Spain’s Nuclear Shutdown Set to Test Renewables Success Story

(Bloomberg) -- Spain is ignoring calls to reconsider its nuclear decommissioning plans, betting renewables and battery storage will make up for the upcoming energy shortfall.

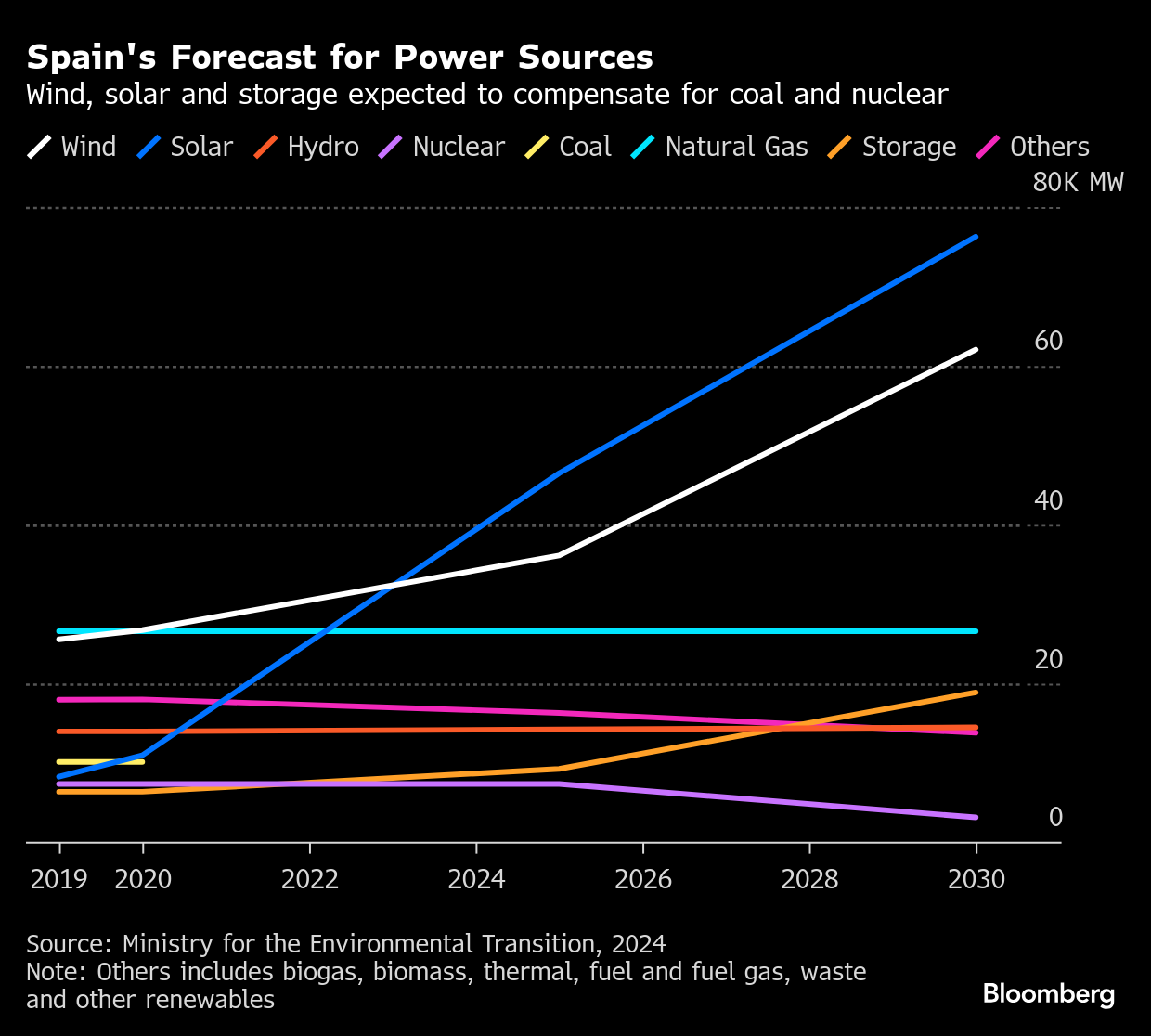

The country is plowing ahead with plans to shut down its seven nuclear reactors, which currently contribute 20% of its power mix, over the next decade. It’s also set to close its last coal plant this year.

While it’s already only second to Germany in terms of renewable capacity in Europe, Spain is looking to fill the energy gap with more wind turbines, solar panels and giant batteries.

