How Climate Tech Investing Is Being Shaped by Trump’s Tariffs and Orders

(Bloomberg) -- The last six months have given the US climate tech sector an extreme case of whiplash, yet venture funding to the industry is on the rise.

After having former President Joe Biden throwing billions of dollars at everything from green hydrogen to next-generation batteries, companies are now dealing with President Donald Trump, who is considering cutting or clawing back funding for carbon-cutting solutions. The tariffs are also adding a new barrier for companies that source materials from abroad while threatening to dampen demand for US technology in other countries.

Climate tech is figuring out how to navigate the chaos of the first three months of the Trump presidency. At least some venture capitalists see sectors that dovetail with the White House’s goals such as “energy dominance” and leading on artificial intelligence. And private tech funding is heading in the opposite direction of what might be expected under a president who’s been vocal about his disdain for electric vehicles, wind turbines and international climate agreements. These and other key trends are shaping the industry and how venture capitalists and startups are charting a course for the next four years.

Venture funding increases — for now

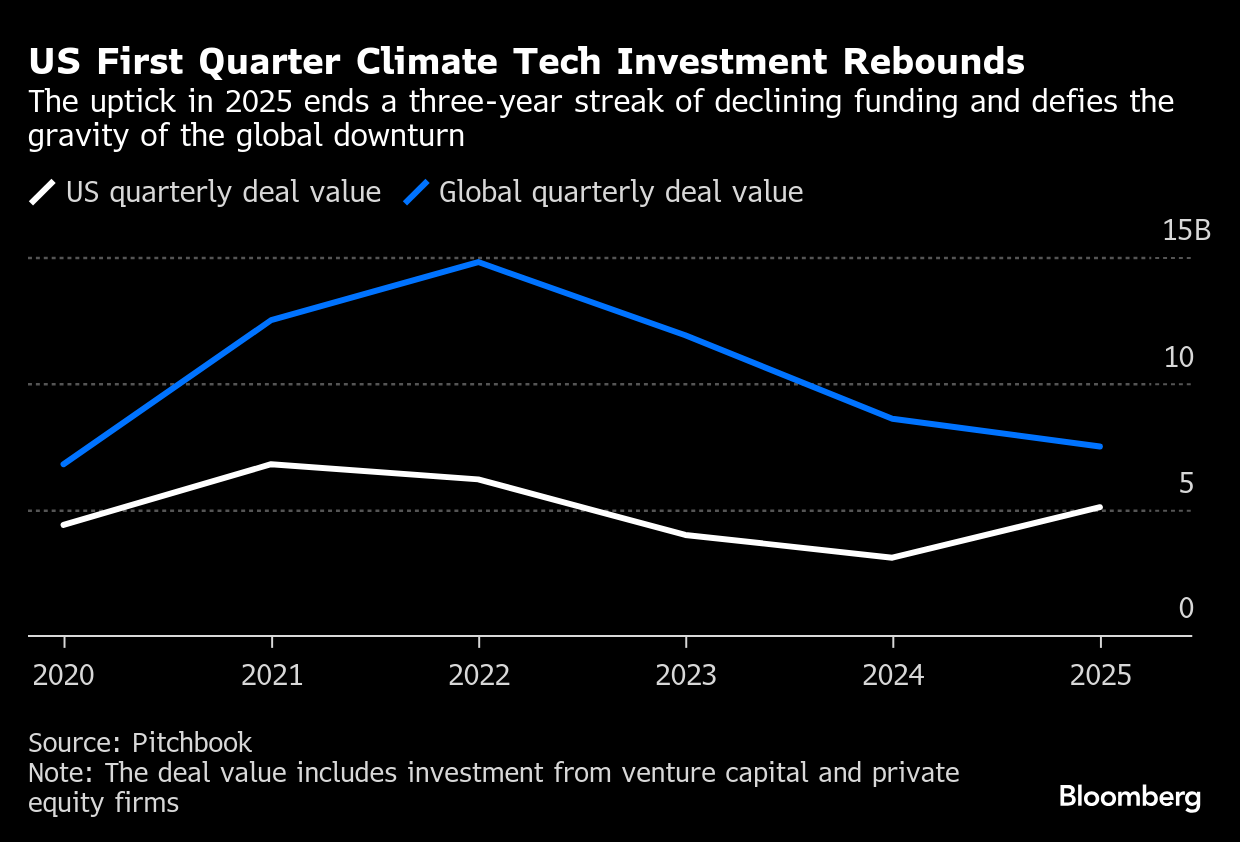

It’s no surprise that companies developing carbon-cutting technology and investors are feeling Trump’s impact. Yet in the first quarter of 2025, venture capitalists and private equity firms poured more than $5 billion into climate tech startups across the country, a nearly 65% uptick compared to a year ago, according to data from market intelligence firm PitchBook. That bucks the global trend in climate tech investing, which dropped 10% in the quarter. The rise in US investing ends a three-year streak of declines, though the investment total is still below the 2021 peak.

It remains to be seen whether the upward trend in the US will be sustained. Many investors took a wait-and-see approach to the election, and the first quarter surge may just be them playing catch-up after a year on the sidelines.

