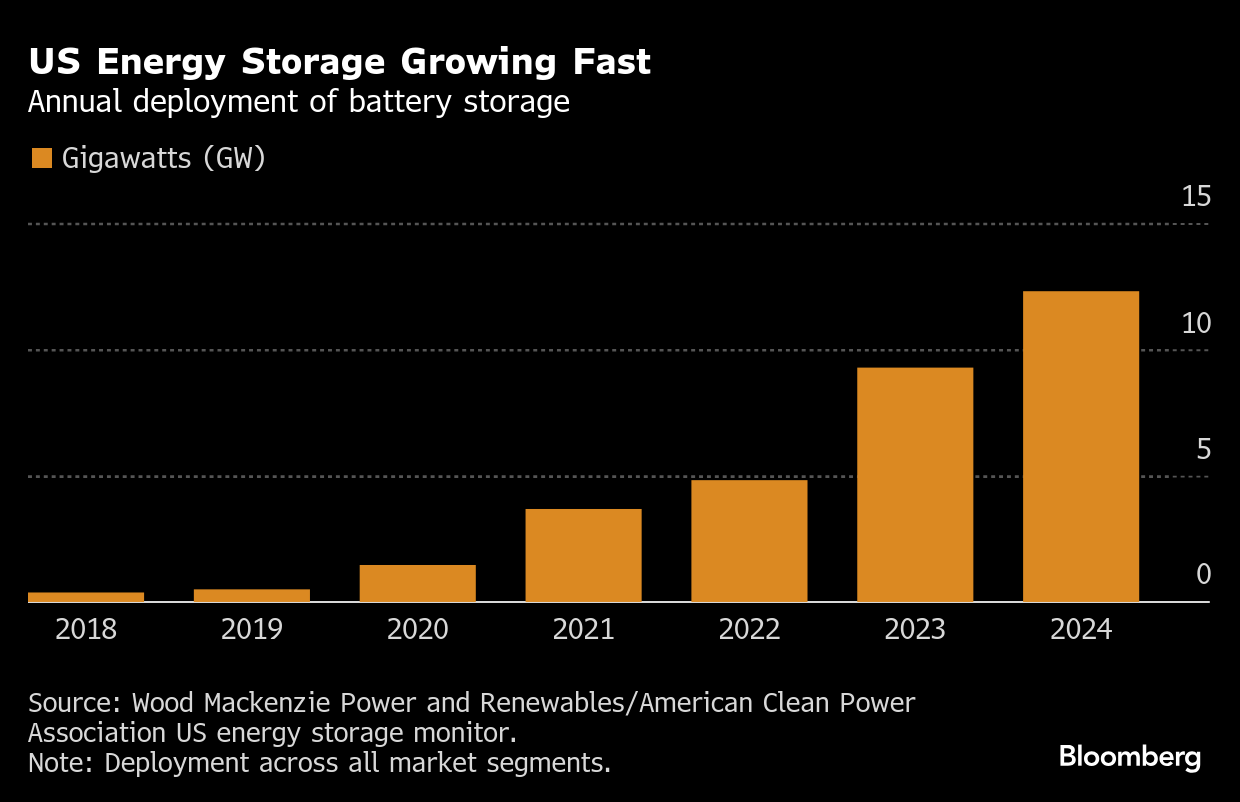

The market for large-scale batteries barely existed a decade ago but has quickly grown. Deployments across the US last year jumped 33% from the year before to 12.3 gigawatts, according to a report from Wood Mackenzie and the American Clean Power Association trade group. That’s enough electricity for more than 9 million homes, although most batteries can only supply power for four or five hours before recharging.

Sporadic fires plagued early battery installations but have become less common over time. The US experienced 27 fire-related incidents at battery facilities in the past decade, according to the Electric Power Research Institute. “That is a very small number compared to the hundreds of thousands of operating battery energy storage facilities, which are operating safely and reliably,” said Noah Roberts, vice president of energy storage at the American Clean Power Association.

Moss Landing, however, has suffered a series of fires and overheating incidents that date back to 2021, several caused by water accidentally being released from fire-suppression systems. The site features two battery storage facilities sitting side-by-side: one owned by power company Vistra, the other by California utility PG&E Corp. When fire erupted at the Vistra facility in January, engulfing batteries installed inside an old building, around 1,200 nearby residents fled their homes.

“The community has come together to say, ‘Hey, this is not OK,’” said Cheryl Robinson, 53, who has lived near the plant since 2001.

Robinson did not leave her home following the fires, staying put with her husband, daughter and birds, including two cockatoos. Since then, she’s been plagued by anxiety and headaches, and her husband’s asthma has worsened. She worries their property has been contaminated by chemicals falling out of the smoke. Volunteers took surface swipe samples from places beneath the fire’s smoke plume, had them tested and found elevated levels of lithium, cobalt, manganese and nickel.

“I don’t want to leave, and I don’t want to be forced to leave,” said Robinson, who has joined a group called Never Again Moss Landing to press for tighter safety requirements at battery facilities. “This is my kids’ generational wealth. I want them to have this house forever.”

A Vistra spokesperson said testing and analysis by local, state and federal agencies has found “no impact to the public health or local agriculture.” She said the facility’s technology was considered state-of-the-art when it was built five years ago.

“As with any industry, improvements in technology are based upon lessons learned, and Vistra and the entire industry will apply the lessons learned from this moving forward,” said Meranda Cohn, Vistra spokesperson, in an email.

California regulators in March adopted new standards that will require battery facility owners to develop comprehensive emergency response plans. And state Senator John Laird has introduced legislation that would require new facilities be inspected by local fire departments before opening, as well as prevent large battery systems from being installed inside enclosed buildings.

Greco and other residents of Brooklyn’s Marine Park see Moss Landing as a cautionary tale. Rosemarie Head said she’s sufficiently concerned about the risks that she’s thinking of selling her home on Hendrickson Street, near NineDot’s two planned facilities.

“I worked so hard to finally purchase a house, and here I am, going on 15 years, and now I have to worry about this,” said Head, 60, an executive assistant. “It keeps me up at nighttime.”

The New York legislation that would establish minimum distances between batteries and homes also would require at least one public hearing in the community involved before a project wins government approval. “When people purchase their property, they don’t purchase their property with a battery plant in their backyard,” said Democratic Assemblywoman Jaime R. Williams, who introduced the bill.

Brooklyn-based NineDot considers the fears misplaced. The company’s facilities will use Tesla Inc.’s Megapack batteries, which feature the safer, cheaper LFP chemistry rather than NMC. They will not be in an enclosed building that can catch on fire.

Adam Cohen, NineDot’s co-founder and chief technology officer, said the projects will help strengthen the local power grid, which was hit hard by 2012’s Superstorm Sandy. He sees Moss Landing as a relic, even though it opened in 2020. “Nobody would build a battery storage farm like that,” he said.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Khosla-Backed Energy Startup Nabs $258 Million to Help Power Data Centers

Plan to Green 30,000 Africa Buildings Seeks $150 Million Boost

Musk Buyouts Poised to Hit US’s $400 Billion Green Energy Bank

Spain’s Nuclear Shutdown Set to Test Renewables Success Story

How Climate Tech Investing Is Being Shaped by Trump’s Tariffs and Orders

China Announces Quartz Discovery Vital to Chips to Rival US Mine

Chinese Battery Makers See Tariff Pain Added to Domestic Woes

AI Data Center Growth Means More Coal and Gas Plants, IEA Says

Trump Signs Orders to Expand Coal Power, Invoking AI Boom