US Solar’s Hoarding Habit Will Help Blunt Sting From Trump Tariffs

(Bloomberg) -- America’s solar industry has a strategy for dulling US tariffs: hoard.

Developers have been amassing piles of solar panels for more than a year, in part because of other US levies imposed before President Donald Trump took office in January. The stockpile is now so big that analysts estimate there’s roughly 50 gigawatts worth of the equipment in warehouses. That’s enough panels to power about 8.6 million homes.

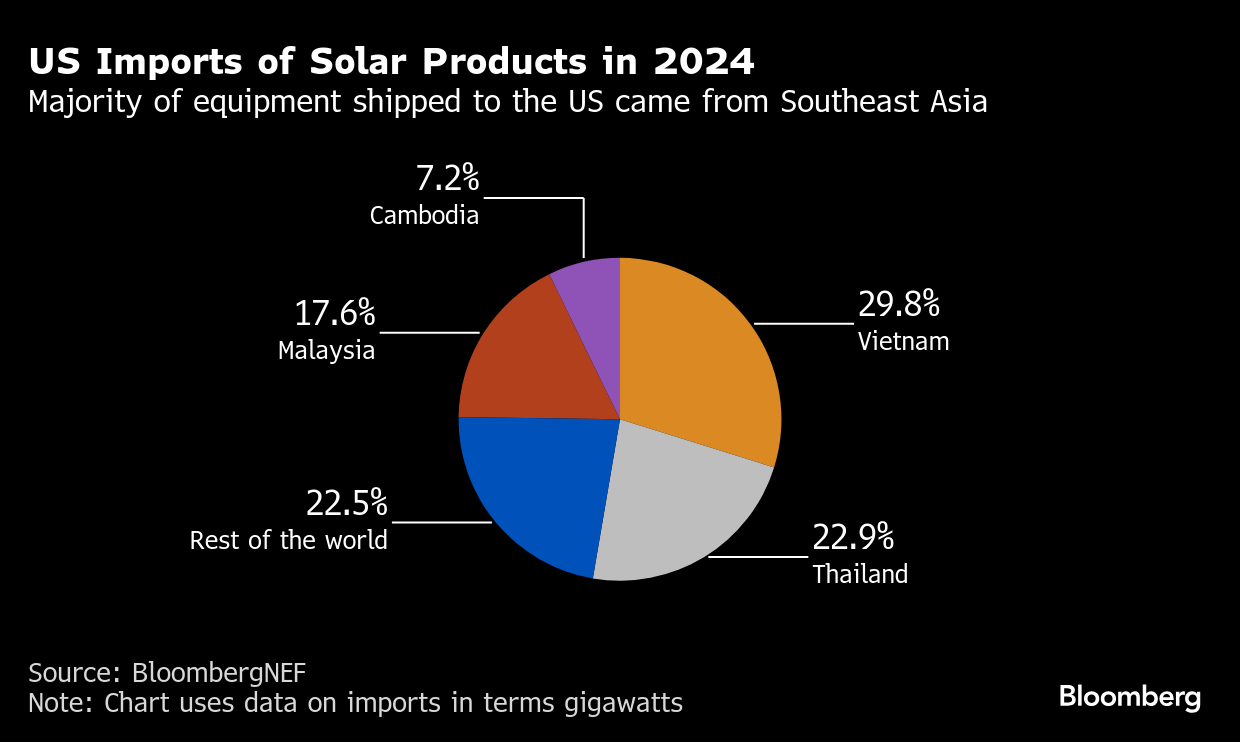

The backup inventory will help ease the immediate sting of Trump’s new levies. That’s especially true since so much of the country’s supply comes from Southeast Asia, a part of the world that was hit by some of the highest tariff rates. It’s a small silver lining for US solar developers, who have grappled with the headwinds of previous duties, high interest rates, slow permitting timelines and the risk of tax credits being repealed.

“Having such a high level of inventory does provide some mitigation against the tariff impacts,” Elissa Pierce, a solar module supply chain analyst at Wood Mackenzie, said in an interview.

Of course, there are caveats.

US developers are projected to build about 54 gigawatts of total solar capacity this year, according to BloombergNEF. Much of that will be for big solar farms, but most of what’s in warehouses are panels designed for rooftops.

At the same time, the industry is still facing longstanding duties on China that were extended to some solar exports from Cambodia, Malaysia, Thailand and Vietnam in 2023. About 80% of US solar equipment was imported last year from those four countries, according to BNEF. But even before Trump’s latest move, solar panels and cells imported from parts of Southeast Asia faced levies that could top 200%.

Those tariffs have hit many solar components imported from those four nations since last June. But they also retroactively apply to affected imports between mid-November 2022 and early June 2024 that have not yet been deployed.

Absent deals to slash Trump’s newly ordered levies, those new duties will now be stacked on top of existing levies, adding to costs and whipsawing the industry further. But the supplies in warehouses will avoid the new fees — unlike fresh imports, which will get charged for both. The four Asian countries saw especially high rates in the latest salvo: 49% for Cambodia, 24% for Malaysia, 36% for Thailand and 46% for Vietnam.

Tariffs are set to have an impact across all types of clean energy, though solar and battery storage are likely to see a bigger hit than wind due to the majority of the supply chain being outside of the US, analysts at TD Cowen wrote in a note.

Wood Mackenzie estimates the US had between 40 gigawatts and 50 gigawatts of solar panel inventory as of the end of 2024. Solar Energy Manufacturers For America Coalition, an industry group, estimated the number at 49 gigawatts as of the fourth quarter. BNEF pegged the number at more than 50 gigawatts.

The figure likely climbed recently as developers readied themselves for Trump’s announcement, according to Pavel Molchanov, an analyst at Raymond James. “There has been pre-buying because everyone has known for weeks that April 2 was the big announcement day.”

Given that most of the panels are for use in rooftop solar, that industry segment “is more insulated,” said Pol Lezcano, a solar analyst at BNEF. “They can tap large stockpiles of modules that are already in the US, so they don’t face the Trump tariffs whereas every new module that comes in through the border will have to pay the tariffs.”

As the domestic inventories eventually dwindle, the price of components will rise in the longer term, Citigroup analysts wrote in a note. That could prompt companies to renegotiate contracts that might delay or cancel projects, they added.

Even for solar panels made in the US, American manufacturers still largely rely on imported cells. Those components will be subject to the new tariffs, according to Pierce. “So even US-made modules will be made more expensive by these tariffs,” she said.

(Updates with analyst comment in 10th paragraph.)

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Trump Team Proposes Ending Clean Energy Office, Cutting Billions

European Stocks Sink Into Correction as Trade Worries Escalate

EU Steps Back on 2040 Climate Goal in Order to Win Over Doubters

Austria Plans Funding Help to Encourage More Geothermal Drilling

UK, EU to Work Toward Linking Carbon Markets at May 19 Summit

Europe’s Solar Season Is Getting More Intense and Disruptive

China’s Efforts to Curb Solar Glut Show Limited Impact, CEA Says

China’s Megacity Shanghai Invests in Nation’s Fusion Energy Push

Germany’s Power Market Bailed Out by Gas Plants as Wind Plunges