But history shows continued investment isn’t out of the question. During Trump’s first term, the US was locked in a years-long trade war with China, a top producer of solar panels, wind turbines and electric vehicles. That trade tension, coupled with a zero-interest rate environment, motivated investors to back homegrown solutions – so much so that US climate tech investments more than tripled from $4.2 billion in 2017 to $14.1 billion in 2020, according to Pitchbook data.

The sectors most likely to strive and struggle

As Trump has pledged to restore America’s manufacturing capacity, startups whose technology not only cuts emissions but also helps improve industrial production efficiency are “getting a lot of much-needed tailwinds,” says Rajesh Swaminathan, a partner at Khosla Ventures. With the administration’s tariffs making imports more expensive, it is creating “an opportunity” for startups to build next-generation factories in the US.

Some of Trump’s cabinet appointees have also said they support some zero-carbon technologies. Energy Secretary Chris Wright has vowed to launch an “American nuclear renaissance,” and touted a mature geothermal industry as a way to “better energize our country.” (Wright, a former fracking executive, has also been very vocal about the benefits of fossil fuel use, though.)

Swaminathan has long urged policymakers and fellow investors to support both sectors. His firm has backed geothermal startup AltaRock Energy and nuclear fusion pioneer Commonwealth Fusion Systems, and see the technologies as key to decarbonizing power generation, particularly as artificial intelligence increases demand for baseload power.

As data centers strain global power systems, a growing number of tech companies from Microsoft Corp. to Alphabet Inc.’s Google have teamed up with geothermal and nuclear energy producers to secure future electricity supply.

The AI boom is also boosting demand for technologies that enable data centers to operate with less energy or strengthen grid infrastructure. “The AI super cycle that we’re in makes me very bullish about 2025,” says Micah Kotch, a partner at Blackhorn Ventures, who invests in software companies.

That said, AI bubble fears reflect at least some investor uncertainty over the technology as a whole.

Other sectors are likely to face challenges if the Trump administration and Congressional Republicans move forward with rolling back parts of the Inflation Reduction Act. The law was a key part of the Biden administration’s vision to grow American clean manufacturing capabilities and aid the burgeoning climate tech industry by providing billions in support.

Green hydrogen and direct air capture — both of which largely rely on government incentives as they attempt to get off the ground — are areas where investors are treading cautiously. The Trump administration is weighing closing the Energy Department office overseeing hubs that would support those technologies, though the hydrogen hubs may be kept “as is.”

Government support is likely to wane

The government also provides support through programs such as the Energy Department’s Loan Programs Office (LPO), which went into hibernation during Trump’s first term before making a flurry of multi-billion-dollar investments in clean tech under former President Joe Biden.

In Santa Clara, California, sodium-ion battery maker Natron Energy Inc. applied for a big loan to help finance a planned $1.4 billion North Carolina gigafactory.

“We had positive feedback all of last year,” says Wendell Brooks, the company’s chief executive officer. Then the administration turned over, and Trump placed a 90-day moratorium on the disbursement of certain funding under the IRA and Infrastructure Investment and Jobs Act. Now, the fate of a potentially game-changing loan for the battery company is up in the air.

“We are the poster child for what should be a Trump era LPO loan if there is one,” Brooks says, citing the company’s creating American jobs and a China-free supply chain. While private loans are an option, Brooks says a government loan would be “much more attractive” due to its lower interest rate.

That’s the problem facing many startups trying to bring their products and services to the mass market, says Sophie Bakalar, a partner at Collaborative Fund. If IRA incentives and government funding vanishes, “I don’t know who is going to be building these big climate projects over the next few years,” Bakalar says. “There’s going to be a pretty sizable gap” that equity funding alone can’t fill.

Clean tech is rebranding

Companies are increasingly talking less about climate change. For some startups, they’re going a step further and trying to speak Trump’s language. Texas-based geothermal company Bedrock Energy, recently changed the wording in some brochures to de-emphasize “net zero” and “clean energy.” Instead, it emphasizes “energy abundance,” says CEO and co-founder Joselyn Lai.

Other companies are also pitching their wares harder to the defense industry, which is expected to flourish under the Trump administration. Take Eos Energy Enterprises Inc., a publicly listed energy storage company based in Edison, New Jersey. To appeal to the defense sector, the company emphasizes the safety and security of its zinc-based energy storage system. The batteries are made in the US and compliant with Defense Department procurement rules, which CEO Joe Mastrangelo says is a key part of Eos’s sales pitch.

The approach appears to be working. In March, Eos secured an $8 million contract with the Naval Base of San Diego, in addition to a previous order serving Marine Corps Base Camp Pendleton.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Musk Buyouts Poised to Hit US’s $400 Billion Green Energy Bank

Spain’s Nuclear Shutdown Set to Test Renewables Success Story

China Announces Quartz Discovery Vital to Chips to Rival US Mine

Chinese Battery Makers See Tariff Pain Added to Domestic Woes

AI Data Center Growth Means More Coal and Gas Plants, IEA Says

Trump Signs Orders to Expand Coal Power, Invoking AI Boom

Clean Power Offers Safety to China Investors Rattled by Tariffs

US Solar’s Hoarding Habit Will Help Blunt Sting From Trump Tariffs

Trump Team Proposes Ending Clean Energy Office, Cutting Billions