China’s Coal Plant Boom Is Undercutting Clean Energy Push

(Bloomberg) -- China embarked last year on its biggest coal-power building boom in a decade, reinforcing the role of the dirtiest fossil fuel in its energy mix even as it aims to transition to renewables.

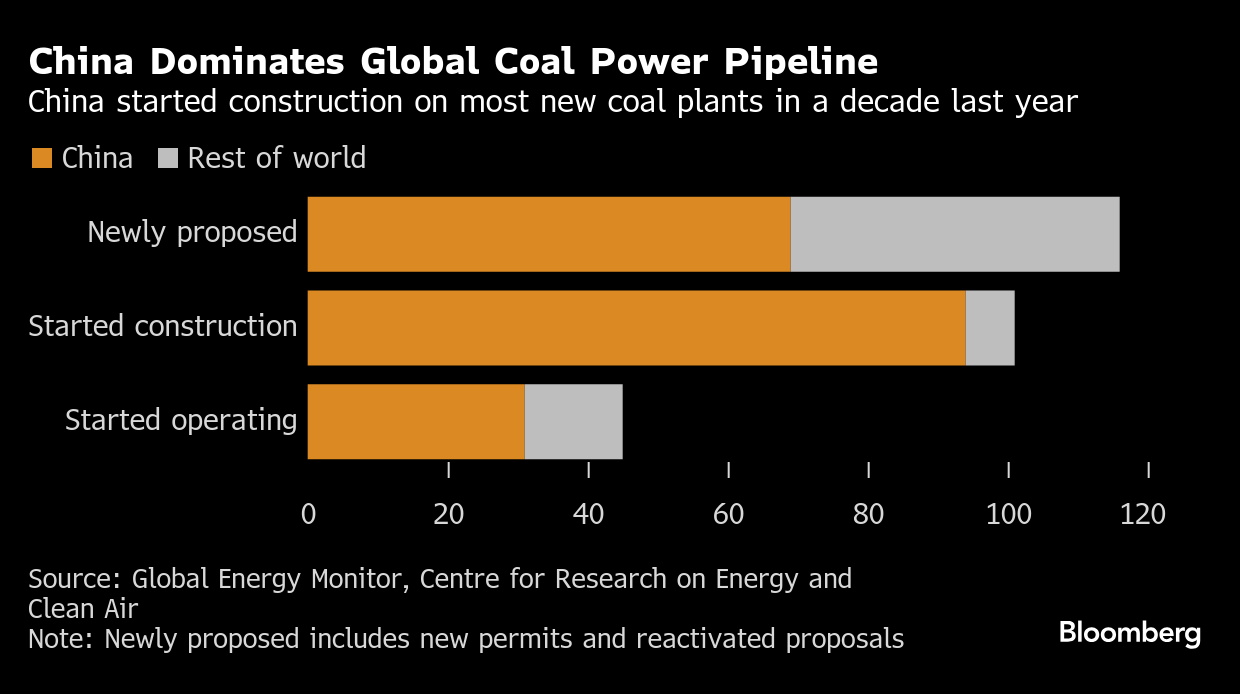

Nearly 95 gigawatts of new coal-fired generators started construction, the most since 2015, according to a joint study released on Thursday by the Centre for Research on Energy and Clean Air and Global Energy Monitor. Local governments also sped up permits for future plants toward the end of the year after a slowdown in the first half, approving a total of 67 gigawatts of new capacity in 2024.

The surge coincides with the country’s breakneck development of clean energy, which included 356 gigawatts of new wind and solar capacity in 2024, making additional electricity from fossil fuels unnecessary. Thermal power generation grew less than 2% last year, and President Xi Jinping has pledged to reduce coal use from 2026.

Still, the fuel is regarded as a key pillar of energy security, and China’s planners have said it’s still needed as a backup to balance out the intermittent electricity provided by wind and solar. But there are signs, including a rise in curtailments of clean energy, that coal generators are entrenching their position and crowding out renewables, limiting the country’s ability to peak emissions before Xi’s 2030 deadline, according to the report.

Coal producers are helping to push the continued growth of the fleet, with more than three-quarters of new permits going to companies with mining operations, the report said. Long-term coal-power contracts are also reinforcing the fuel’s dominance at the expense of renewables.

“China’s rapid expansion of renewable energy has the potential to reshape its power system, but this opportunity is being undermined by the simultaneous large-scale expansion of coal power,” said Qi Qin, an analyst at CREA.

On the Wire

DeepSeek has been likened to a Sputnik moment for Chinese technology, a breakthrough so transformative that the rest of the world faces a mad scramble to catch up. But one area where it hasn’t had much of an impact is energy.

Xiaochao Yin has been appointed to run global soybean trading at Cofco International Ltd., the trading arm of China’s state-owned agricultural giant, as part of a reshuffle at its Geneva headquarters.

Chinese authorities are working on a proposal to help China Vanke Co. plug a funding gap of about 50 billion yuan ($6.8 billion) this year.

This Week’s Diary

Thursday, Feb. 13:

- China to release Jan. aggregate finance & money supply data by Feb. 15

- CSIA’s weekly solar wafer price assessment

Friday, Feb. 14:

- China’s weekly iron ore port stockpiles

- Greenpeace China seminar in Beijing on regional green power markets, 14:00

- Shanghai exchange weekly commodities inventory, ~15:30

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

US Green Steel Startup Raises $129 Million Amid Trump Tariff Uncertainty

Spain Signals Openness to Keeping Nuclear Power Plants Open

Musk Foundation-Backed XPRIZE Awards $100 Million for Carbon Removal

As Tesla Falters, These New EVs Are Picking Up the Pace

Fashion Is the Next Frontier for Clean Tech as Textile Waste Mounts

Nissan Commits Another $1.4 Billion to China With EVs in Focus

NextEra Energy reports 9% rise in adjusted earnings for Q1 2025 as solar and storage backlog grows

US Imposes Tariffs Up to 3,521% on Asian Solar Imports

India Battery-Swapping Boom Hinges on Deliveries and Rickshaws