Trump Tariffs Threaten Spread of Big Batteries on the Power Grid

(Bloomberg) -- President Donald Trump’s trade war threatens to slow down a fast-growing technology that’s key to the clean-power transition and preventing blackouts — big batteries.

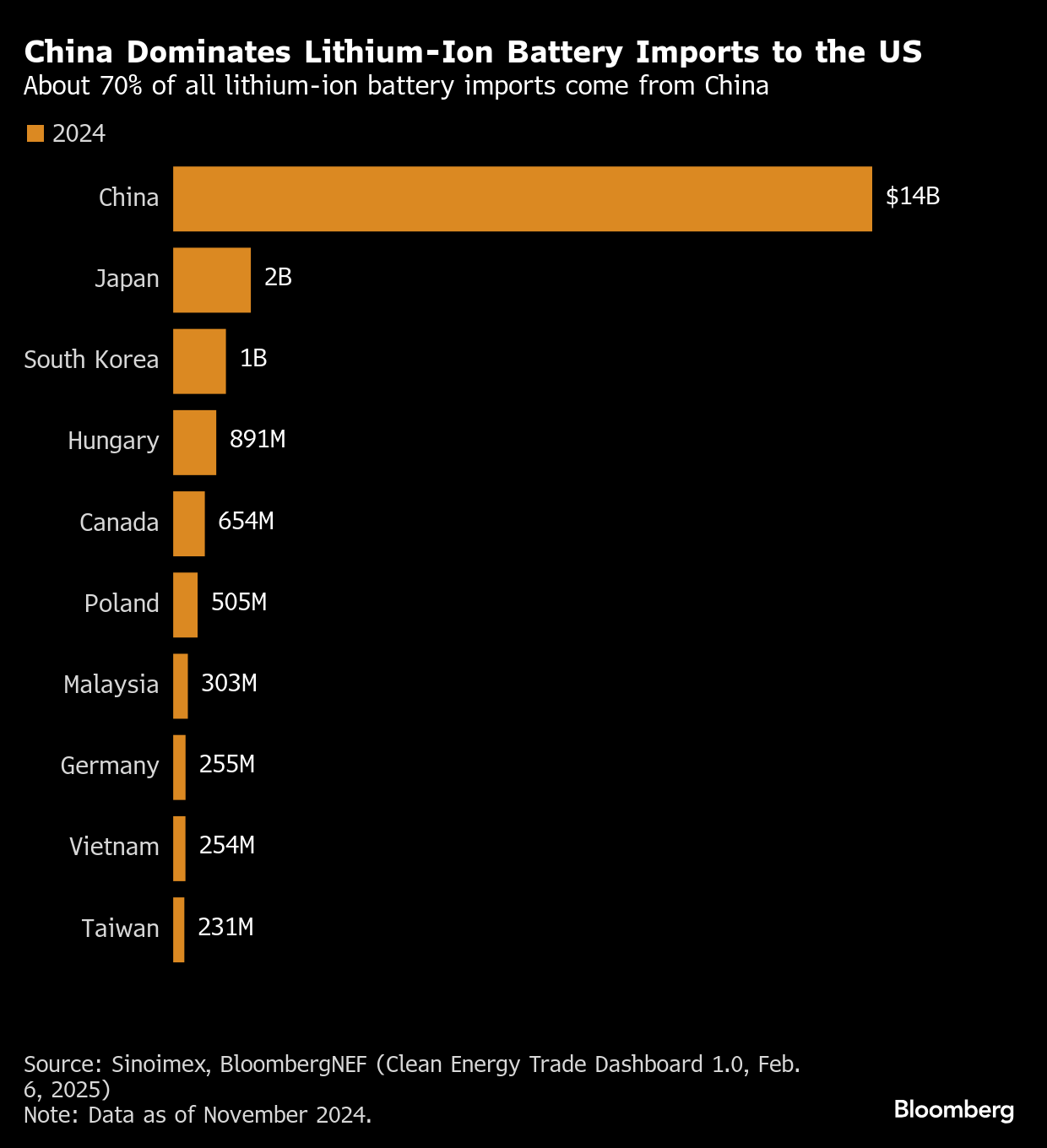

Energy storage devices large enough to feed the electric grid have been spreading across the US, with deployments surging 33% last year. Officials in California and Texas credit them with helping prevent blackouts during heat waves, when electricity demand soars, and integrating variable solar and wind power onto the grid. But despite efforts by former President Joe Biden to build a domestic supply chain, the US still relies heavily on imported lithium-ion batteries — with 69% of the imports made in China, according to the BloombergNEF research provider.