The strategy isn’t completely fossil fuel free — as it would rely on natural gas plants as a backup for the foreseeable future. Yet it is a substantial wager on clean power: It depends on a still nascent energy storage industry in Spain to rapidly expand from just 3 gigawatts of capacity today to a target of 20 gigawatts by 2030. It also requires an unprecedented roll-out of wind and solar over the next five years. Spain is targeting 81% power generation from renewables by the end of this decade — from just above 50% in the past two years.

“Spain is a postcard, a glimpse into the future where you’re not going to need baseload generators from 8am to 5pm” with solar and wind providing all of the grid’s needs during that time, said Kesavarthiniy Savarimuthu, a European power markets analyst with BloombergNEF. Still, she said, there is a reasonable chance this goal may take longer than expected and “extending the life of the nuclear fleet can prove as an insurance for these delays.”

Spain’s plan to ditch nuclear, which was decided in 2019, currently stands out against a worldwide revival for atomic energy. The worries countries once had about safety and radioactive waste have been outranked by an insatiable hunger for constant, low-emission power supplies. Energy consumption is set to skyrocket with new demand sources such as artificial intelligence and its associated data centers. Europe has also been on a mission to replace Russian gas since the invasion of Ukraine in 2022.

Since 2023, 31 countries agreed to triple nuclear capacity by 2050, from 2020 levels. China alone is building 28 new reactors, while Canada, the UK and the US hope advanced reactors will come online by the end of the decade, according to BloombergNEF. Belgium has delayed the closure of its two newest plants to 2035.

“If everyone’s going in one direction and we are the only ones going in another, we should at least stop and think,” said Ignacio Araluce, president of Spanish nuclear industry association Foro Nuclear.

Spain believes extending the life of their aging reactors would only increase the cost of dealing with radioactive waste. So far, the government says it has received no formal request from nuclear companies to make changes to the scheduled shut down. “The calendar for closures was agreed on in 2019 and there are no news, ” Minister for the Environmental Transition Sara Aagesen told reporters in March.

Plant owner Endesa SA did not comment when asked whether the life of its reactors could be extended, but a company spokesperson said fiscal burdens associated with the plants, namely taxes, have risen over the years. Operators Iberdrola SA, EDP SA and Naturgy SA did not comment.

Spain is reluctant to invest in new reactors, saying renewable capacity is more cost efficient to deploy. Solar and wind farms in Spain are built faster and generate three to four times more power than nuclear with the same amount of investment, according to an internal document from the governing Socialist Party seen by Bloomberg.

Yet there are reasons for Spain to feel a sense of caution as it looks to switch off its first atomic facility in 2027. After Germany shut down its last reactor in 2023, coal plant operators said they may need to remain remain open longer than planned to keep the country’s lights on. Natural gas plants might also be needed to run beyond 2035 — Germany’s target date for carbon-free power production.

Moreover, countries across Europe have struggled to balance supply and demand on their grids as more intermittent renewable energy comes online. Surges of wind and solar supply have sent electricity prices below zero at an increasingly frequent rate in Spain. Negative electricity prices were unheard of in the country two years ago and that increased to 247 hours of sub-zero prices last year, according to Bloomberg analysis of Epex Spot SE data. Just in the first quarter of this year, that figure was 54 hours, more than France, Germany and the UK combined.

As a way to stablize power markets, the government has granted 100 million euros ($110 million) to four projects to store energy through reversible pumped hydroelectric plants, including one to Iberdrola SA, one of Spain's largest renewable power companies and also an operator of nuclear power plants.

While this all points to Spain remaining bullish on renewables, Araluce said his group wants to convince the government wind and solar isn’t the only way to fight climate change. “There’s still room for negotiation — we are hopeful,” he said.

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Musk Buyouts Poised to Hit US’s $400 Billion Green Energy Bank

How Climate Tech Investing Is Being Shaped by Trump’s Tariffs and Orders

China Announces Quartz Discovery Vital to Chips to Rival US Mine

Chinese Battery Makers See Tariff Pain Added to Domestic Woes

AI Data Center Growth Means More Coal and Gas Plants, IEA Says

Trump Signs Orders to Expand Coal Power, Invoking AI Boom

Clean Power Offers Safety to China Investors Rattled by Tariffs

US Solar’s Hoarding Habit Will Help Blunt Sting From Trump Tariffs

Trump Team Proposes Ending Clean Energy Office, Cutting Billions