China Solar Lobby Sees Fewer Installations After Record Year

(Bloomberg) -- China’s solar industry expects installations to drop in 2025 after an unprecedented surge in additions last year left power grids racing to keep up.

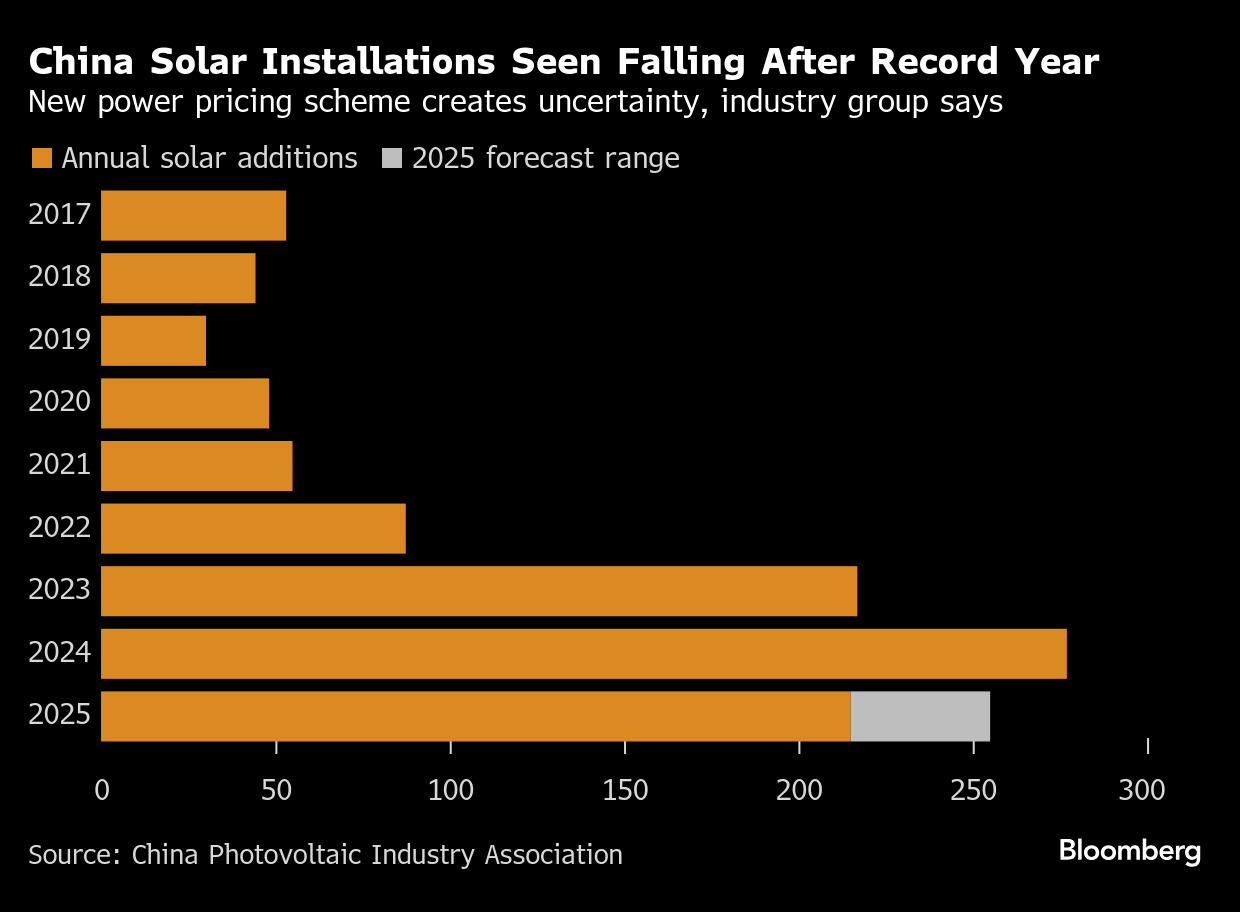

The China Photovoltaic Industry Association expects 215 to 255 gigawatts of additions in 2025, Chairman Wang Bohua said at the group’s annual conference in Beijing on Thursday.

The world’s second-largest economy added 277 gigawatts of solar last year, shattering the previous year’s record of 217 gigawatts. The surge came amid a tough year for the industry in China, where a supply glut has caused huge losses for leading manufacturers.

The influx of panels that only generate when the sun is shining has put pressure on grids to increase investments in power lines, energy storage and digital tools to help make sure the power is used. The government also announced new power market rules that go into effect June 1, which will create a new challenge for wind and solar by leaving market forces to determine the rates generators are paid for power.

A rush of solar installations is expected in the second quarter this year, as developers seek to take advantage of the older price policy before the new market-based scheme takes is implemented, S&P Global solar analyst Hu Dan said Wednesday.

The CPIA’s Bohua said the new rules, as well as stricter policies and connection issues for distributed solar generation from rooftops, have left the industry in “wait-and-see mood, thereby increasing the uncertainty around expected installations in 2025.”

On the Wire

China’s growth target is usually the single most important indicator of how macro policy will be set in the year ahead. At the 2025 National People’s Congress, the inflation objective will be just as telling, according to Bloomberg Economics.

China is extracting lithium as a byproduct of producing alumina, highlighting the country’s push to maximize domestic supplies of the battery material.

China’s plunging coal price is closing the window for imports. Mining shares dropped after Citigroup downgraded their ratings to reflect slower demand and lower prices.

This Week’s Diary

(All times Beijing unless noted.)

Thursday, Feb. 27:

- China solar association’s annual meeting in Beijing, day 2

- U.N.’s climate change panel meets in Hangzhou, day 4

- CSIA’s weekly solar wafer price assessment

- EARNINGS: HKEX

Friday, Feb. 28:

- U.N.’s climate change panel meets in Hangzhou, day 5

- China’s weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- EARNINGS: Xinyi Solar

Saturday, March 1

- China’s official PMIs for February, 09:30

(Updates with comments from the CPIA’s chairman in sixth paragraph)

©2025 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

New Jersey Wildfire Is Tied to Arson as Firefighters Make Gains

US Green Steel Startup Raises $129 Million Amid Trump Tariff Uncertainty

Musk Foundation-Backed XPRIZE Awards $100 Million for Carbon Removal

Nissan Commits Another $1.4 Billion to China With EVs in Focus

NextEra Energy reports 9% rise in adjusted earnings for Q1 2025 as solar and storage backlog grows

US Imposes Tariffs Up to 3,521% on Asian Solar Imports

India Battery-Swapping Boom Hinges on Deliveries and Rickshaws

China Reining In Smart Driving Tech Weeks After Fatal Crash

Japan Embraces Lab-Made Fuels Despite Costs, Climate Concerns