Germany Denounces Calls to Break-Up Power Market Into Zones

(Bloomberg) -- Germany pushed back against a proposal made by Europe’s grid operators to split its power market into five separate bidding zones, setting the stage for what could be a bitter fight with neighboring countries.

Entso-e, the umbrella organization of transmission system operators in the European Union, said in a report Monday that carving up the Germany-Luxembourg power market into five could bring as much as €339 million in annual savings. That’s equivalent to around 1% of the system costs for the Central European region, it said in the report.

Berlin was quick to criticize the findings, with a spokesperson for the government saying that the report “systematically overestimates the positive effects of bidding zone splitting.” They added that the findings are not legally binding and it was up to Germany to decide on how it proceeds.

“We remain committed to the single German-Luxembourg electricity bidding zone,” the spokesperson said.

Currently Germany is comprised of just one bidding zone allowing industry, located in the south, to access power production in the north at cheaper rates. Proponents of breaking up the market say that it would reduce bottlenecks in the grid system and provide better price signals for the build out of renewables in the south. Both the government and industry worry it could push up prices for a crucial sector.

Connected markets like Sweden have raised complaints that Germany’s sole bidding zone creates large swings in its own power market and is refusing to finalize a new power cable connecting the two countries until there’s reform.

Listen on Zero: How to Upgrade the World’s Biggest Machine

Germany will now have to persuade all neighboring countries within six months to unanimously reject the recommendation, or the issue will be elevated to the European Commission, according to Casimir Lorenz, a managing director at Aurora Energy Research. The EU’s executive branch would then have another six months to make a decision.

“Investment risk is rising,” he said in emailed comments. “Investors should prepare.”

Still, the grid operators highlighted a number of caveats like the initial costs of the changes may not be recouped until the mid-2030s. The report also said that the possible negative implications on market liquidity and transaction costs should also be assessed so that they do not outweigh the benefits.

“We are clearly in favor of a single price zone,” said Peter Reitz, chief executive officer of the European Energy Exchange, the world’s biggest power bourse. “Liquidity is a major asset that needs to be defended.”

There are also political considerations, including making sure that possible higher prices in some regions should not lead to closure of industries. There could also be knock-on effects for industrial consumers trying to access clean power, while the offshore wind sector may also face challenges, entso-e said in the report.

Germany’s energy industry lobby also criticized the proposal, saying that they would lead to “massive uncertainties” for industry and would harm the investment case for renewables.

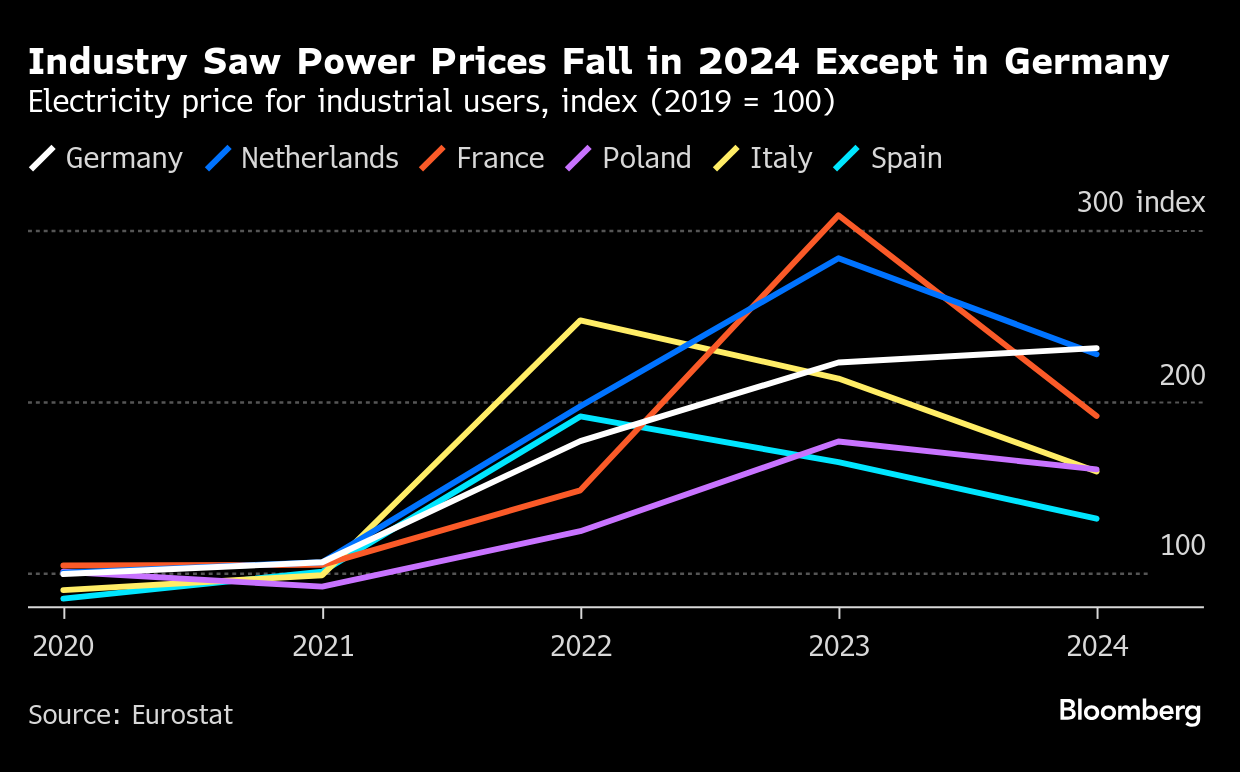

It “would turn the industrially strong regions in particular into high-price zones for electricity,” the lobby BDEW said in a statement. “Electricity costs, which are already very high by international standards, would be driven up even further, putting the companies based there at a considerable disadvantage and massively weakening their competitiveness.”

Germany’s new government, led by Friedrich Merz’s CDU/CSU bloc and the Social Democrats, has committed in its coalition agreement to maintaining the country’s single electricity price zone. Markus Söder, the CSU Prime Minister of Bavaria, reinforced this position last week, stating in a local newspaper Augsburger Allgemeine, that Germany will push this through despite concerns from the European Commission.

Despite the growth of low-cost renewables, electricity prices in Germany remain high because expensive gas-fired power plants often set the market price. Additionally, taxes and grid fees contribute to the costs paid by consumers and German industry, posing a significant challenge.

The think tank Agora Energiewende said that abolishing Germany’s uniform electricity price zone could lower electricity costs for most consumers and reduce distortions in grid operations.

(Adds further detail of Entso-e recommendation from fifth paragraph.)

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Chinese Solar Losses Deepen Even Before Worst of US Tariffs

Trump EPA Approves Sales of High-Ethanol E15 Gasoline for Summer

Want Solar Panels on Your Roof? How to Navigate Market and Tariff Chaos

New Danish Nuclear Power Fund Targets Raising €350 Million

US Green Steel Startup Raises $129 Million Amid Trump Tariff Uncertainty

Spain Signals Openness to Keeping Nuclear Power Plants Open

Musk Foundation-Backed XPRIZE Awards $100 Million for Carbon Removal

As Tesla Falters, These New EVs Are Picking Up the Pace

Fashion Is the Next Frontier for Clean Tech as Textile Waste Mounts