Now, Trump’s tariffs are piling costs onto new battery projects. Analysts warn the increased costs will likely lead to cancellations and delays, cutting the industry’s torrid growth.

“Many of the projects in the pipeline will be affected,” said Isshu Kikuma, a senior associate at BNEF.

BNEF had forecast battery prices to fall about 13% this year, continuing the steep, long-term decline that has fueled the industry’s growth. Instead, Trump’s tariffs on Chinese imports will push prices up. Earlier this week, he planned 104% tariffs on Chinese imports, which BNEF estimates would have made large-scale batteries installed in the US 58% more expensive than without the new duties, with prices averaging $322 per kilowatt hour. Then on Wednesday, Trump boosted tariffs on Chinese products to 125%.

Nor do his tariffs just target Chinese batteries. Trump has threatened a 24% tariff against Japan, which supplies 8% of US lithium-ion battery imports, and a 25% tariff for South Korea, which makes 5% of imports. On Wednesday, however, he said he was pausing for 90 days his higher, reciprocal tariffs against many countries, although they will still face a baseline tariff rate of 10%.

Grid-scale batteries are essentially larger versions of the devices powering personal electronics and plug-in cars, although they often use different chemistries. While most can only supply electricity for four hours before they need to recharge, they’ve proven essential to managing solar and wind power on the grid, storing energy during periods of peak production so it can be used later. They also help stabilize the grid when it’s under strain.

The US is the second-largest installer of energy storage capacity behind China, while nations including India, Germany, Spain are also expected to drive growth in the sector through the rest of the decade, BNEF said in a November report.

Biden saw building battery factories as key to US economic success in a clean-energy future, and his signature climate law — the Inflation Reduction Act — funneled tax credits into their construction. North America is expected to make up 13% of global lithium-ion production capacity by 2033, according to the Wood Mackenzie consulting firm.

But the ramp-up is still underway, and it has been uneven across different battery chemistries. Most domestic plants produce older, nickel-based chemistries, said Laura LoSciuto, a manager in the RMI think tank’s carbon-free transportation team. The US has no domestic manufacturing capacity for lithium iron phosphate, or LFP, batteries — the preferred chemistry for grid-scale storage. A number of suppliers are “in various stages” of building LFP factories in the US, said Jeff Waters, CEO of Oregon-based energy storage company Powin. But those will take time to get off the ground.

“What the industry is really looking for is just some stability between tariffs and tax credits — what those are going to be,” he said in an interview. “Once those get established, the industry will be able to figure out what is the best and most appropriate way to build out the demand.”

In the meantime, some planned battery installations will likely be delayed or cancelled. It’s a big change for an industry used to rapid growth.

“Putting a large tariff on imports of Chinese batteries today will massively slow the deployment of storage in the US, leaving utilities and ... grids without the new capacity they need and were planning on,” said Roselle Kingsbury, a senior brand strategy and communications manager at twentytwo & brand who represents battery firms, in an email.

Even as US battery manufacturers ramp up production, they’ll still be impacted by tariffs. Domestic batteries rely on imported components, with US plants needing to import an estimated 83% of the cathodes and 67% of anodes they’ll use this year, according to BNEF. Suppliers are scaling up, but with the Inflation Reduction Act’s future now in question under Trump, some manufacturers may put their US plans on hold.

“Sudden changes in policy can be incredibly disruptive, chilling investments and slowing job creation — especially for manufacturers,” said Abigail Ross Hopper, president and chief executive officer of the Solar Energy Industries Association trade group, in an email. “In the global competition for capital, manufacturers need long-term policy certainty to be confident about making multi-billion-dollar investments.”

Listen on Zero: How to Upgrade the World’s Biggest Machine

(Adds new tariff details in paragraphs five and six. An earlier version of this story corrected the attribution of a quote in paragraph 13.)

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Musk Foundation-Backed XPRIZE Awards $100 Million for Carbon Removal

Nissan Commits Another $1.4 Billion to China With EVs in Focus

NextEra Energy reports 9% rise in adjusted earnings for Q1 2025 as solar and storage backlog grows

US Imposes Tariffs Up to 3,521% on Asian Solar Imports

India Battery-Swapping Boom Hinges on Deliveries and Rickshaws

China Reining In Smart Driving Tech Weeks After Fatal Crash

Japan Embraces Lab-Made Fuels Despite Costs, Climate Concerns

GE Vernova’s HA-powered Goi Thermal Power Station adds 2.3 GW to Japan

Used Solar Panels Sold on Facebook and eBay Have Cult Following